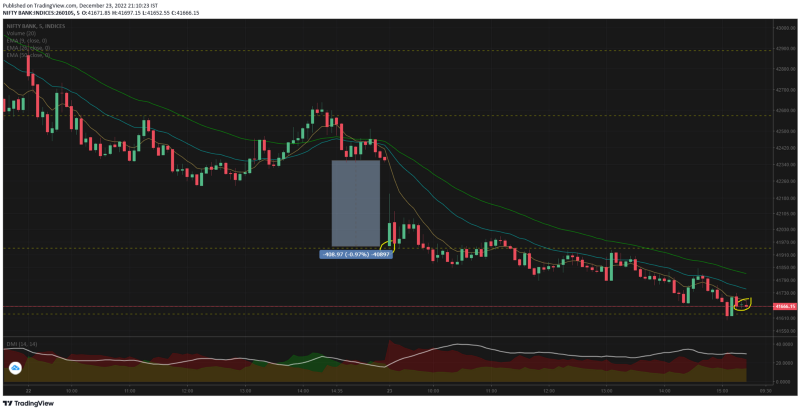

Bank nifty lost over 1.75% today of which ~ 1% was lost in the gap down open itself. The open was at 41951 pretty near to our support line 41940. The first candle showed positivity & i thought maybe bank nifty will hold the level.

By the 2nd candle it had fell back to the support level and by 10.00 we had a breach in support. From there it was a gradual fall to the next support level of 41629.

At 15.05 we had a test of the 2nd support level and it seemed like holding it from further falling — we cannot be sure as bank nifty was saved by the bell.

So the major portion of today's trade was between the SR levels of 41629 & 41940. And today the general market trend was also negative which does add to the reckless selling continuation.

Yesterday bank nifty did fall but the NiftyIT index was holding green almost till noon. But today even the IT index came under pressure as overnight S&P500 and Nasdaq100 fall was intense.

By now most of you would have predicted the change in bullish stance, most traders are now looking for shorting opportunities — 1 leading indicator is the amount of CE writing (volume speaks)

49500 CE was traded for 49.42 lakhs, 46000 CE for 64 lakhs, 45000 CE for 82 lakhs, 44000 CE for 1.46 crore, 43000 CE for 3.3 crore. Just multiply these with the average trade price to know the total traded value in rupees.

The good thing is that majority of the participant is expecting the markets to fall further over the next 4 days. The bad thing is that — if there is a reversal or a small pull back that goes above the previous session high, the short-covering rally will over inflate the option premiums.

So this calls for an exciting week and monthly expiry — as its festival cheer the trading volumes will go down & the volatility is expected to spike as price spreads will increase.

Of the bank nifty components:

-

HDFCbk had a gap down opening and the day was traded with a small rise, but there was no recovery or attempt to close the gap.

-

ICICI opened gap down but there was a recovery to flat line and by 11.05 the selling resumed

-

SBIN was in a perfect bearish pattern, gap down opening and selling into that.

-

AXIS also had a recovery to flat line opening minutes and then the selling for th rest of the day

-

Kotak was putting up a fight just like yesterday, it was holding green till 14.05 but the last 30 mts ensured it too is closing red.

-

IndusInd had 30mts of green, hit the flat line and then selling intensified.

15mts & 1hr are confirming the downtrend, both are breaking support levels and no recovery rally on a closing basis

1D TF shows 3 continuous red candles, and the length of the candle ie drop in the price is also quite strong.

We are now at a level that was peaked at 15th Sep from where we had a massive dip till 37420 levels. Also we have now retraced the prices till 07th Nov.

For the selling to intensify the current level has to be broken otherwise it will just appear as a higher low in an otherwise up trending market.

And for the bearish case to sustain the current swing should close below the 37420 levels and create a lower low pattern.

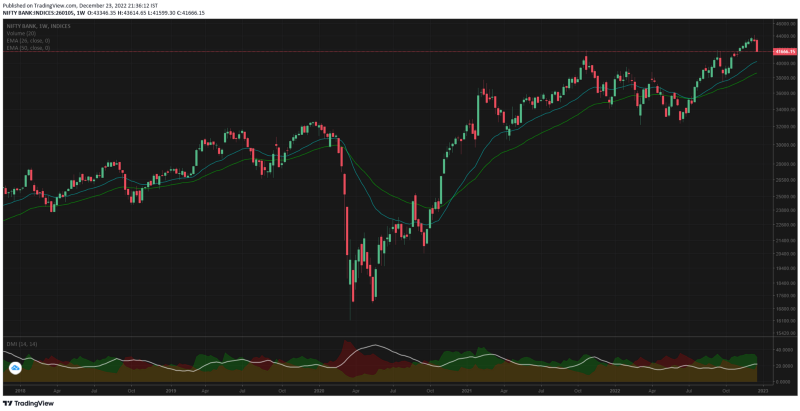

1W TF is showing just a big red candle — there is no question of bearishness on the weekly scale, its just too early to say that. Once the moving average (50 & 26 EMA in my case) cross over, only then we need to go for a real bear run.

The nearest date that happened was 16th March 2020. On 11th Jul 2022 we had a hit between these 2 EMA but they did not cross.

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

I am not a SEBI registered analyst — the views are for educational purpose only

Comments

Post a Comment