When i said its going to be a down day today, I expected a drop of 1 to 1.5% not just 0.18% — see yesterday's analysis as link below

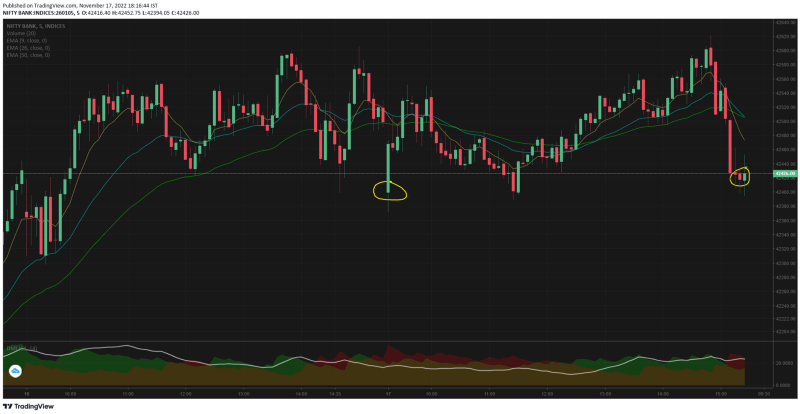

Bank nifty opened 42399 gap down and on expected lines as the global handover was quite negative. But in the first 4 candles itself BN had recovered the losses. From 10.00 to 11.25 there was a fall and i expected the index to trade much lower.

But somehow our bank nifty is staying strong, the sheer ability not to breakdown deserves special mention. From 11.30 to 14.50 we had another rally and it took out the HOD. And then from 14.50 to close we had a bearish break down and the final close pretty near the open price.

I was really expecting the last hour move to come before 11am, that would have created a bearish chart pattern — but as it stands the move just looks flattish.

Of the Bank nifty components -

-

HDFC bank maintained ground till 14.40 but broke down in the last 40 minutes

-

ICICI bank was outperforming and made a bullish pattern

-

SBIN started the first half of the day bearish, then made a surge and then broke down in the last 40 mts

-

AXIS bank although traded bearish, it took support at yesterday's close price and then rallied moderately

-

Kotak just gave away some gains that it had made yesterday, but the last 1 hour selling was really painful

-

IndusInd bank traded without any special bias, but the trades from 14.05 to 14.55 seemed quite strange.

Today was expiry day and there were multiple option strategies you could have deployed

-

Naked straddle should have worked out if you had the conviction, because the open and close prices were same. But the stop loss would have hurt you on the CE side. If you knew how to roll up the CE side short position — it should have made you money

-

All far OTMs went to zero, but the premiums were quite low, around 10.10 to 10.20 there was a spike in OTM CE prices — you could have gone naked short. Around 09.25 to 09.35 there was a spike in OTM PE prices too.

-

Ratio spreads — which requires a strong direction to make money would not have made sense today, because both the moves were short lived.

SPX had a down day yesterday, seems like it may go down further too as the retail data from US companies did not look good. The soft inflation data bullishness is fading out?

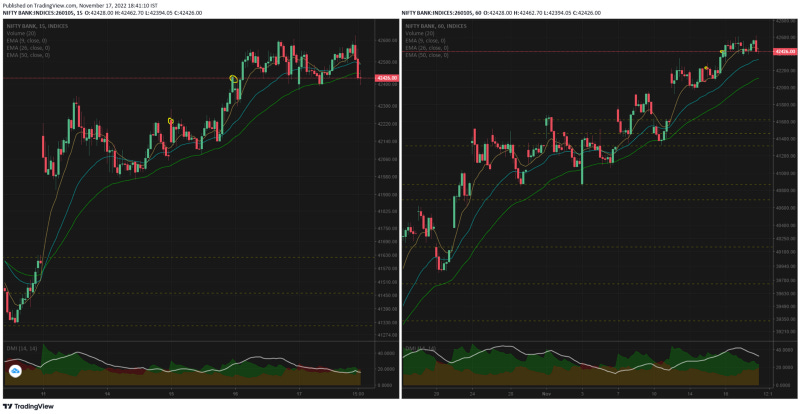

SPX vs Bank nifty — spread widening again !

Yesterday's trade was between the support of 3945 and resistance of 3991. We would need the index to cross either of these zones to catch a trend.

15mts vs 1hr — both the charts are not looking bearish at the moment. Because we need a break in support level for a trend reversal and my nearest support line is at 41618 around 1.9% below the CMP.

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

Comments

Post a Comment