SPX and NDQ had risen 2.6% & 2.3% overnight in spite of worse CPI inflation data. Look at the chart below. There was a rally of 5.4% from the intraday low - this isnt a crypto, pennystock or shitcoin - its the world's most tracked & liquid index - S&P500

When the global markets fall, Indian markets will rise. And when the global markets rise, our markets will rise further. Welcome to the new world of decoupled Indian stock market indices.

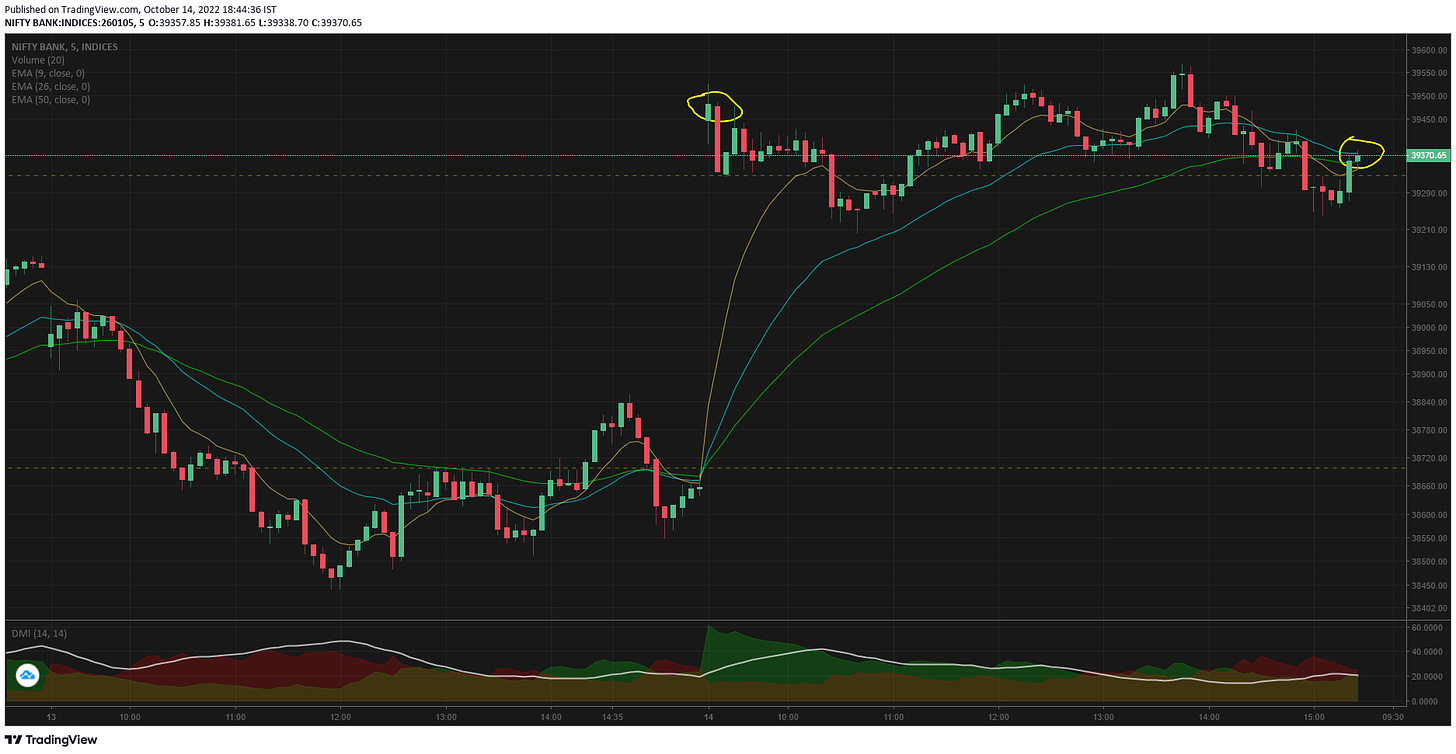

BN opened mega gap up at 39446 breaking through 2 resistance levels in a single go. Even after mega gap-up - never in the day BN attempted to close down the gap - this shows the immense short covering + fresh long additions in the opening hour.

Traders who had the guts to do the 9.20 straddle would have made lot of money today in spite of the surge in options premium - because the traded range of BN was very narrow. Only the opening scare was there - and few traders like me would have chosen not to take any trades today.

Coming back to the rally aspect of S&P500 - if its based on any change in fundamentals, its fine else that index is going to give back more than it made. Thats the classic feature of the bear market rally.

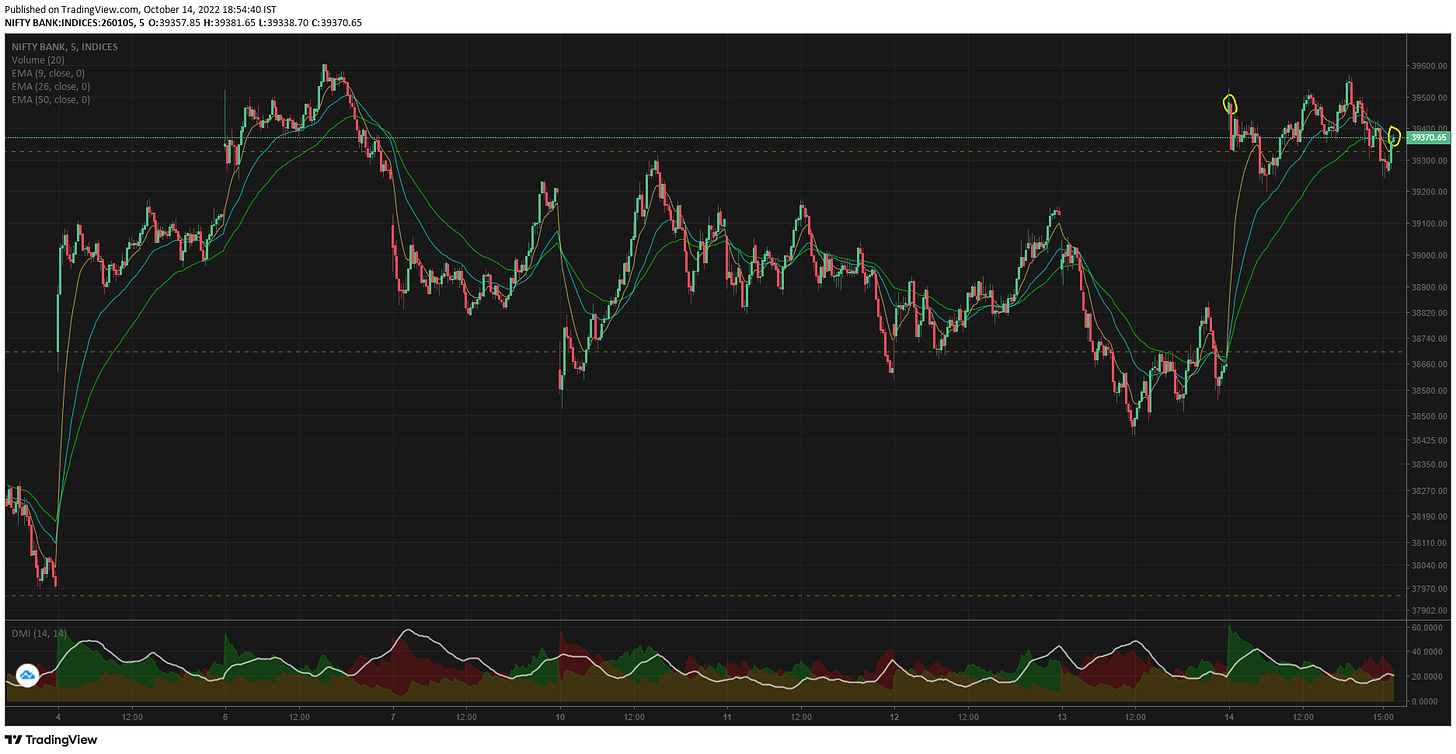

5mts TF has a big change from the analysis done yesterday, all of a sudden its looking bullish after having broken out of the range.

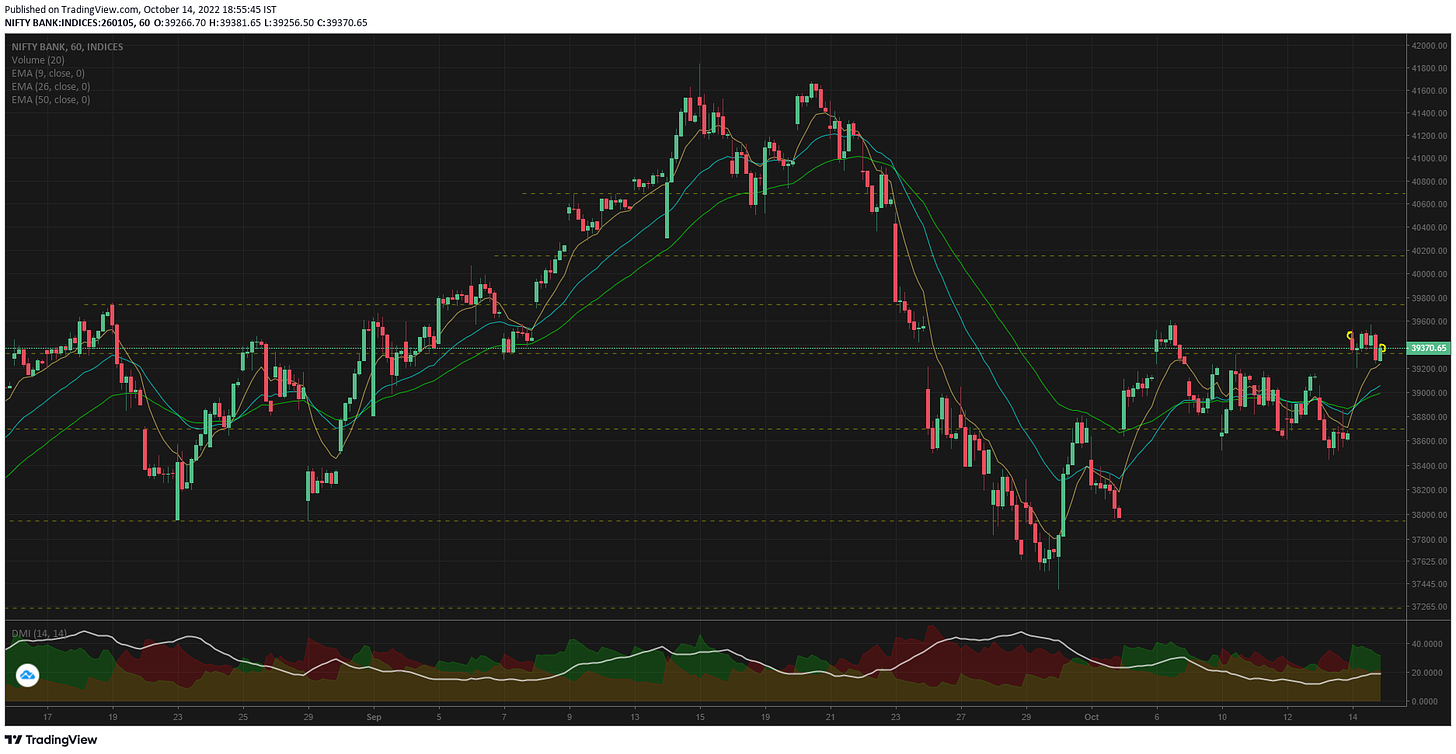

1hr TF is not looking bearish or bullish yet. Further moves are required to cement the direction.

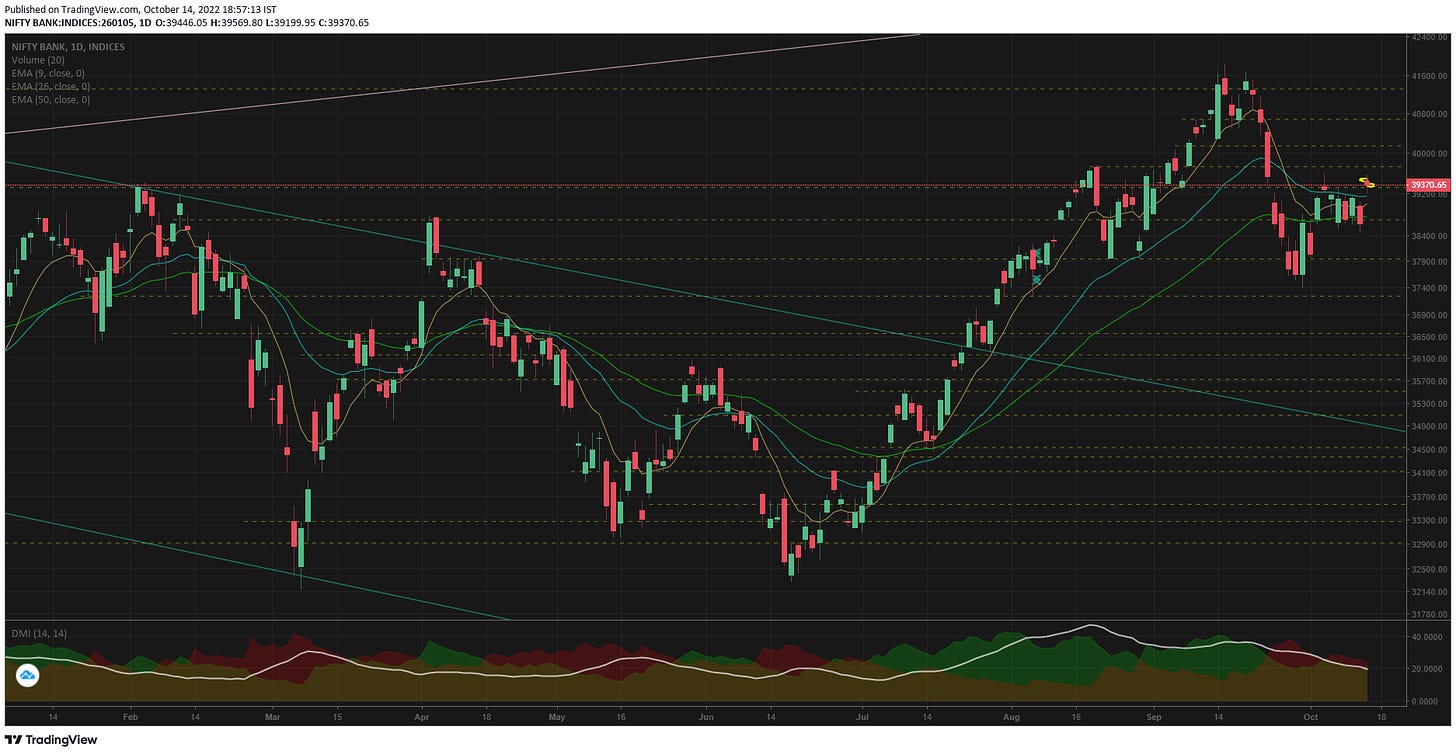

1D TF has now created a doji above the SR level of 39326. This is the same level where BN created a reversal candle on 6th Oct. Unable to guess the direction with contradicting information as of now

1W TF creating a bullish candle, notice how the bottom of the green candle is on the support line and the top is on the resistance with small wicks on either side.

Bank nifty important support and resistance lines

s1:39326, s2: 38698

r1: 39739, r2: 40154

Comments

Post a Comment