If you had read by bullish call before that — you would have thought i am crazy.

From an expiry trading perspective today proved to be an ideal day for traders both bulls & bears, thats because we had 2 swings today.

Bears till 13.30 and Bulls in the last 1hr. But i think more traders would have lost money today, thats because by the trend set in the day — no one would have anticipated the recovery in the last 1 hr.

So ATM option writers of call options would have hit into stop losses. Also there is an equal probability that buyers of PE option 42000 to 41500 would have lost much more — like i did.

Anyways its not our cup of tea to tame the beast bank nifty is — we just need to survive to fight another day!

I guess i should start trading US markets as my predictions are more accurate there, well it could also be because i dont have skin in the game there as i paper trade there.

And here in India — since i deploy funds, my emotional aspect also comes into play !

US CPI data has come at 6.5%, last year it had increased 7.5% — read here

January 2023 CPI weight update Starting with January 2023 data, the BLS plans to update weights annually for the…www.bls.gov

Lets say the inflation value is say 1000 in Jan 2021, then by Jan 2022 it became 1075 and in Jan 2023 it became 1144.87 — i dont understand why people feel inflation is cooling down. Or is my math wrong?

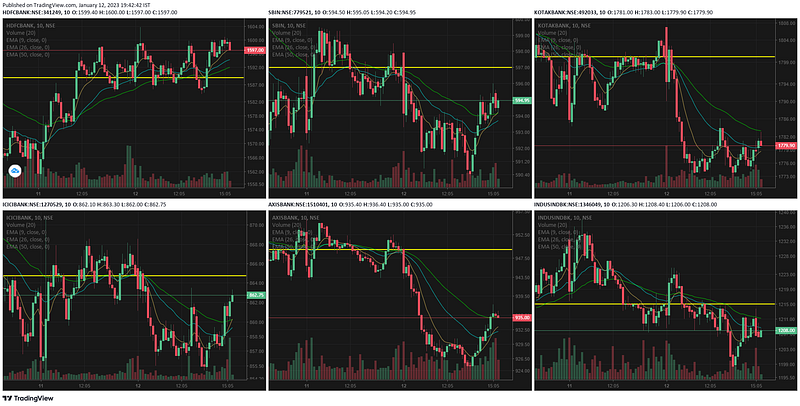

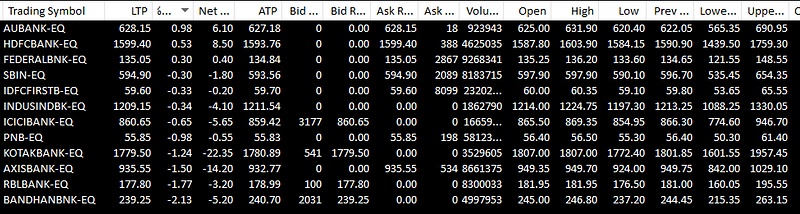

Looking at the bank nifty components, you would believe that we fell only 37pts today

- HDFC Bk was the only bank that fought for the bulls — up 0.53%

- ICICI bk was the major contributor that helped BN cut its losses last 2hr. because it moved up 8pts ~ 1%

- SBI was showing trend continuation pattern from yesterday, but the reversal from 13.45 helped it cut the losses to only 0.3%

- AXIS bank also had the last 2 hr recovery, but its pattern is still bearish.

- Kotak had some deep cuts earlier in the day, was down 1.84% by 11am a near vertical drop. Although there was some stability afterwards the chart pattern is still bearish.

- IndusInd was just continuing from yesterday's trend. Prefer to say that volatility was relatively lower for this bank today comparing peers.

15mts chart may prompt most analysts to go bearish, but for me i would like to see the support level taken out first before going short.

1hr chart looks more bearish than 15mts thats because of the prior day's fall creating the illusion of fall. Until 41620 stays intact — its still not safe to go short.

Comments

Post a Comment