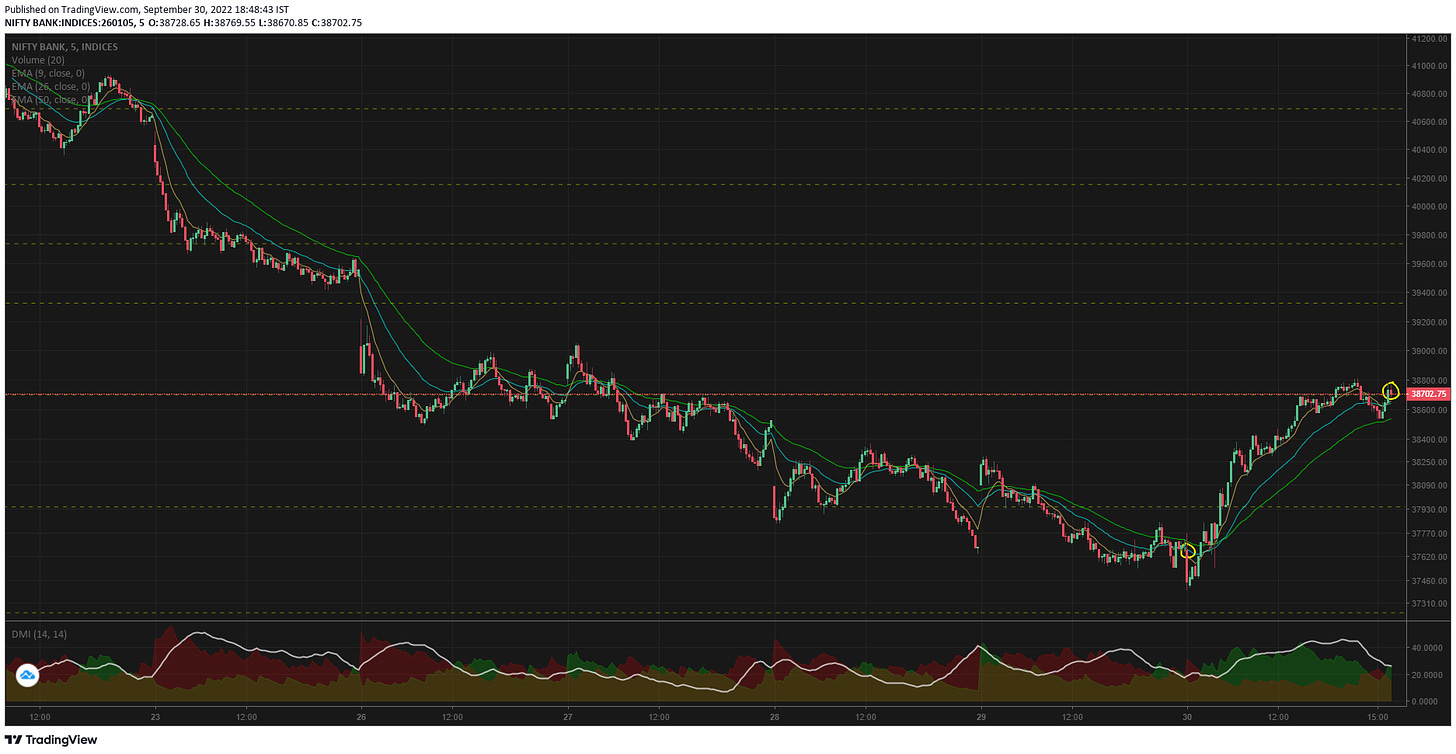

BN opened at 37660 and made a strong red 1st candle, i personally thought we will have a down day, and i held that belief till 10.15 when the first resistance got taken out. I started the day with selling CE options, but when i saw this counter move i squared off CE side and went to the PE side looking for opportunities.

The rally from 10.30 to 14.25 is not a simple one to neglect, remember we had seen huge shorting of CE options from the last 3 weekly expiries. Assume lot of traders would have rolled over their shorts to this new series, but a move like today esp friday would have taken out most of their stop losses. Most of the near ATM strikes swung from -30% to 190% - its quite impossible to manage if its a naked trade.

There was a small pullback from 14.30 to 15.05 but the bank nifty managed to close above the resistance line.

I am kind of shocked to find 2 of my assumptions came true from yesterday

-

The hike in interest rate are good for banks - see here

-

The fall on 29th Sep will be negated today - see here

Today's rally is quite similar to the relief rally we saw in S&P500 on 28th. Since it was expiry for us on 29th, that rally just played out today. Even though bank nifty rallied - no body would have expected it to break through two of its resistances, the first one 37946 at 10.15 & 38698 at 13.45.

Both these SR lines were quite important, just recently bank nifty took support twice at 37946 thrice at 38698

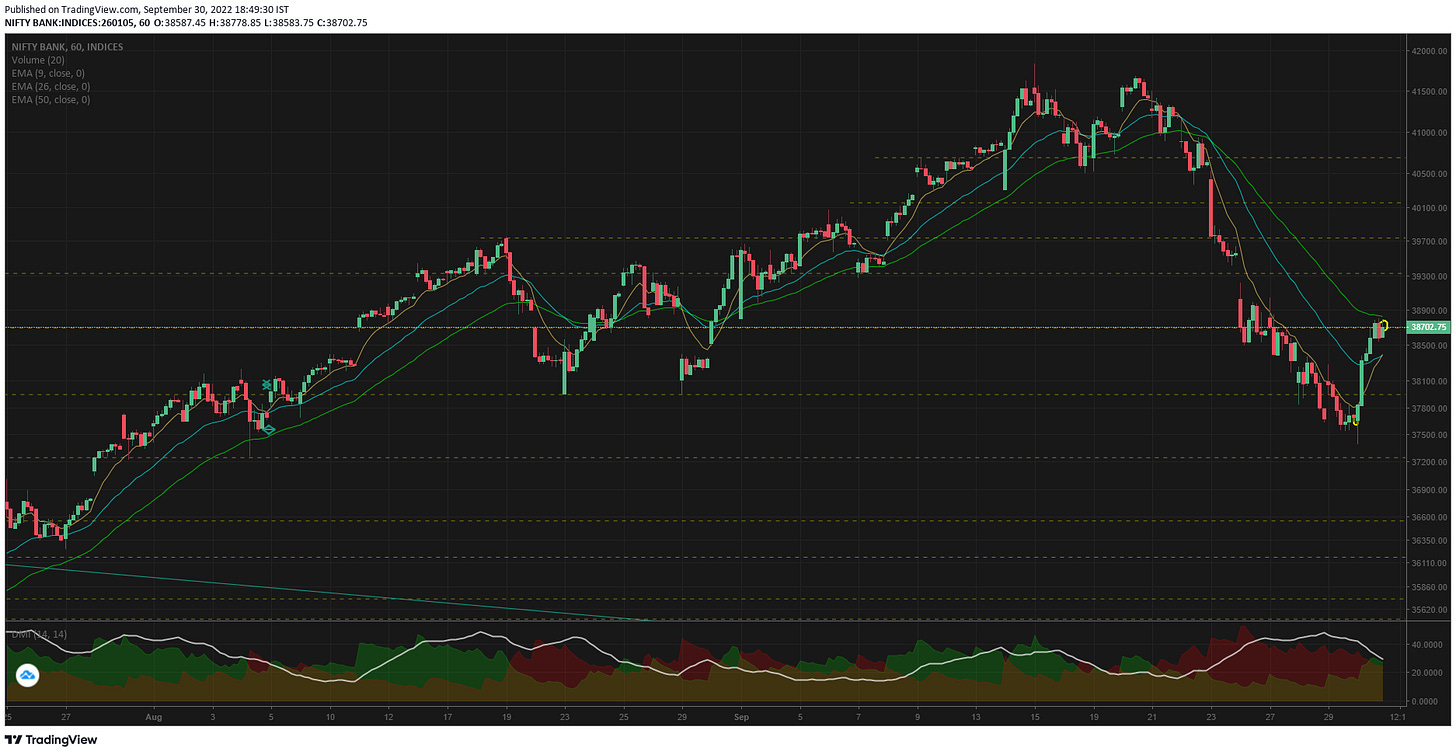

1hr TF shows the strength in today's upmove. Majority of the candles are in green, the resistance being taken out by strong green candles. (In fact the 2nd resistance line is not taken out in the 1hr TF)

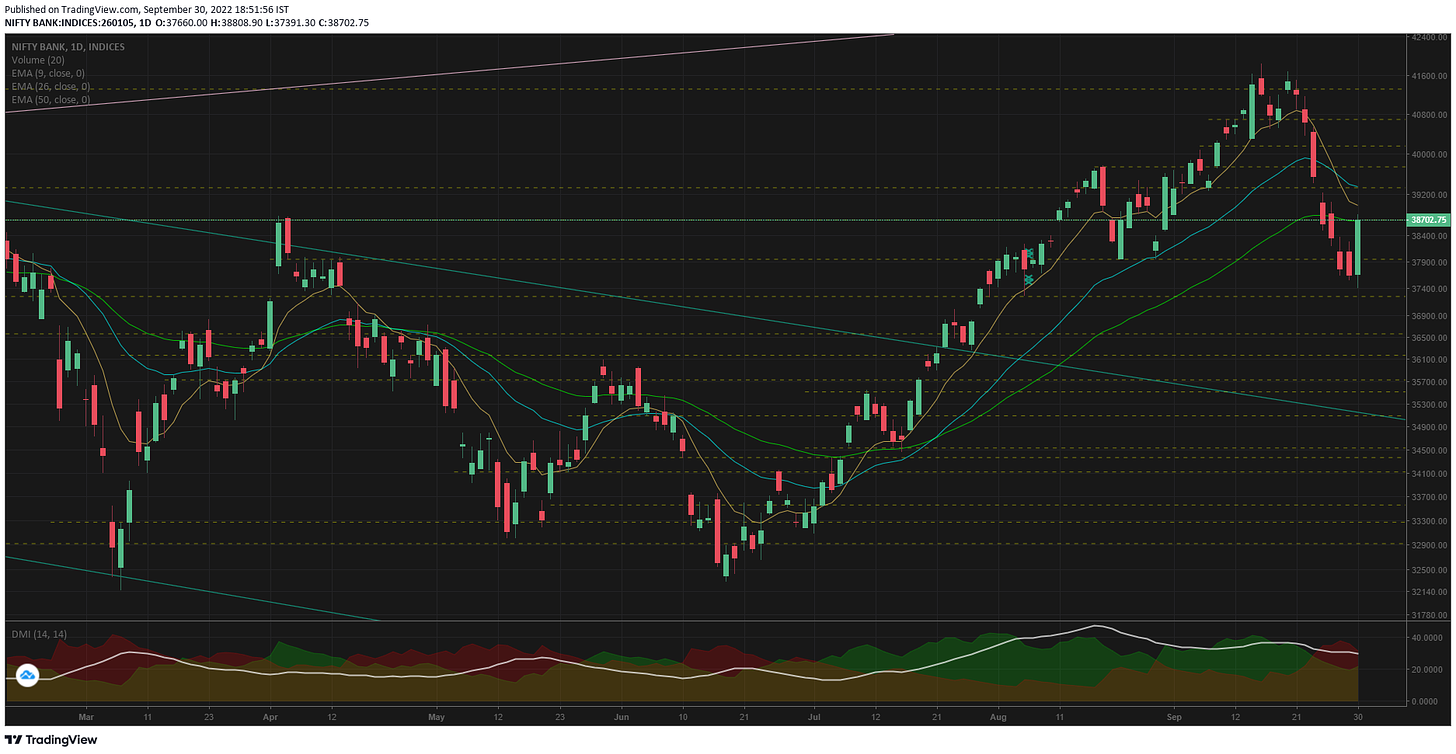

1D TF shows the strength today - a strong green. For upmove to continue 39747 has to be taken out in next week.

1W TF doesnt really show if its downtrend or uptrend. Last week we spoke about the shooting star & evening star formation. For that to take full effect this week's candle had to be anything else than an exhaustion hammer. So lets wait for another week before making any conclusion

Bank nifty important support and resistance lines

s1: 38698, s2: 37946

r1: 39326, r2: 39739

Comments

Post a Comment