Banknifty has made an unique price action today — again the day belonged to the bulls. Their never ending optimism is driving the valuations crazy.

BN opened gap up at 42467 made 2 red candles instantly and came back to yesterdays close price. From there it traded with a slight upward bias and gaining steam last 40mts.

Look at the yellow marked region — apart from the gap up today — the rest of the day shows continuity with yesterday's price action. The recent support levels never tested shows the eagerness of bank nifty to keep scaling up without any resistance.

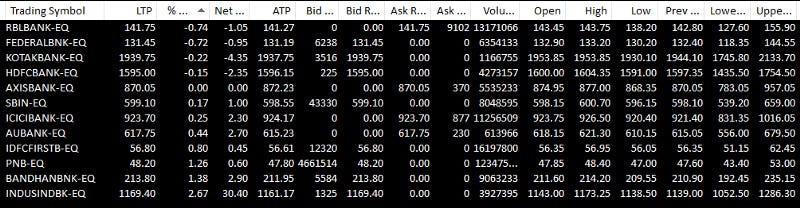

Of the bank nifty components

-

HDFC Bank was flat although there was a spike at 12.05 which then gave up more than it went up hitting an intraday low at 14.40

-

ICICI Bank surged in the opening minutes and the gave it back, tried again and gave it back 2nd time. Tried 3rd time but gave it back by EOD. Still the close was in green

-

SBI opened higher then went underwater by 10.10, then caught a trend from 11.40 closing in green with strength

-

AXIS opened higher and went higher but started giving back gains by 11.05. Finally it dropped to Prev. close level and traded flat to end the day

-

Kotak had a dangerous opening 5mts candle but then it traded in that range for the rest of the day

-

IndusInd bank carried the good form from yesterday and gained strength and momentum throughout the day.

SPX vs banknifty +3.13% vs 27.44% now. Both having upward slope in 1hr TF but the spread is widening

SPX ended yesterday with a loss of -0.39% but its final close was just above the resistance line of 3945. If it manages to hold it then we can see a further upside. If it doesnt the next fall is going to be bit brutal as the support comes up only at 3813.

15mts vs 1hr TF comparison. 15mts shows a sideways movement as the top formation may get ruled out after today's price action. 1hr shows upward slope hence bullishness will continue unless we get a reversal by breaking support level.

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

Comments

Post a Comment