Nifty50 was having more positive price action vs banknifty today — that may be because there are 2 more resistance zones to go for Nifty50 to reclaim the ATH whereas I do not have another resistance level for banknifty.

Also the NiftyIT was providing some additional support today. If Nifty50 has to go up further, the additional points has to come outside of the financial sector.

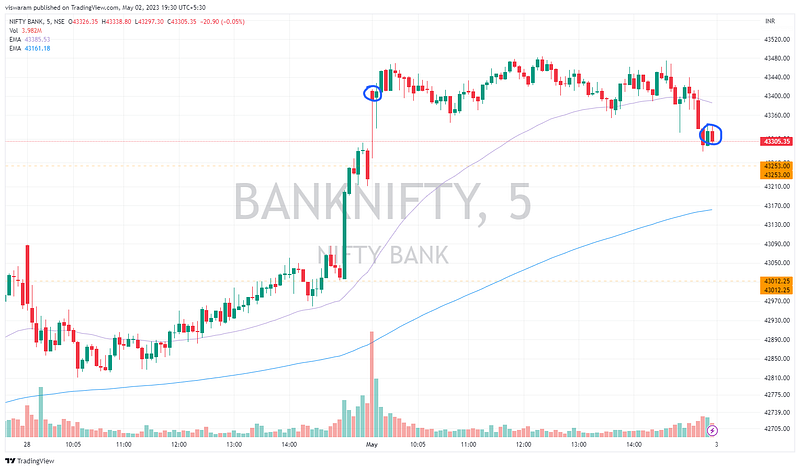

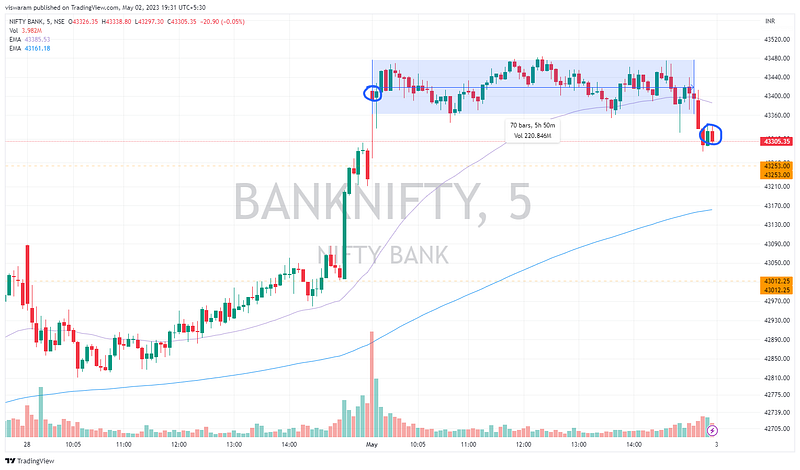

Banknifty opened gap-up, but the price action formed is continuous as the first candle retested last closing level. From there we had a narrow band sideways market.

For 5h 50mts today we had a narrow traded range of 43362 to 43476. The upside was capped as the buying momentum was missing. The downside was protected as the bulls were quite strong. So literally we did not have any place to go today.

Only in the last 1 hr we had some pattern forming indicating a profit-booking or an interim top like formation. Just a minor 180pts fall from HOD. Why I say there could a bit more selling to come is mainly because the volume of credit spreads that were getting created on the call side.

Nifty50 also had a flattish pattern and unlike the banknifty the last 1 hr selling was not visible. It was a perfect day to get into a straddle today as the opening and closing prices are near same.

Nifty50 traded in the range 18136 to 18175 today with no pressure to pick a direction.

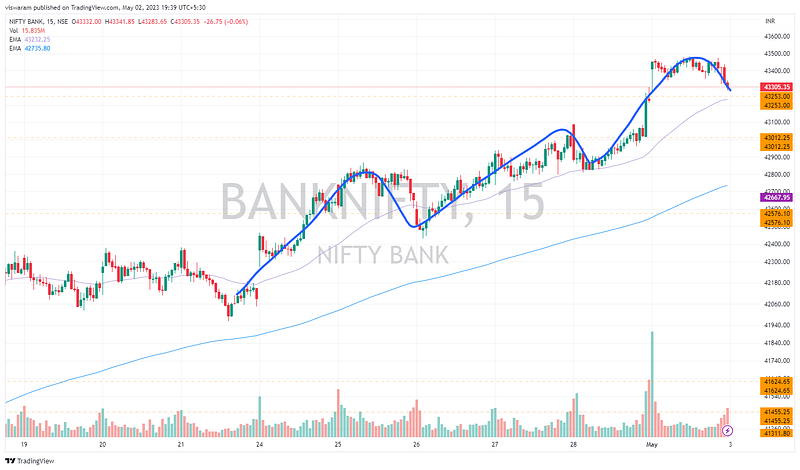

15mts on banknifty is still bullish pattern. And its looks like a rounded top is getting formed. We would need further trades to happen below 43253 to have a change in bias.

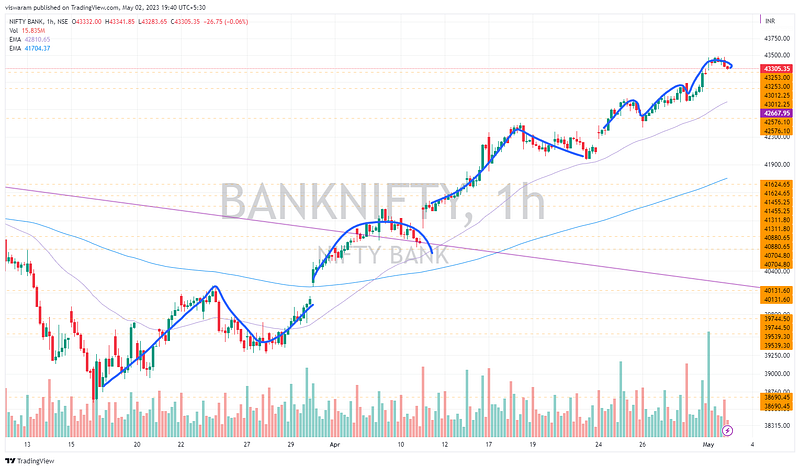

1hr is still bullish and we would need a close below 42576 to have a change in bias. I do not have a resistance zone above the current levels. However it is quite unlikely that just banknifty moves up without Nifty50 crossing the 2 more resistance lines.

Finnifty expiry special.

The open was gapup same like bank nifty and the traded range was again pretty narrow. However the selling pressure in 3 candles via 14.45, 15.00 and 15.15 was quite strong.

These 3 came at a time when the options premiums were all near zero, so assuming these were un-windings of the positional trades taken for expiry.

I am starting to spend more time on finnifty for Tuesdays as its much easier to trade than just banknifty. Atleast the certainty that the options will go to zero is still there. This is more relevant now as the banknifty options premiums are at their lowest levels. Unless the volatility rises the premiums of banknifty will remain subdued.

Comments

Post a Comment