Bank Nifty Today — 29 DEC 2022 Post Mortem & Expiry Analysis

I dont know why the bank nifty didnt fall today, the science seems so solid — if i were to borrow King Julian's words from Madagascar.

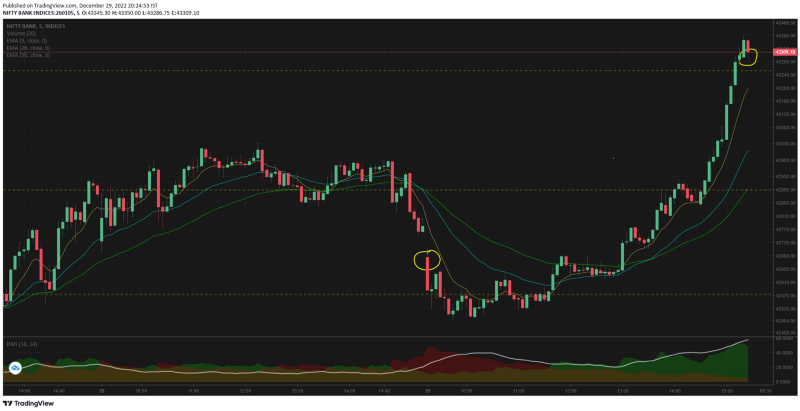

The handover from US market was negative as expected and today's opening was a gap down at 42684. The first candle was red went down to the support level of 42573.

Till 11.40 BN spent its time around this SR level without falling. And then miraculously it took support & started rallying.

From 11.40 to 14.05 the rally was with less conviction and the 1st resistance line was hit. And from 14.40 to the close the 1st resistance was taken out, so was the 2nd resistance of 43252.

Absolutely no red candles from 14.30 to 15.20 in what would be an epic move. The 2nd leg of rally had lot of steam and there was no stopping unless the bell.

Looking back and thinking — my bearish opinion was proven wrong, but more painfully the counter move proved to be a bear market killer.

I guess the bank nifty bulls cannot be killed now, the bears will have to persuade them to suicide. Bulls cannot be stopped.

Probably 2022 will go down in the years of economics as the brightest year for India. When the entire global markets were bleeding — we are not just up YTD but up by a whooping 39.22%.

EPIC !

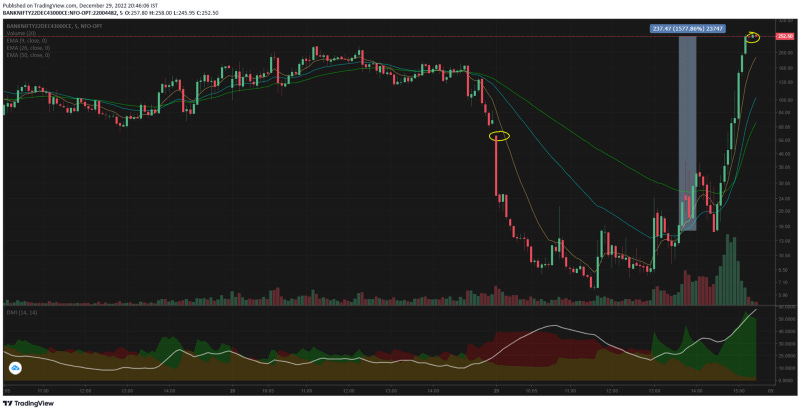

From an expiry perspective the premiums died much ahead of schedule — there was no spike in IV for any OTMs. The story of 43000 CE is that of a shining start today — let me pull up its chart.

By 10.15 the premiums had already died and the LTP was 8.3, spot was at 42531. Normally people who'd love to hedge naked call shorts would have entered into this trade by buying lots of 43000 CE.

In the end it went up 1577% today from 15 something to 252 in the last hour of trade today. A rag to riches story candidate for today. Well who would have the conviction to buy calls today when the bank nifty was expected to fall — i didnt. And thats why i didnt make money today !

The bank nifty components had no anomaly today — everyone of them were in alignment to what happened today.

-

HDFCbk got back to the flat line and then the last hour ensured it spiked well above the swing high of Dec 26th

-

ICICI also same story and is at the swing high of Dec19

-

SBI has retraced a lot of fall & looking strong

-

AXIS undid what happened yesterday

-

Kotak just managed to reach just above the flat line only

-

Indus Ind also retraced much of the recent fall

The volume bars at the bottom for each of the 6 charts shows intense buying — why so, I dont know yet.

I cannot think this as a short covering rally, it has to be fresh longs — why would anyone cover their shorts when the US markets had fallen yesterday. Unless they knew from Inside on any geo-political developments.

Is the war over???

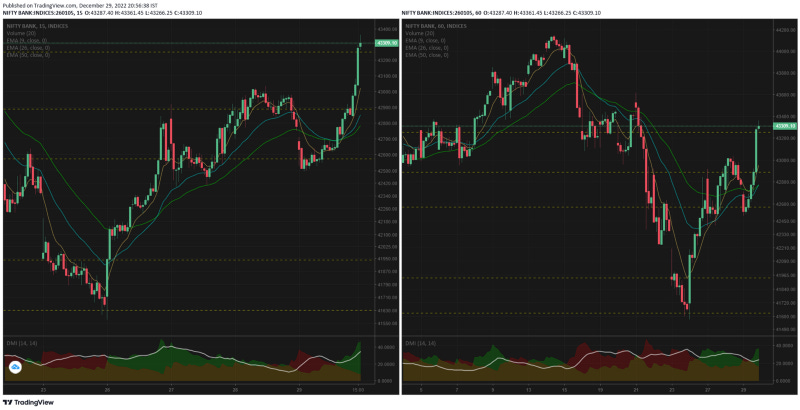

15mts vs 1hr — the multiple resistance breaks may have just confirmed we may not be looking at a new lower low anytime soon.

I am not taking any directional bias as of now — will wait for further price action to take positional trades.

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

I am not a SEBI registered analyst — the views are for educational purpose only

Comments

Post a Comment