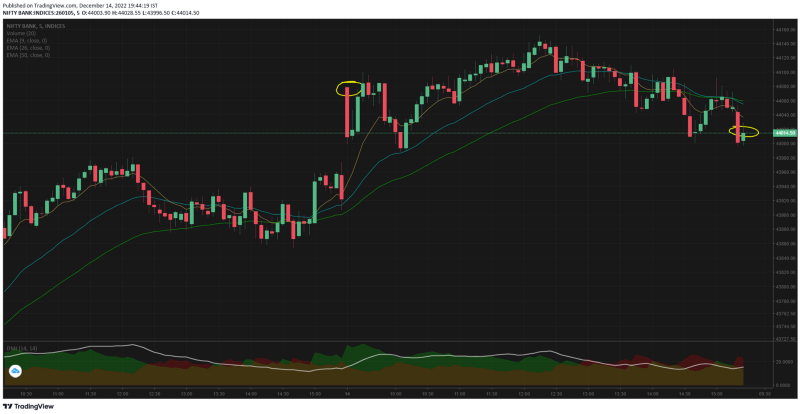

Its become business as usual for bank nifty to take out the all time highs — new ATH is now 44151. Today bank nifty opened gap up at 44078 mainly because yesterday's handover from US markets were quite good.

US CPI (Inflation) came 20bps below their estimate and that triggered an immediate surge on SPX by 2.71% — the final closing was only 0.73% higher and the earlier gains were all sold into.

We opened strong and the first candle was a big red one, then we had a 3rd & 4th candle ensuring bank nifty is back to where it opened. There was a brief gap closing from 09.50 to 10.05 — but it took support at yesterday's swing high.

Then there was a steady up move from 10.10 to 12.15 setting the new ATH. And the period from 12.20 to close saw a similar slope but to the negative side.

Looks like a roof ! Now this is at a gap up — so if the next few days are getting spent at a lower levels, it will resemble an evening star pattern on the daily TF

Today's move in US indices will be the actual direction setters. Inflation coming down doesnt mean any thing when looked at in isolation. If the FED continues to remove the liquidity then the growth stocks will not break out.

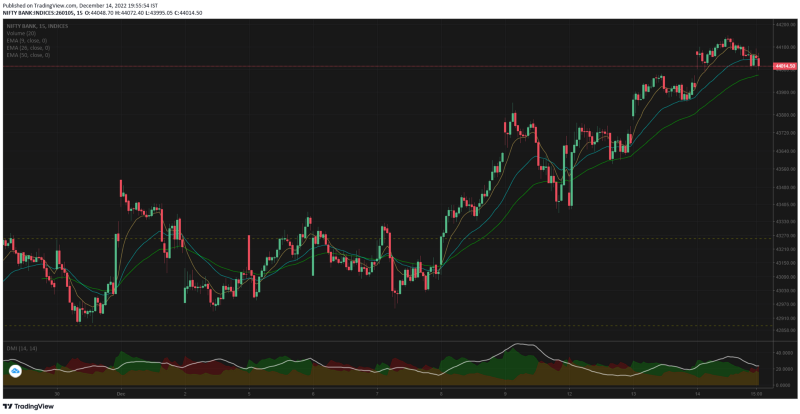

The 15mts TF of bank nifty shows how easily the upmove was constructed once the resistance band of 43255 was broken.

Of the bank nifty components

-

HDFC Bk had a huge jump from 10.15 to 11.05 and then the remainder of the day was a flattish trade

-

ICICI opened gap up and then fell consistently with no pull back or attempt to go back to flat line. A fall which doesnt look like a positional trade but similar to some news or event that may come up.

-

SBI had a good green shoot at 09.25 and then the rest of the day it built from that gains. The pattern was bullish.

-

AXIS had a positive start and went strong till 12.15 after which it fell underwater. From 14.45 there was a minor attempt to retrace to the flat line.

-

Kotak had one strong red candle at 09.45 still showing the overhang of the negative bias, but it took support at the flat line and the final closing was steadily in green.

-

IndusInd continued from yesterday's chart pattern and had a good positive run.

The 1hr TF of bank nifty looks absolutely stable and strong, the perfect slope of almost 45 degree. To have any possibility of trend reversal we need to watch out for the support getting taken out along with the EMA cross over.

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

I am not a SEBI registered analyst — the views are for educational purpose only

Comments

Post a Comment