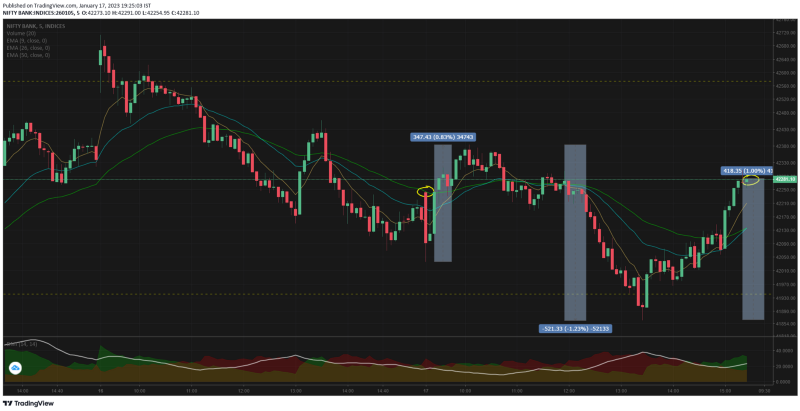

We had another interesting day today, technically the open & close of bank nifty was near the same — but there was some price action thats worth analyzing.

The opening candle was long red body with a short tail, by the 2nd and 3rd candle BN recovered what was lost in the 1st. From there it started building up gains till 10.00 where it kind of ran out of momentum.

So an early rise of 0.83% ~ 347pts from opening lows.

Then we had a gradual sideways move till 12.10 from where the selling intensity started aggravating. The selling halted only at the support level.

1.23% ~ 521pts fall from the HOD to the LOD at 13.25. You wont believe i went short at 13.20 when the support level was broken — but my decision was wrong & i had to cover when BN recovered the SR band.

The final 2 hours saw a recovery of 1% ~ 418pts which ensured that BN closed in green EOD.

For traders who got it right today, would have made money both ways ie down in forenoon and up in afternoon. But for those who got it wrong like me would have run into both stop losses.

Among the bank nifty components:

-

HDFCbk recovered the losses it made yesterday after the results show. Up 1.91% ~ 30.11 pts by 10.35 from the LOD. Final close of today is just above the close of friday, which means the positional unwinding of yesterday is complete & we now have HDFCbk at similar levels for normal trading.

-

ICICI bank was interesting because it kept falling today also till 14.30 after which it got some nitro boost and quickly turned green in 1 hr. It made up 0.91% ~ 7.81 pts.

-

SBI moved quite opposite to yesterday, the price action from 10.05 to 13.15 seemed quite dangerous when it dropped 2.72% ~ 16.49pts. There was some recovery last 2hrs but nothing dramatic as the fall.

-

AXIS was continuing the fall from yesterday making lower lows today also. The last 2 hr rally helped it gain 1.31% from intraday lows.

-

Kotak has the habit of making quite strong candles be it red or green, so we had a 1.19% surge in opening 3 candles from LOD and then a 0.89% rally in last 2 hrs. Kotak ended the day in green as well.

-

IndusInd slipped to red today with a fall of 2.19% till 13.05 and then a recovery rally of 1.52% last 2 hrs.

So today's recovery puts a question mark on the 15mts and 1hr time frames. Because the 15mts is not showing bearishness anymore. And 1hr will not go bearish unless the support levels are taken out.

As discussed yesterday also if the support levels are not taken out the momentum which is dying will flip the favor to the bulls who have been waiting till now.

Since BN is a no man's land — we dont have a directional strategy that could be deployed currently.

Comments

Post a Comment