Looking at the price action i had given a sell short call yesterday — read here

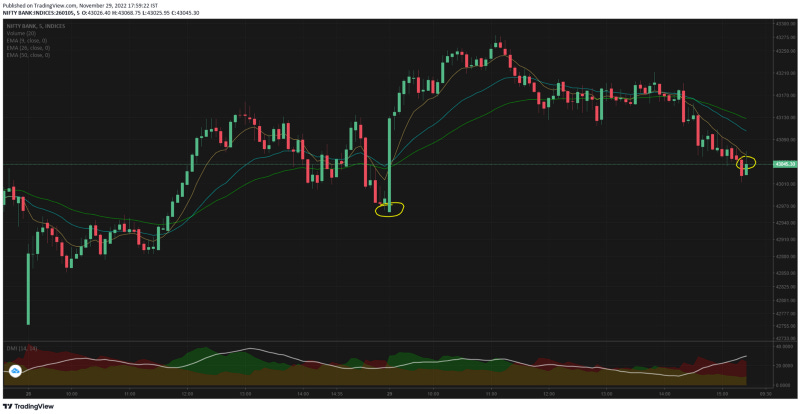

I had to literally change the view looking at just the first candle. A mega green 5mts candle that took bank nifty 172+ points & above the swing high of yesterday. The rally did not stop until 11.05 creating a steady buying momentum.

From 11.05 to close of day it was a slow fall back to where it all started. Final close just 0.08% above yesterday's close.

In the gradual decline there are 2 candles that stands out, one at 14.20 and 14.35 which led bank nifty to fall below the swing high of yesterday.

Now we have 2 contradicting signals — a breakout bullish signal in the forenoon session and a gradual bearish signal in the afternoon session. Which do we consider — not quite sure.

Remember yesterday we had discussed the massive amounts of call writing especially for 43000, 44000, 45000 & 48000 CE. The pattern is quite similar today also. Approx 25 to 30% of options trading volume came after 15.00 today.

Such intensity of call writings happens only when the call writers are confident that the markets will not move higher. I am a strong believer of this leading indicator and continue to be cautiously bearish till we see the call writing vs put writing ratio normalizes.

Of the bank nifty components

-

HDFC bank started the day strongly, made a peak and then started falling in the afternoon session. Final close was flattish but the pattern showed bearishness

-

ICICI Bank showed intense strength, kept climbing and then showed no signs of reversing even when other banks started falling afternoon. Today's chart pattern looks flattish

-

SBI had a gradual rise and then a regular fall in afternoon — final close flattish

-

AXIS started the day strong, but the fall after 10.25 showed negativity. Although it went underwater only after 15.15 — the chart pattern shows negativity

-

Kotak bank also closed flat but the chart pattern was quite confusing. A gradual fall to start the day, the a quick rise to swing high and then a quick fall to go back to flat line.

-

IndusInd bank showed gradual bearishness.

15mts TF shows a top formation in place. If we have a down day tomorrow we can confirm it.

1hr TF shows either an interim double top or a consolidation move — will need to wait for more clarity.

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

I am not a SEBI registered analyst — the views are for educational purpose only

Comments

Post a Comment