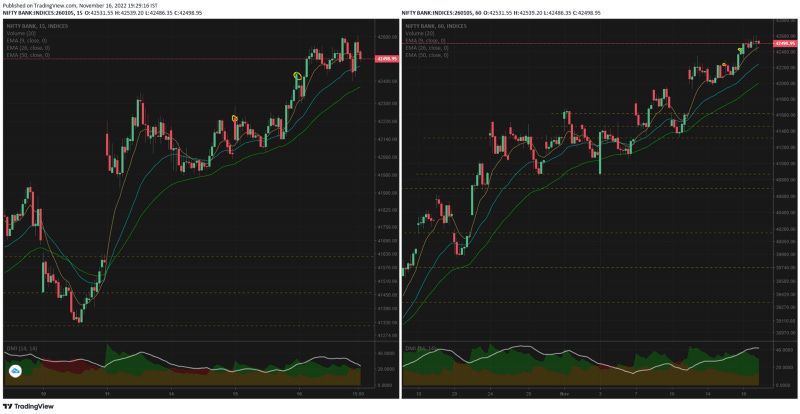

A very good trading day today, bank nifty opened in line at 42371 made a long legged doji in the 1st candle and then made 7 consecutive candles with 100pts swings in each before deciding on the direction.

We had a up day today with a decent run from 09.50 to 11.30 and then a small pull back till 12.05 and then resuming the trend till 13.45. The price action from 13.50 to 14.40 looked mostly expiry related.

Majority of the previous expires were island days — the positional selling between 13.50 to 14.40 may hint that we could even have a negative day on 17th. However i am not certain as the underlying buying interest for bank nifty is pretty euphoric. There is no amount of negative data that can pull down our indices and most of the traders would be gung-ho.

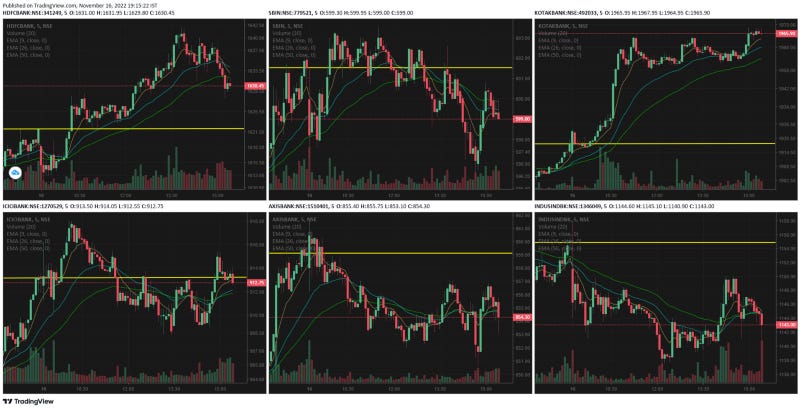

Of the major bank nifty components

-

HDFC Bank was contributing to the index pretty strongly today, but gave up most of the gains after 13.55

-

Kotak bank out performed and closed the day with 2.8% gains (pretty unusual unless there is a news event which i am unaware of)

-

ICICI even though started the day positively, fell below the yellow line by 11.35 and traded with negative bias

-

SBIN started low, then shot up and then made a strong negative price action by 12.55

-

AXIS and IndusInd had negative bias today the chart pattern slope nearly matching.

2 Major option strategy would have worked out very well today.

-

Any call debit spread taken after 09.55

-

A far OTM call ratio spread purely for intraday ie. Buy near ATM and sell multiple lots of far OTM CE options. This would have worked mostly because of the time decay as its 1 DTE today.

There was an anomaly in the way far OTM PE options reacted in the last 30mts — check the graphs for 40000, 39000, 38000 PE — the premiums were surging — i would like to see this as intense put writing as part of expiry tomorrow. This can be considered as a bullish sign and may even contradict my view of bearishness tomorrow.

SPX is rising vs Bank nifty which is rising much more. The indices might be seen as converging but the speed at which bank nifty rising is actually creating a wider spread.

SPX closed right at the resistance line of 3991 yesterday — so today's move will be interesting as it may have to pick up a direction soon.

15mts vs 1hr — both charts are in agreement and showing a bullish bias. Again as all the market participants are long — we cannot even rule out a quick dip anytime.

Bank nifty support and resistance has been updated

S1: 41929, S2: 41618

resistance: no resistance as at ATH

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

Comments

Post a Comment