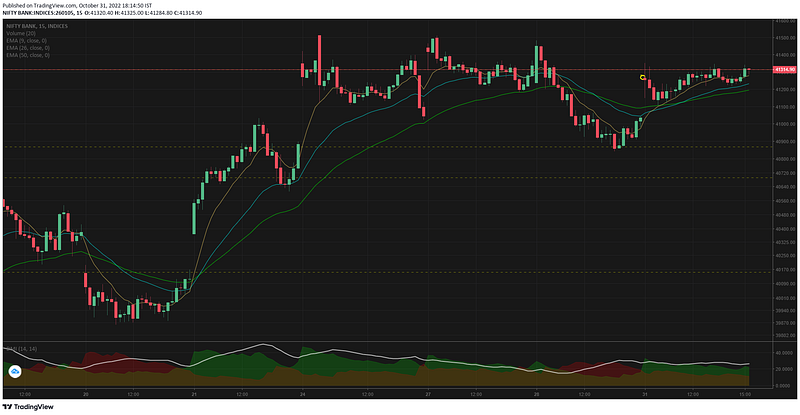

Bank nifty opened gap up at 41265 rallied above the resistance line and closed the first 5mts candle in red. The length of the candle was quite long — indicating the amount of trades taken place to settle the price discovery.

Again the opening is by a gap — which indicates the shift in macro outside of our trading hours. The best trades that can be taken are intraday — as positional traders would feel handicapped to adjust.

The resistance level of 41314 proved quite strong today, the rejection at 09.35 was strong enough to tumble BN to intraday low of 41106 by 10.05 itself. From there it was a strong recovery and the final close was right at the SR level.

See the image below, the count of bottom wicks that got generated between 13.30 to 15.00. I have not seen such a consistent wick generation in the recent past. I guess i still dont know the psychological reason as to why this got generated.

- Was it because of low volume & there were jump in prices?

- Was it a problem with the charting software?

- Was there a coordinated purchase/sell agreement?

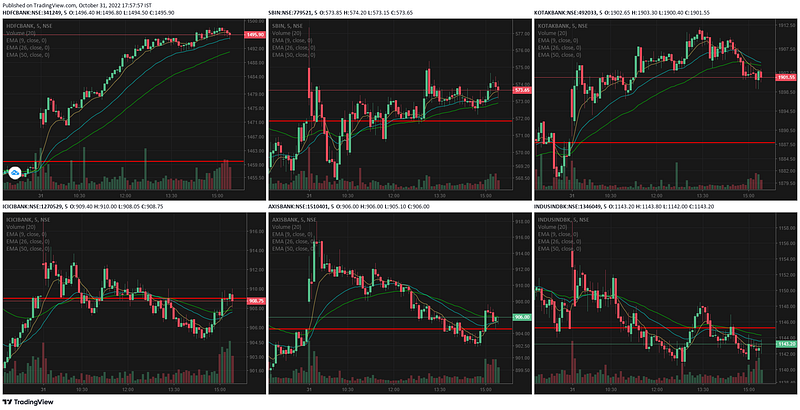

The 6 major banks did not follow a similar price action today.

- ICICI bank, Axis & IndusInd showed same pattern.

- Hdfc bank was unusually bullish — opened higher and closed with strength

- Kotak bank was also bullish but the strength weakened in the last 2 hours of trade

- SBI had gone negative earlier in the day but managed to close higher

Expecting some news on HDFC this week for the unusual price pattern today.

One of the option trade that would have worked beautifully would be a short iron fly. Thats because the final closing was quite near the opening price. Since its a defined loss strategy — the stop loss would have been automatically taken care off. However the decay was minimal & the amount made also less.

The 9.20 straddle would have worked better — but for most of the traders the put side stop loss would have been hit at 10.05. For traders who had the stomach to hold on — would have made money today.

The next option was to go short at 09.45 by entering into a call credit spread ie sell 42000 CE at 99.2 & buy 42100 CE at 80.15. The rationale was because the resistance level was rejected. If you closed this trade at EOD it would be at 88 & 69.25 respectively. You would have made (99.2–88) — (80.15–69.25) = 0.3 pts per lot. This is inspite of the market reversing and going above our entry point.

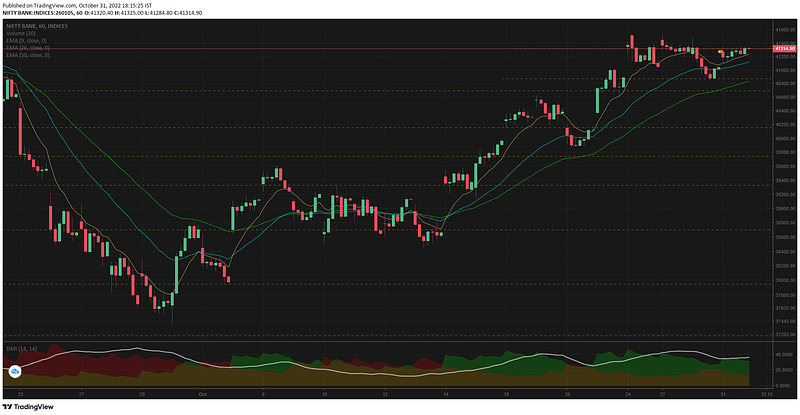

Comparison with US market shows — bank nifty up 8.51% & SPX down -11.16% this is because the S&P500 had gained some ground on friday’s trade.

15mts chart shows sideways momentum

1hr chart shows price consolidation at top & no sign of bearishness

Bank nifty support & resistance levels

s1: 40867, s2: 40691

r1: 41312, r2: ATH

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

Comments

Post a Comment