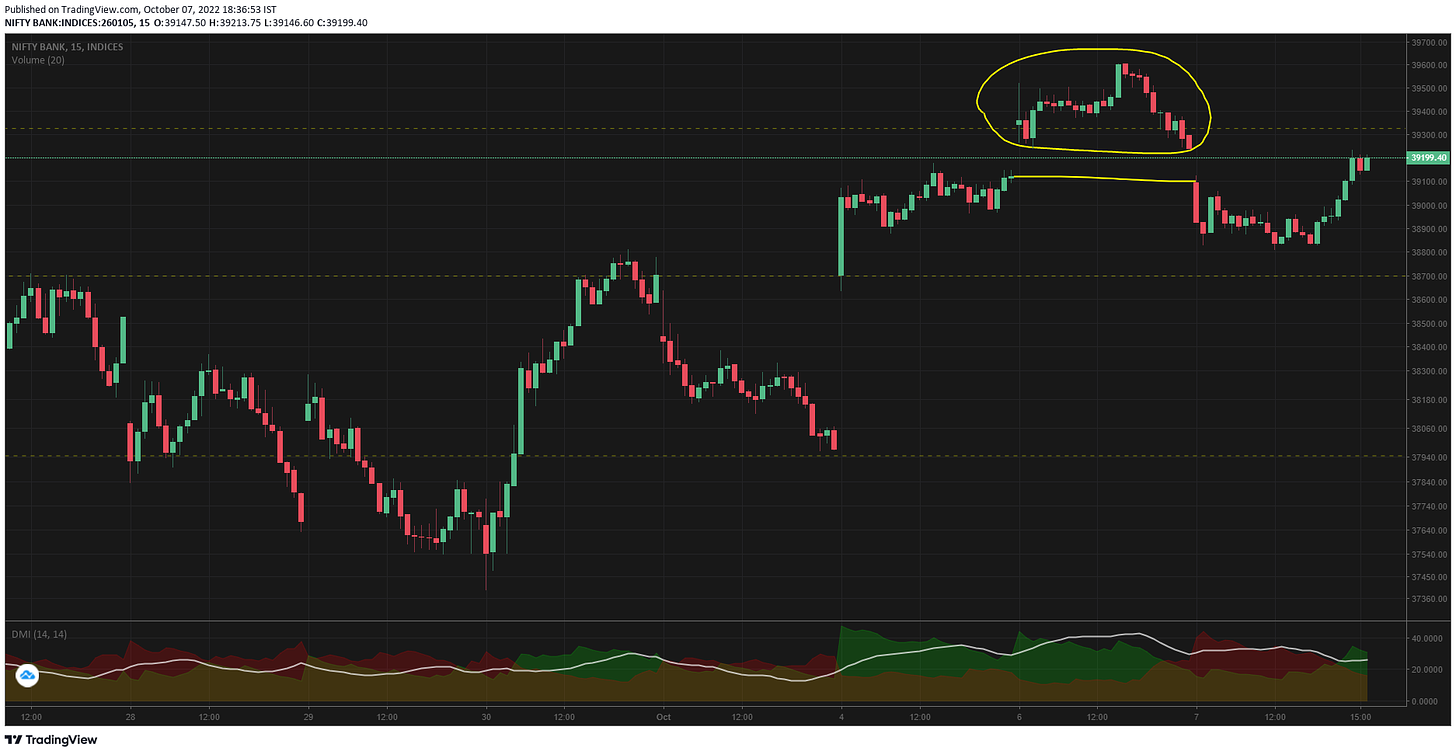

The chart pattern we were expecting on 6th Sep came today. I think this is the 2nd or 3rd occurrence wherein the expiry day chart patterns are decoupled with the normal trading days. It may be due to huge positioning or legally possible manipulation by the institutional desk.

Look at the island price action for expiry day alone & the previous day close = next day open. Seems like a standalone expiry day to square off some positions in the 39500 strikes.

BN opened gap down at 39093 mid way between the support & resistance. There was a small but step by step lowering trade till 13.25. After 13.30 to almost close its as if BN got its wings back - there was a surge in trade with a fair jump in volumes for ICICI Bank, SBI Bank and Axis Bank. Both Kotak and Axis which were trading lower than yesterday shot up and closed higher.

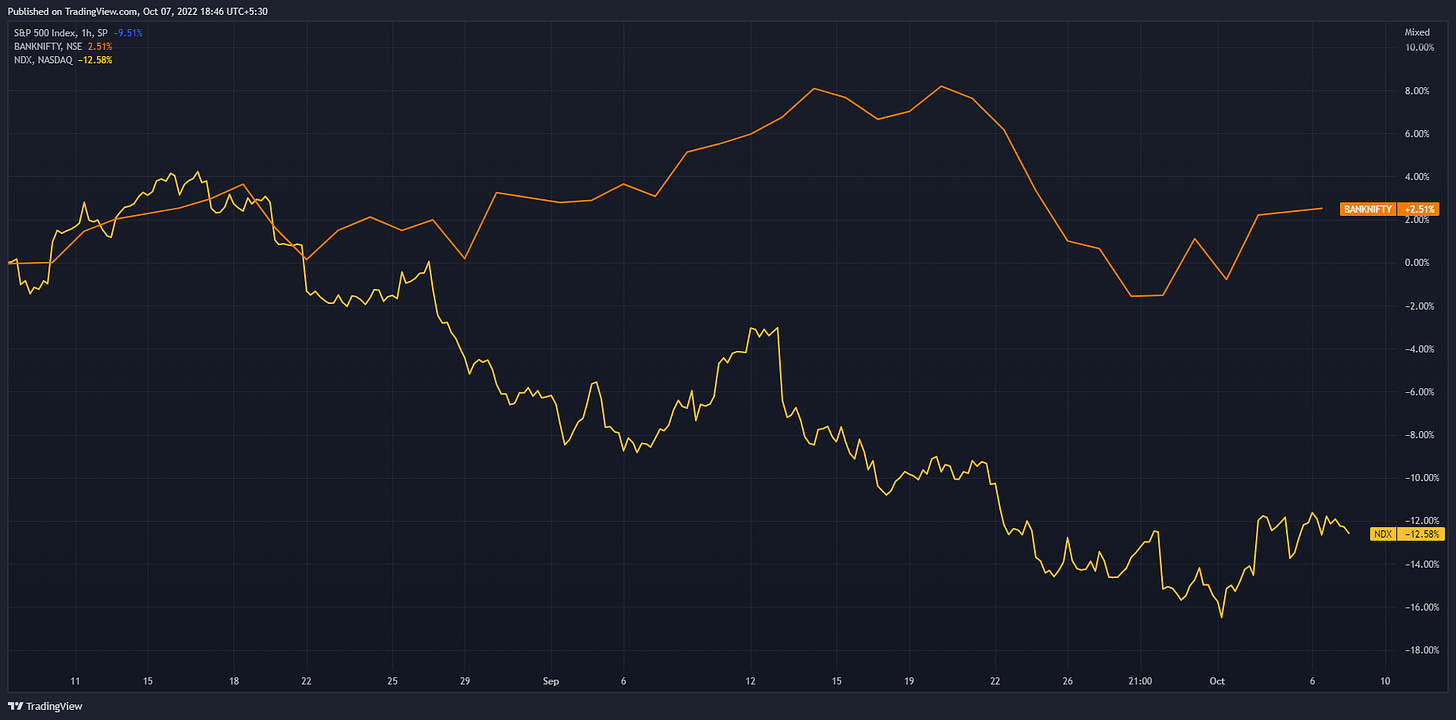

I am not very sure who is buying banks now, esp when the global macros are pretty bad. There is a Nuclear war threat by Russia, Energy crisis in Europe, Oil production cut by OPEC which will raise prices & of course India has food export ban on Rice & Wheat eventhough the Govt. has denied shortage.

$SPX vs Bank nifty 1hr TF - the outperformance of our banks are pretty clear

$NDX vs Bank nifty - 1hr TF

$SPX vs Bank nifty 1D TF - our banks has decoupled from the US index

I know its fair not to compare Indian banks vs US indices as the major weighted players are non financial institution. But for a country like India the backbone of the corporate, PSU or MSME sector is bank. My objective is to show the variance here and soon enough the gap has to narrow down.

Either the US markets has to go up or ours will have to crash. And if ours crashes - the level will fall below & stay lower than the US mean.

S&P 500 has closed yesterday's trade right at the support level of 3744. Supports coming up at 3641, 3577 and 3548

Resistance lines at 3945 & 4072 which seems pretty far away as of now.

Bank nifty important support and resistance lines

s1:38698, s2: 37946

r1: 39326, r2: 39739

Comments

Post a Comment