The lower than expected CPI data of 4.7% would have leaked with few big-boys and they would have ended up loading the banks because from how I see it Nifty50 only rallied 46pts in the same period.

India's retail inflation in the month of April eased to an 18-month low of 4.70 per cent, data released by the National…indianexpress.com

Lower inflation is good for the banks? I thought higher inflation translating to higher interest rate was good for the banks — guess I will have to spend more time reading some articles on this.

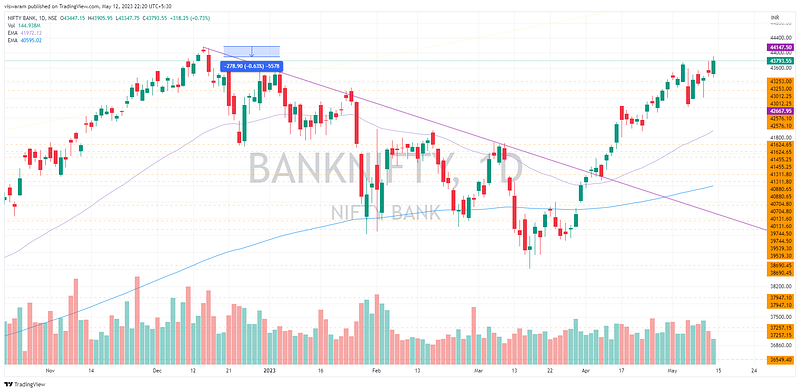

Banknifty & Nifty50 are diverging in today's chart pattern, mostly because the NiftyIT was underperforming. Banknifty has made a higher high and the next swing could even reach up to the ATH. Nifty50 on the other hand has 2 more resistances to go.

This divergence is not good and does not make sense, one of them has to catch up for a broad-based trend. If banknifty takes out the ATH with the Nifty50 flat — it wont end well.

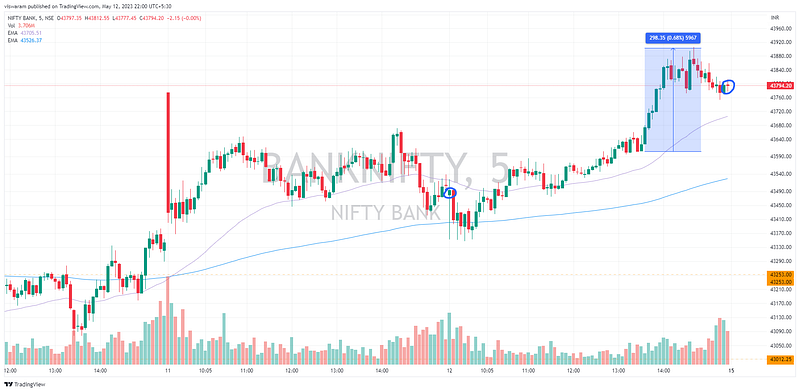

Today's open was in line and then we had a gradual grind up till 13.30. From there it was a sling shot to take out the swing high of 4th May & 11th May. Since the final close was above both — we can safely assume that level is crossed.

All 6 major banks participated in the rally from 13.30 to 14.40 — this unison is usually unusual. I do not really understand why would big-boys take an opposite position to the global trends in this weekend. Are they assuming that the Ruling party will win in Karnataka?

Elections definitely moves the market, if the ruling party wins again — markets will like it. Who would not want stability and regime continuation. If this argument is correct — why was Nifty50 not participating? What extra did the financial institutions had that the other top corporates did not?

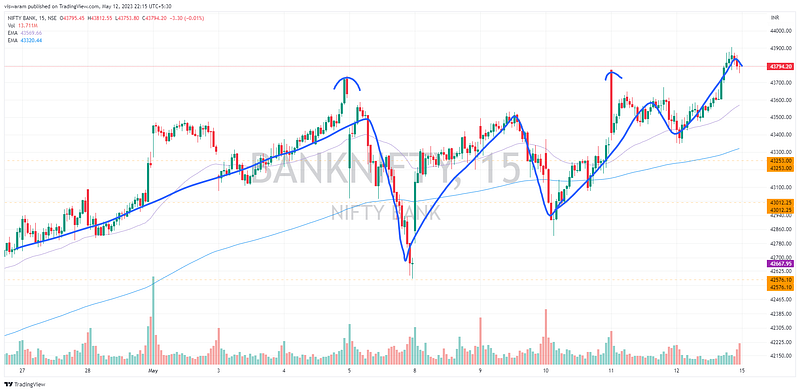

15mts shows the higher-high and higher-low formation, the trend continues. Since we have taken out the recent swing high, the next level to watch is the all time highs.

Before that the markets will be excited to see the election results on 13th May. Looking at the options data, lot of credit spreads were written at the PE side meaning more players expecting further upside movements.

1hr shows an awkward shaped W type formation, since the slope is upwards the double bottom is not horizontal but having the same degree of slope as the trend.

It also makes sense to bring up the 1D chart as the ATH is just 270 to 300pts away ~ less than 0.7%. Is that not amazing, banknifty vs nifty50 — guess who the real chamption is?

I am quite happy to get the printed version (paperback format) of the book I wrote for FY22–23

The same is available for purchase at : https://notionpress.com/read/183-days-of-post-mortem-on-bank-nifty-daily-analysis-chart-reading-in-simple-english

ebook is available at amazon kindle.

In depth technical analysis done on bank nifty index & option trading strategies used in the last 183 trading days…amzn.to

Comments

Post a Comment