For some reason Axis Bank and IndusInd bank was quite strong today counter balancing the fall in SBI. Remember the Fibonacci discussion we had yesterday — seems like its playing its part, but not until all the strike premiums got eroded on Finnifty.

The late movements on the index has become a mainstay these days — it is a safe strategy for the big boys not to burn their pockets.

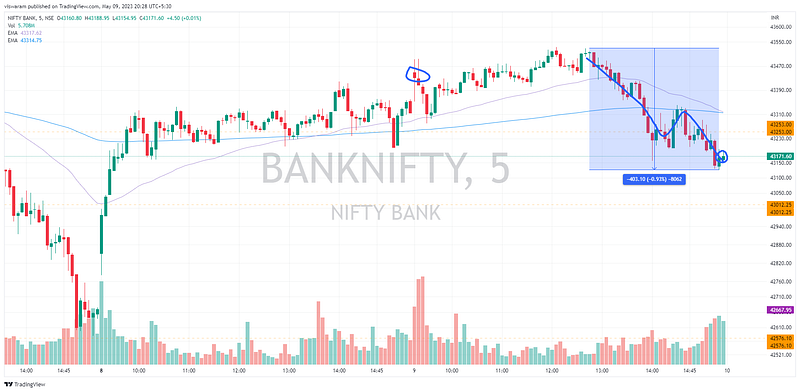

So today banknifty has taken out 1 support level at 43253, at 15.10 (5mts TF). All that while the markets were slowly grinding up, I was also quite surprised by the strength showed by the bulls today — with a negative sentiment prevailing they were not giving up. It took 4 red candles from 13.45 to 14.00 just to shake them.

15mts TF has not turned bearish yet, we would need a close below 42576 for that. At any point in the next 3 sessions if banknifty is able to take out 43700 levels then the chart will look bullish. So if the bears has to do something — now is the time.

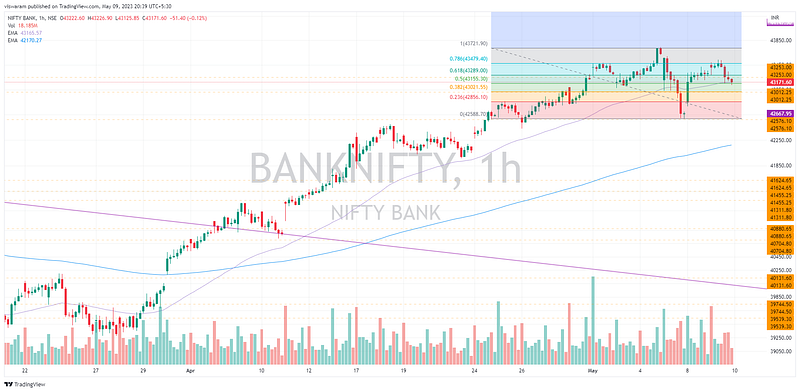

1hr TF is shown with the FIB levels, today's reversal came at 78.6% retracement level and not at 61.8% (so my first assumption was wrong). Also the strength of the bulls were too strong that my bearish opinions were weakly held.

Finnifty had a similar pattern to banknifty, but the support provided by HDFC in the early part of the day was quite evident. The FIB levels are exactly same for both the indices — today's reversal came exactly at the resistance zone of 19421.

From an expiry stand point, the margin requirements on finnifty options are comparatively lower giving a higher returns for the same risk vs banknifty.

Will finnifty gain more popularity than banknifty due to this??

Comments

Post a Comment