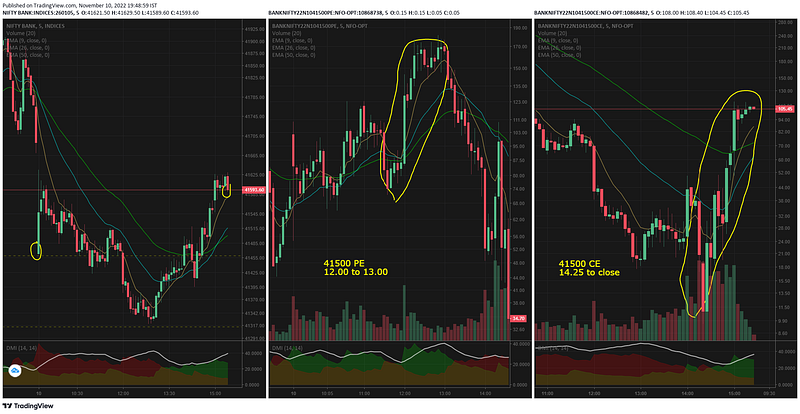

Bank nifty opened gap down at 41462 (right at the support line of 41459). BN tried to close the gap in the first 5mts itself but didnt have enough momentum. Yesterday we had analyzed the heavy option writing volume for the far OTM CEs — this was the main reason the BN had a negative start today.

This support line was not broken until 12.00 wherein it went ahead and tested the 2nd support line at 41314. For a moment we thought it would break the 2nd level also — but the pull back and the accompanying price action suggested BN wont be falling further today.

The recovery rally from 13.05 to close had good momentum — again strong buyers this ensured the resistance of 41459 is taken out by 14.35. Final closing was near the high of the day.

Of the bank nifty components, we had some interesting anomalies today

- Kotak bank was extremely bullish and ended the day pretty strong

- HDFC bank started the day gap down and negative, only after 14.00 it went ahead with a strong rally to close with a bullish tone

- ICICI bank was flashing around the previous close with pretty strong swings, after 14.45 it rallied and closed higher

- SBI and IndusInd had similar pattern — both bearish and no attempt to go higher during any part of the day

- AXIS bank opened significant gap down and traded in a small range suggesting a macro/news/event would have happened or is expected.

Expiry would have brought in multiple choices of option strategies that could be deployed. Most of them would prefer to naked sell the far OTM as they can monitor the risk — since its intraday.

The bulk of the money is made near the ATM where there is significant rise or fall in premium

Since the market moved in V shape today there were 4 basic opportunity based on the style we trade

- Buy 41500 PE from 12.00 to 13.00

- Sell 41500 CE from 12.00 to 13.00

- Buy 41500 CE from 14.25 to close

- Sell 41500 PE from 14.25 to close

Selling options gives clarity on the max premium we can gain. Option buyers has to exit whenever they feel an optimum bang-for-buck has been reached as there is no clarity on the max amount we can gain.

S&P500 vs Bank nifty — the spread is at -18.28% vs +8.22%. The minor drop in US CPI data may bring cheer to US markets and we could expect some short covering. Only to realize that the new inflation itself is weirder — people dont realize its YoY and the last year also they had a pretty bad inflation to begin with.

So the fine print may look like a softer number, but the hard reality is that inflation is still above last year's comparison.

S&P500 closed yesterday with a loss of -2.08% breaching the support line. The next support is at 3641 and the higher up resistance is at 3813.

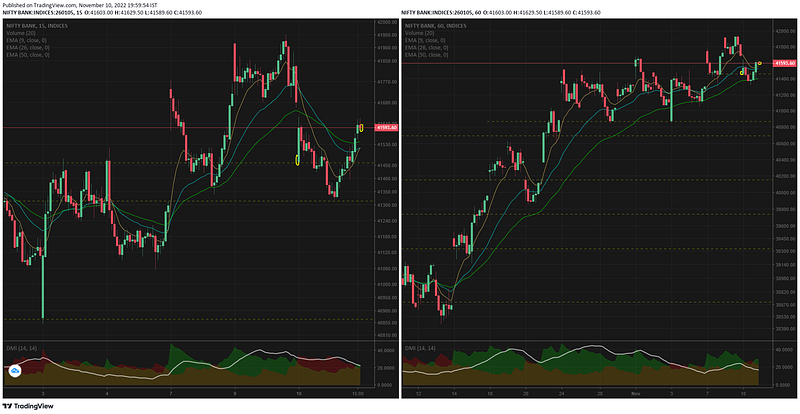

15mts TF shows a minor pause vs bullish tone in the 1hr TF

Bank nifty support & resistance levels

s1: 41459, s2: 41314

r1: no resistance as near ATH

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

Comments

Post a Comment