We opened today without a handover from US as it was Thanks giving holiday for them on 24th Nov. Bank nifty opened at 43192 just in line with the last hour trend that started yesterday. And went to a new all time high of 43339 at 09.30.

This 5mts candle had a long top wick just hinting of a possible short term top formation. What followed was exactly that — we had a first leg of drop from 09.30 to 11.55 and a 2nd leg of drop from 13.55 to 14.15. But the final closing was a decent one. So from a day's perspective we only had a drop of 0.21% but the intraday chart pattern showed a bit negativity.

The moves on monday and tuesday will be crucial as December is usually the month wherein the FIIs book profits for the year. Volumes may drop on Dec that will increase the fluctuation in prices.

Of the bank nifty components

-

HDFC had a classic bearish pattern today — a sudden morning dip and then a narrow fall

-

ICICI tried to hold on to the flat line till 10.30 but it broke down and then flattened by close

-

SBI was in positive territory till 11.10 after that it too fell underwater, final closing did not see recovery

-

AXIS stayed positive today and was the leading contributor to the index — never fell below the flat line today

-

Kotak had the most bearish pattern for the day, 2 legs of drop today.

-

IndusInd also stayed positive today and ended with gains of 0.98%

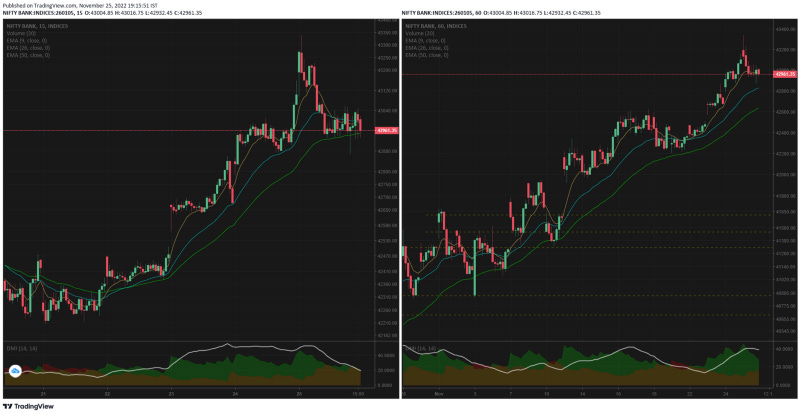

15mts vs 1hr — the intraday bearishness was not visible on the 15mts or 1hr chart as such.

15mts may create a top formation pattern if we have a fall on monday. 1hr is continuing to show bullish pattern.

1D TF shows bullishness, but today's red candle may indicate a warning for the days to come.

1W timeframe does not really show today's price action that much — as it stands the candle is strong green and we have 3 consistent green weekly candles. The low of this week's candle is the first support level for bank nifty.

Also note that we are nearing the top of the decade channel.

US markets were underperforming Indian markets for this year — there are 2 possibilities that could happen and both of them may not be good for Indian indices

-

FIIs could start selling now, take back money to their mother market as they are starting to move higher

-

Further worsening of global macros or war could force FIIs to sell off and move to cash

FII selling will definitely weaken the rupee, further devaluing their returns.

Indian indices will not fall if the domestic mutual funds and retail investors keep accumulating shares. But i am starting to think — arent the valuations of these companies simply unexplainably high???

Comments

Post a Comment