So it was just an ultra short term target, we also discussed it might be the counter move to the finnifty expiry tuesday.

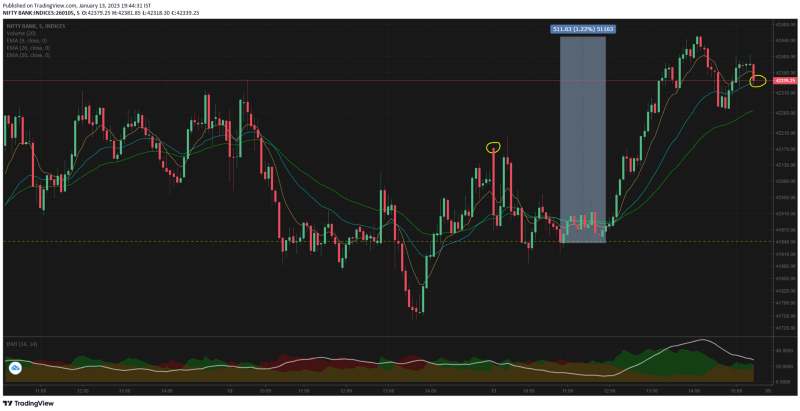

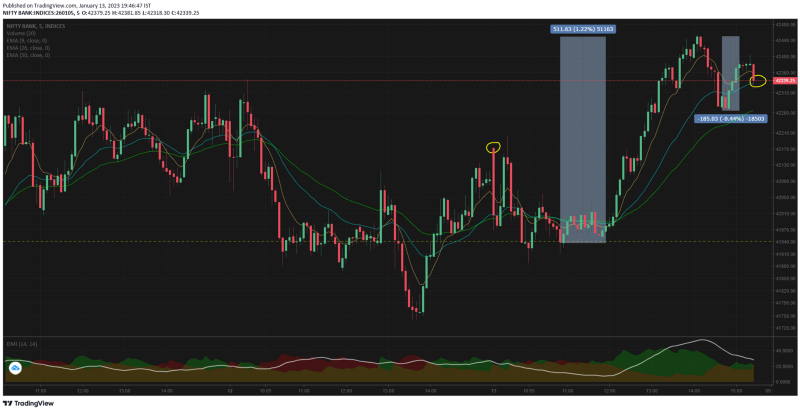

Bank nifty's today's move was obvious when the support level of 41940 was held. Although we started the day with some sharp moves it kind of settled by 10.10 and then we had a flat consolidation at SR.

Then the rally of 1.22% ~ 511pts from 11.50 to 14.05. During this time the volume on the PE options also hinted that the rally may gain momentum. Unfortunately i was not able to take the trades today due to a business meeting.

We then had a dip of 0.44% ~ 185 pts from 14.10 to 14.45 — may be profit booking. And finally the close was at 42339 a total gain of 0.69%

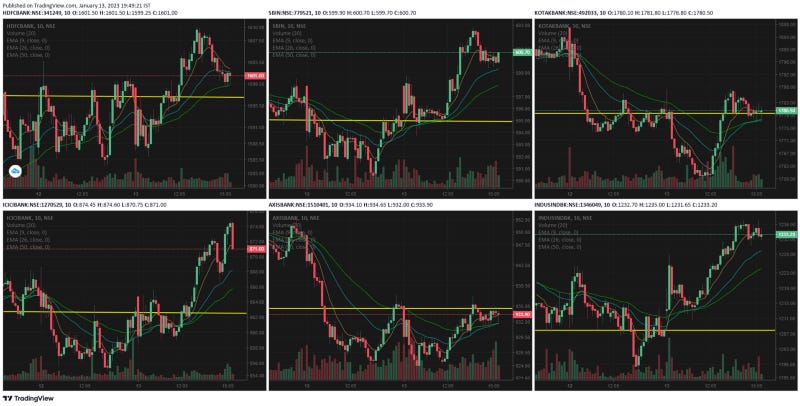

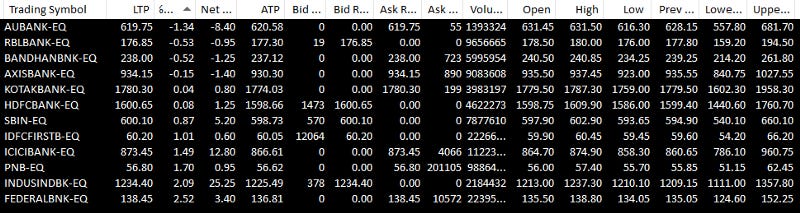

Among the bank nifty components:

-

HDFC Bank started the day lower and a strong rally from 10.05 to 13.15 ensured it gained 1.5% ~ 23.8pts. Towards EOD we saw gains being shaved off and the close was flattish.

-

ICICI had a stronger rally, leg 1 from 11.45 to 14.15 and then leg 2 from 14.45 to close

-

SBI also started rallying from 12.05 and closed at 600.7 with healthy gains

-

AXIS as discussed yesterday was in the bearish continuation trend — atleast for the short term.

-

Kotak eventhough had a rally from 12.05 to 13.25, it was just to cut its losses, there was no momentum to go up into the positive territory.

-

IndusInd bank was taking a break for last 2 days and is now continuing its new found momentum. Earlier we even addressed it as the lone wolf fighting in green when all the other banks were in red.

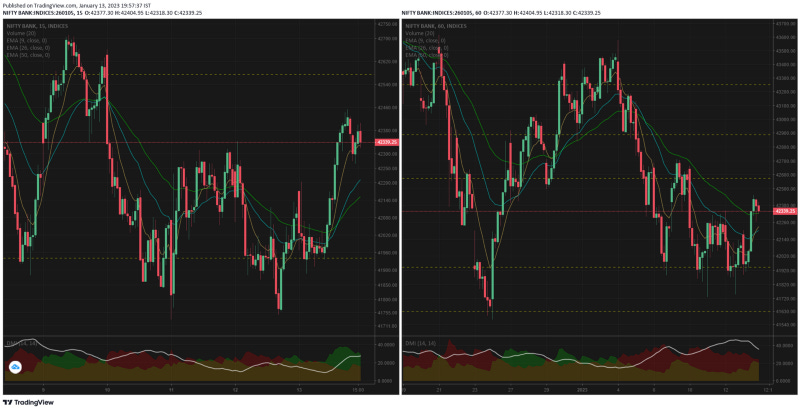

15mts chart now shows sideways movement and until the nearest support or resistance as marked by yellow dotted lines are not taken out — we cannot have a directional bias.

1hr chart — medium term prospects look bearish still, this is even after the soft bounce we had. I do not have a bullish call anymore and i will be happy to look at bearish trades if the 2 support levels are getting taken out in the upcoming days.

Comments

Post a Comment