Lets go by the crowd's mindset — What would you have done today morning just after the pre-open wherein bank nifty indicated a gap up opening & HDFCBk (most weighted component) had a superb results QoQ.

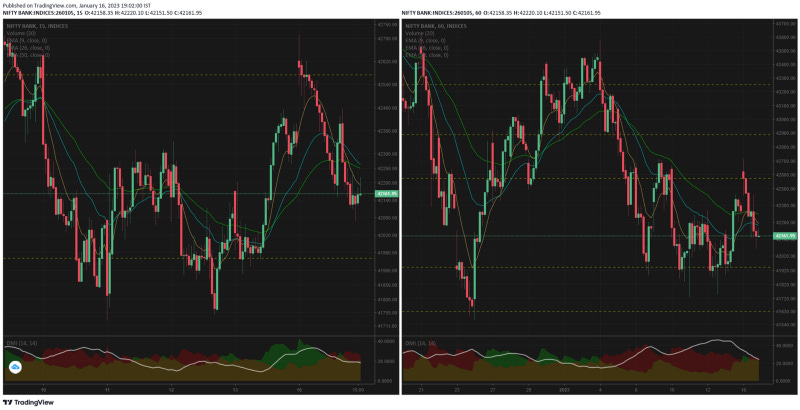

Ans: You would have gone long today — right? And thats where the smart money would have trapped you. Gap up opening at 42622 above the resistance line and then 3 consecutive red candles guiding a close below the support line — 42573.

Second question — would you double your long position thinking you got a better buy or exited at a loss?

Ans: Most likely you would have added on to your losing trade -thats obvious from the 15mts chart where we had a massive red candle festival.

14 out of 15 candles in red. These are not fresh positions — its just that people are unwinding their positions taken last 2 days.

Read the 13th analysis below —

So right now we are at the middle of the support & resistance level ie 41940 & 42573 with today's breakdown pushing many traders with the bearish bias.

Also remember our markets outperformed the US markets in 2022, and our Central Govt. Budget is coming up in 15 days. There is a decent possibility that the foreign institutions move to cash position before redeploying or exiting.

Thats because if the US market debt markets are surging, everyone would be interested to move the capital back. Infact if you gave me the option i would have taken their 4.25% 2 year treasury rates plus the added advantage of USD strengthening against INR ~ 14% YoY. So why would the FIIs rot their wealth here in India if US markets are staging a comeback?

Now if our markets outperform this year also ie more than 20 to 25% returns — FIIs would prefer to continue holding & saving taxes too. Well nobody knows what is going to happen other than the person deploying the smart money (which will swing the pendulum in their favor)

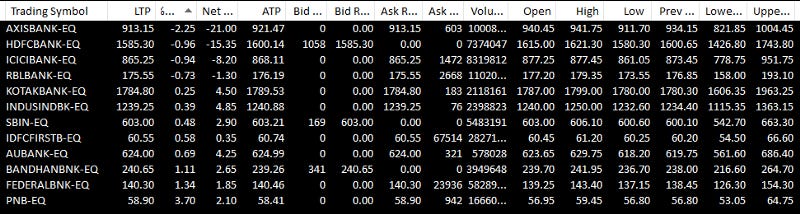

Among the bank nifty components:

-

HDFCBk did indicate where its going to trade today in the opening candle itself, the volumes also supported quite well. Today's negative trade shouldnt be read as their QoQ financials were below standards. In fact their results were really good & today's reaction may be just a positional unwinding.

-

ICICI Bank also reacted to the trade similar to HDFCBk may be indicating its results also to be expected on similar lines. ICICI usually has more firepower to move during results day.

-

SBI moved the other way today — it ended the trade in positive territory. Well not that much high but enough to lend support to BN from falling too much.

-

AXIS had a breakdown today, ended the day -2.25% in deep red. Maybe it has some news or event coming up (i havent checked yet)

-

Kotak also held its ground today but the candle at 10.55 was quite surprising — see the accompanying volume.

-

IndusInd also held its head above water today, flattening from the rally previous sessions.

The counter moves in SBI, Kotak may also be due to the unwinding in HDFCBk and ICICI — The operators would have taken the contrarian positions not to let the BN fall too much and mess up their MTM.

15mts may have tipped the scale to the bear's favor — but until the support level not being taken out, we do not have a confirmation.

1hr pattern remains bearish, but the momentum is seen dying unless we have a quick downward move tomorrow or wednesday — then bank nifty could even remain range bound and gather support.

Comments

Post a Comment