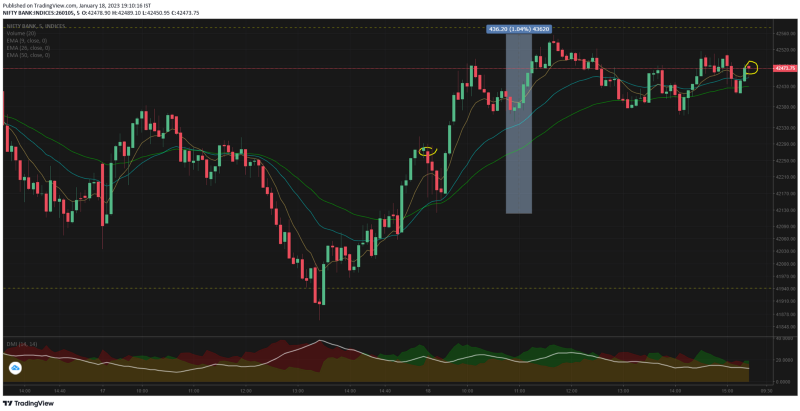

Quite an uneventful day today, bank nifty did not break the nearest support or resistance level which means the range bound trade continues.

Open was inline wrt previous day's close, but we started falling in the first 20mts. Nothing major and we had a quick reversal & bullish rally.

From the LOD we went up 1.04% ~ 436pts by 11.40 and stopped by the resistance level of 42573 (refer the dotted lines for the support and resistance levels).

From there on we did not have a reversal or breakdown instead bank nifty continued to chop horizontally till close. Since the resistance was not taken out we cannot authoritatively say that BN is bullish. But as discussed yesterday the 15mts TF was not showing bearishness either.

Looks like we may be stuck in this range till a macro or fundamental trigger.

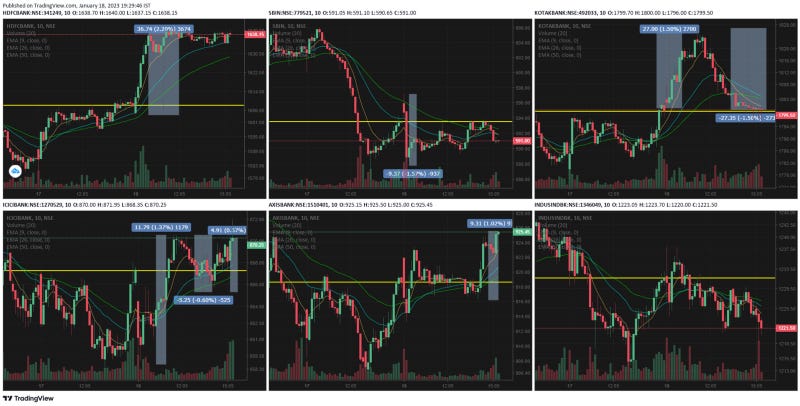

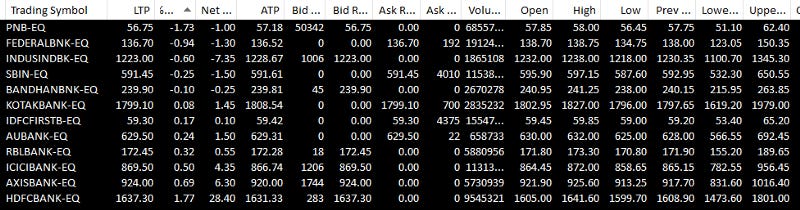

The bank nifty components had lot of drama today, we will discuss it one by one

-

HDFCBk had a 2.29% ~ 36.74 pts surge from open to 11.15 with good volumes. Quite indicative of the strong QoQ results — most likely the people who would have booked profits on 16th are now entering back FOMO. From 11.15 to close, HDFC went no where — just flattish.

-

ICICI hit the LOD in the opening candle itself and then a good rally of 1.37% ~ 11.79 pts till 11.35. This helped it go above water. Then we had a pullback of 0.6% went below water and then the 2nd leg of rise of 0.57% which ensured the close is green.

-

SBI was continuing from the trend yesterday, had a gap up opening and fell 1.57% ~ 9.37pts by the 2nd candle. From there it tried going above water atleast 3 times but did not succeed.

-

Axis was not having any special pattern today, until the last 90mts rally where it took from just below water to +1.02% ~ 9.31pts to end the day in green. The overall pattern still looks bearish when the previous day's actions are considered.

-

Kotak had the most drama today, it went up 1.5% from open to 11.15 and then fell back 1.5% from 11.15 to close. Literally going no where.

-

IndusInd did not have any specific pattern or trend worth pointing out, but it traded with a minor negative bias today. Overall trend looks flattish only.

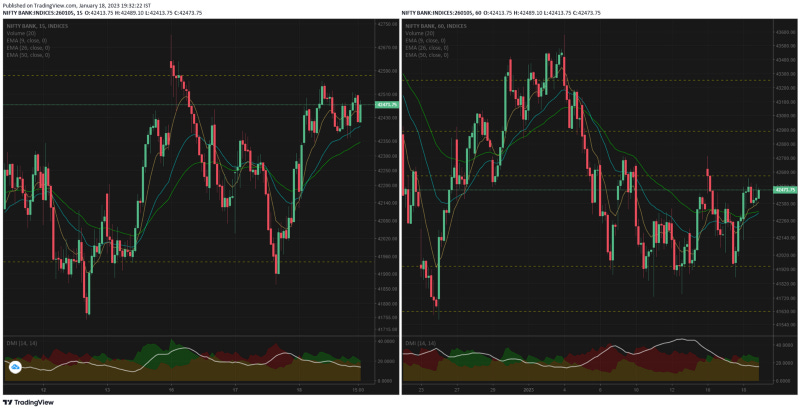

15mts is out of the bearish trend now, 1hr TF is still not out as the resistance is still not taken out.

We will need to wait for further macros, sentiments or events esp from US markets SPX, NDQ or CPI inflation for a trend to set.

Comments

Post a Comment