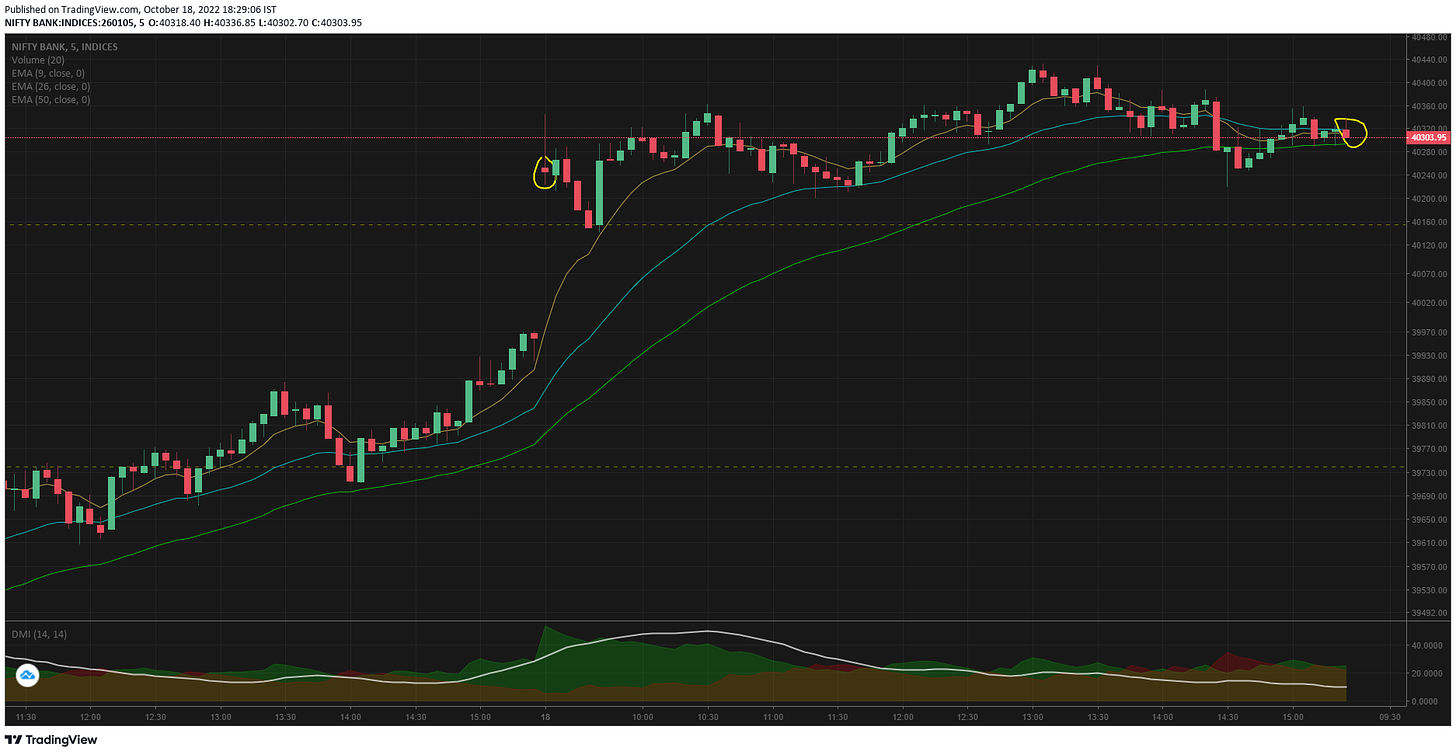

Bank nifty opened gap up at 40252 much above the resistance level of 40154. The first candle was bearish, so was the price action till 09.35. But the support level of 40154 held quite strong and there was an immediate bounce.

The green candle at 09.40 almost took back the bearishness of the preceding 3 candles. For the remainder of the day, bank nifty traded in this small range and finally closing at 40303 much above the support line - indicating strength.

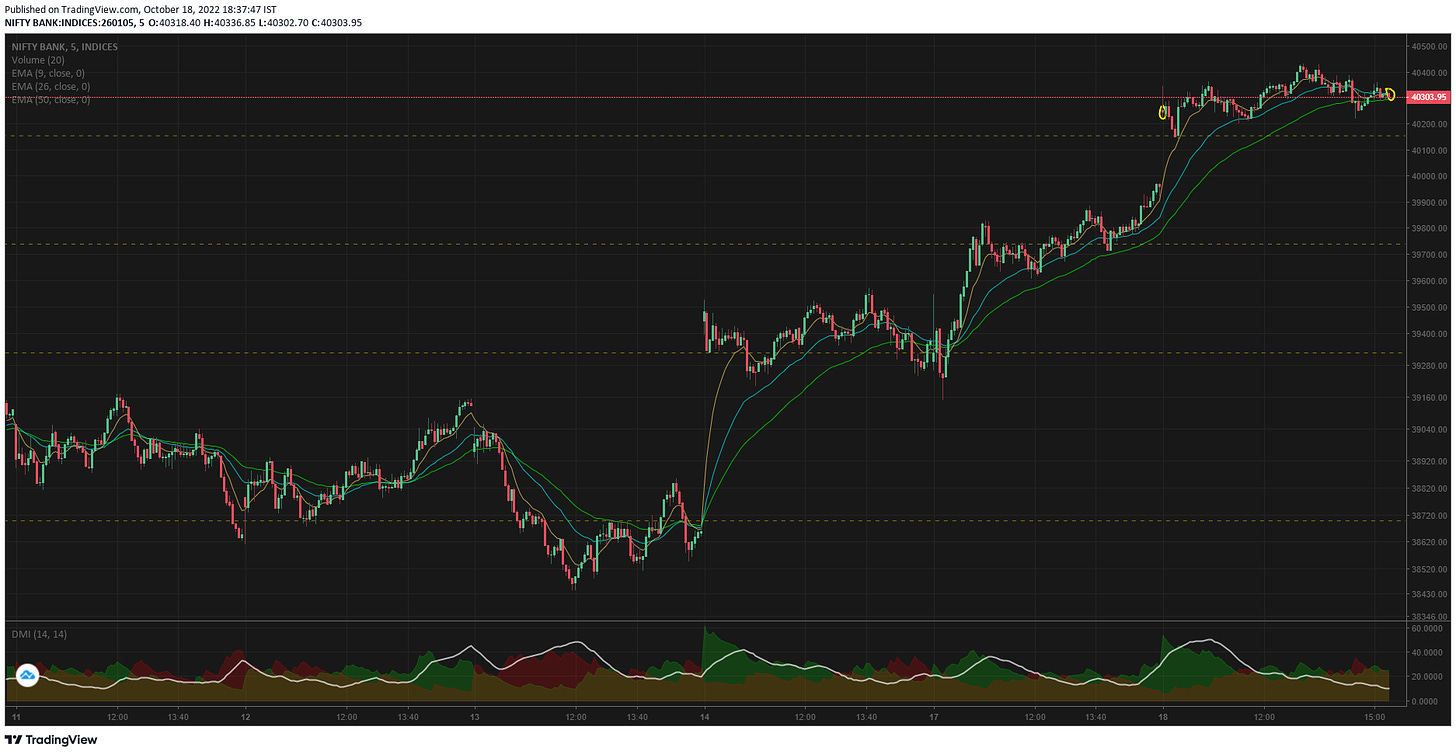

Again it was a classic day for the 9.20 straddlers - but who would have had the stomach to do it? Eventhough BN has set a bullish tone - the further upside may look challenging. BN is unable to rally through the day - the best option it took was to gap up. Resistance are taken out by gap ups instead of intraday rally.

From where i see it - its a high risk game. The gap up is usually because of a change in fundamental. Currently the only fundamental that is changing is the quarterly results. If the results look ok - banks will not rally. If the results are superb - then we can expect further upside.

But if the results are weak - then the impact towards downside will be heavy.

5mts TF look bullish as the resistances are taken out on consecutive sessions

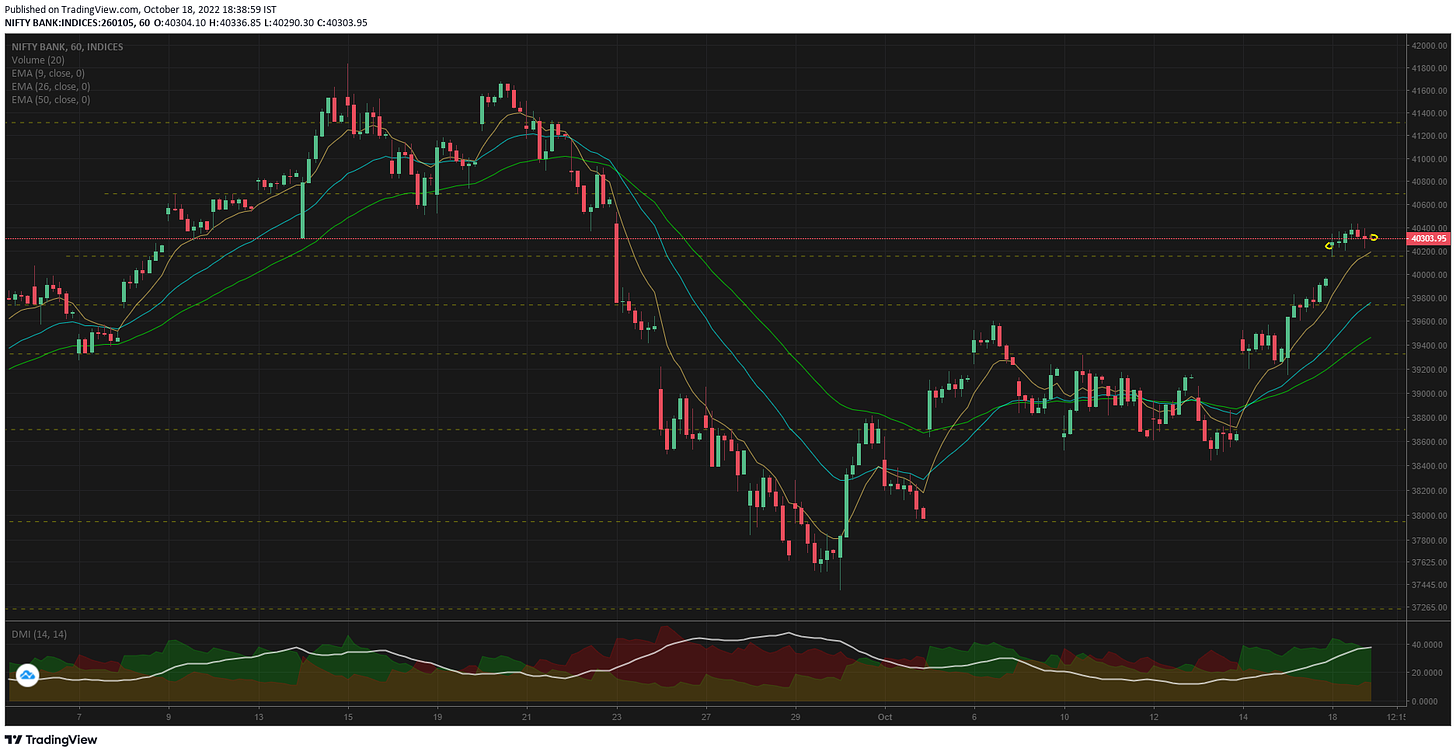

1hr TF starting to look bullish - but we need a strong close above 40700 SR level

Bank nifty important support and resistance lines

s1:40154, s2: 39739

r1: 40691, r2: 41312

Comments

Post a Comment