Strange looking opening candle by bank nifty today. Mega gap down opening at 43093 and in the first 5mts a rally to close the gap.

193pts ~ 0.45% recovery in the opening 5mts and then a build up till 09.55. From there we had a breakdown till 11.05. Kotak's Nest trader had price tick issue but their orders were getting punched. I was lucky to place orders today when the volatility started picking up.

The fall continued till 14.50 with no particular recovery in sight. But it was not a deep cut, though we might have some in the days to come.

Another strange thing is that the open's low was not broken today, at 14.01 and 14.44 we had 2 tests — but nothing gave way. And the 5mts candle at 15.00 gave some pull back momentum.

All these are quite hard to believe — after a 1.79% fall in SPX US markets — our markets are not even falling 0.5% Nifty50. Eventhough the Nifty IT index had intraday cuts around 1.8 to 2% — it closed at -1.45%.

Now the RBI's MPC meeting minutes will be disclosed at 10.00 AM on 7th Dec 2022 which will create few wild swings. According to me, today's move did not show any positional clue regarding the event tomorrow. Maybe we will have a Gap opening tomorrow to price in the interest rate decision.

As always a higher interest rate is good for the lenders and not so good for the borrowers. If the interest rates are too high then we may push the economy into recession as the borrower would rather shut the business temporarily than borrow.

Of the bank nifty components, in the 10mts TF

-

HDFC bk almost had a replay of the price action from 12.00 to close 5th Dec. Final closing at the same level — pattern is bullish

-

ICICI had a gap down and continued falling even though not at a high intensity. pattern is mildly bearish

-

SBI's fall creates an interim top like formation or creating another leg of price action. We need further price action to determine what it is.

-

Axis behaved quite strangely in the last 40mts. The bulk of the reason banknifty recovered some ground is due to axis. The forenoon session it was trading underwater, but the rally form 12.05 was strong and final close was also strong with momentum.

-

Kotak did not go anywhere today, had a gap down made the day's high at 10.45 and then gradually fell to the flat line. Chart pattern is confusing.

-

IndusInd had a bearish pattern after a gap up opening. So now the prices are back to the Dec 02 closing levels.

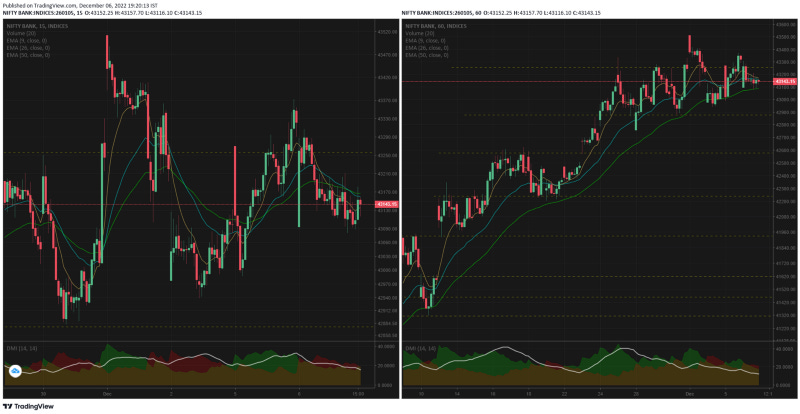

15mts TF does not show a direction — the prices are between the support and resistance levels and without breaking anyone of them — it cannot create a trend

1hr chart does not show bearishness, but if the support levels are not broken then the bullishness will resume.

PS: Read the standard disclaimer at: https://bit.ly/3Nm3RER

I am not a SEBI registered analyst — the views are for educational purpose only

Comments

Post a Comment