I will be slightly modifying the daily postmortem journal to include 5 major sections

-

Price action of bank nifty index

-

Price action of the 6 major components in bank nifty

-

The option strategy that would have worked today

-

Comparison of BankNifty vs SPX (S&P500 US index)

-

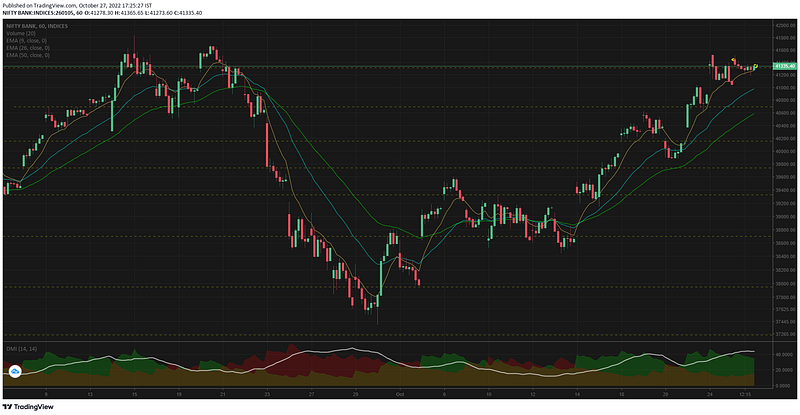

15mts & 1hr TF of Bank nifty to view the broader trend

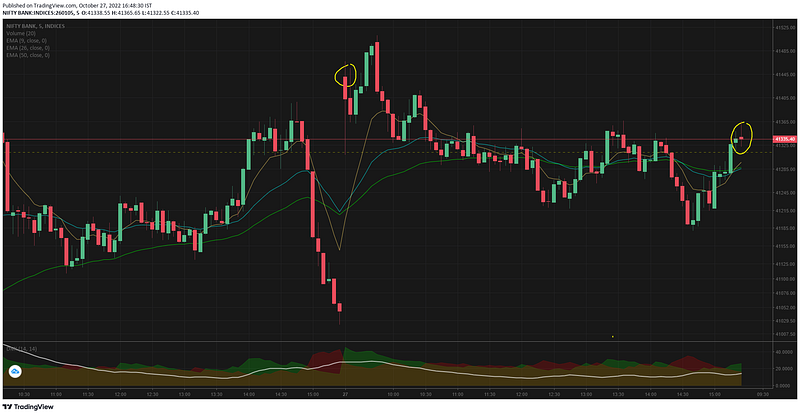

Bank nifty opened gap up at 41440 much above the resistance line of 41312 and almost 395pts from the last day's close. The first candle itself took support at the SR level & the trades till 09.40 showed positive intent.

There was a strong red candle at 09.45 and what followed was a shallow selling with no strong momentum. The support was taken out decisively only at 12.15, but by 13.25 BN scaled back up. And then we had on more round of price action but the final close was at 41335.

Looking at the daily move, its green but the price action showed quite negativity.

6major Bank Nifty components ie HDFC Bank, ICICI Bank, SBI, AXIS Bank, Kotak Bank & Indus Ind Bank respectively presented in the 15mts time frame.

HDFC Bank opened higher and traded lower, however the final closing was in green

ICICI bank was flattish

SBI was flattish but the price action is showing bullishness

AXIS traded significantly higher & the momentum is showing bullishness

Kotak is trying to recover from a sharp selling on previous day

IndusInd traded in a small range but closed a bit higher

Option strategy that should have worked today was the credit spread & short iron fly and short iron condor

Although BN traded lower, the range was quite narrow and a hedged short trade should have given good profits. People who would have gone in naked short selling would have felt their stop losses being hit due to the spike in moves at 09.45, 12.25 & 14.40. But if the trade was a credit spread or iron condor — the issue of stop loss would not have bothered you.

All CE credit spreads above 41500 & all PE credit spreads below 41000 would have given good results.

Bank Nifty is +8.2% vs SPX -7.74%. The spread widened after 8th Oct & is gradually closing up.

SPX & Nasdaq are macro negative as the results of tech majors is initiating further rounds of selling in an already bear market.

Bank nifty on the other hand is near the all time highs.

15mts TF is showing bullish continuation trend

1hr TF is also showing bullish trend — also BN at all time highs

Bank nifty support & resistance levels

s1: 41312, s2: 40691

r1: no resistance as near ATH

Comments

Post a Comment