Banknifty made some contradicting moves today with respect to the moves in Nifty50.

Nifty50 is showing an interim top formation on 15mts, 1hr chart but BankNifty is not showing signs of cooling down — every selling move is getting arrested.

Lets analyze today — BN opened at 42286 a gap down wrt last session and then made a green first candle and a red 2nd candle to reach where it started. Nifty50 on the other hand kept falling.

By 09.40 the selling got arrested on both bank nifty as well as nifty 50 — but remember nifty50 was right at its support line (see yellow) whereas the nearest support line for bank nifty is 1% lower.

Why contradictory? Its because bank nifty made 2 strong attempts to go higher, the first one from 09.45 to 11.25 and then 13.25 to close. The 2nd attempt was stronger. But nifty50 was laying low at the SR level without making any moves.

This shows the strength in bank nifty bulls — dont really know whats keeping them up.

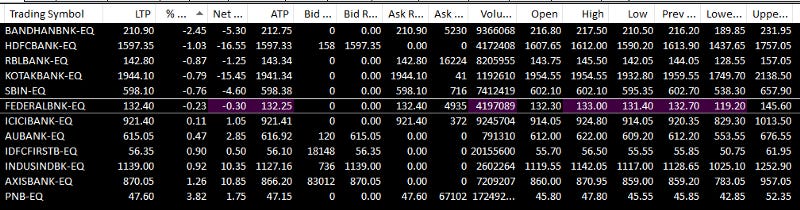

Of the Bank nifty components

-

HDFC bank made bearish chart pattern

-

ICICI bank was perfectly flat — had a breakdown at 12.00 but recovered by 12.50

-

SBI also made bearish pattern

-

AXIS made bullish pattern

-

Kotak bank fell, but the first 5mts was brutal and the rest of the day was in that range.

-

IndusInd turned bullish after 12.05 — but by the news it may be due to some news or event.

The option premiums were also quite strange today, mostly because the India VIX was rising in the earlier part of the day when Nifty50 was falling but the equivalent implied volatility may not have risen for Bank nifty.

The real premium rise came after 11.25 when Bank nifty started the 2nd leg of fall — but by looking at the volume of far OTM CE — it looks like short positioning.

Remember i felt bearish on 18th — read here, but the fall is shallow than expected.

I tried a debit ratio spread — sell 1 lot of 42000 PE and buy 2 lots of 41800 at 13.24 when the BN was trying to break lower. But this resulted in a loss as BN did not go lower.

SPX vs Bank nifty — our 1hr TF looking at a spread of +1.59% vs 25.91%

SPX rose 0.48% on friday — now its right midway between the support of 3945 and resistance of 3991. If it breaks the support today — then we will definitely have a down day on 22nd.

15mts vs 1hr — we can see an interim top formation on the 15mts TF — but it isnt that visible on the 1hr.

So we would need to wait for some more downward moves before we can confirm a change in trend.

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

Comments

Post a Comment