Today's market price action would not have surprised anyone, thats mainly because we had some breathtaking moves last 2 to 3 days. So today bank nifty was pausing to take some breath.

Tomorrow we have the Union Budget — so we can expect some moves after 11 AM when the FM starts her speech. But honestly the market is not going into the budget with any serious positions or expectations — neither the PE or CE options premium are commanding skyrocket valuations.

Last year i think i saw the farthest OTM CE at a value of Rs32 on the budget day, as of today 38500 CE is at Rs2.6. In 2021 we had an intraday rally of 8.26% may be that set the tone of the 2022 & people were expecting similar percent spikes. In 2022 Budget the rally was only 1.4% — so this year people are expecting trades of similar range. Maybe that explains the low premiums.

If for some reason we have an unexpected declaration tomorrow on GST, corporate taxes, windfall taxes, capital gains tax, new laws or rules or bans — then the options premium will spike.

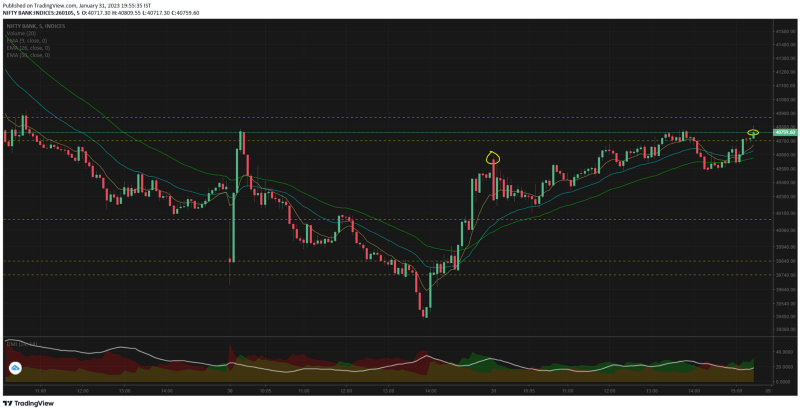

So if we just look at today's chart nothing major can be decoded. Open was inline between the support and resistance zones — we did not break any support level which can be read as positive. And we just managed to take out 1 resistance on the 2nd attempt — not that convincing, but still okay.

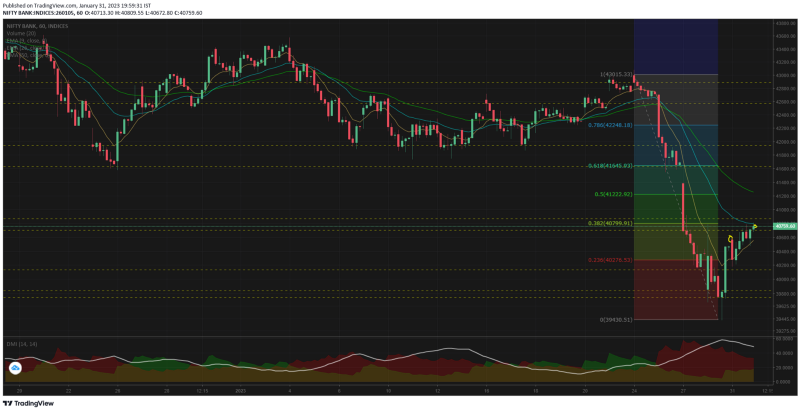

Lets switch to the 15mts chart and show the Fibonacci levels from the last 2 to 3 days

From the recent swing high to the swing low, today's close is right at the 38.2% retracement level popping up further questions of bearish moves ahead. The 5mts chart wont tell this story — but the 15mts does.

1hr chart also shows bearishness when the Fibonacci levels are marked.

Now — these are just views and there is a high likely hood things can go absolutely wrong with our views. For example i take a trade with a rationale or bias, definitely the person who took the opposite trade to mine has a different rationale — only then this system will work.

Now if i lose money on that trade, the other trader makes it — which means his bias was correct. So for anyone who is reading market reports or research reports — need to keep this in mind. An analyst's view is formed by the belief system he follows & the kind of exposure & experience he has.

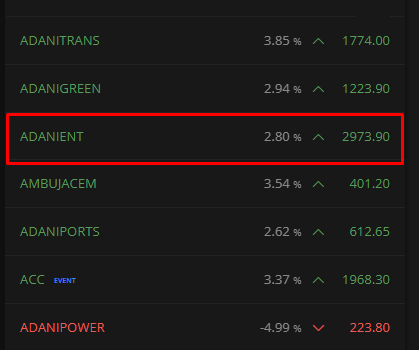

I was personally disturbed by the way Adani enterprises share price behaved today — earlier all the adani stocks did come under pressure after the hindenburg fraud accusation. We all knew today is the last day for FPO subscription.

After the day's close — reports came that the subscription crossed 100%. I still cant believe institutions purchased FPO at a premium when the spot was available cheaper.

Also i strongly felt the share prices were engineered not to fall & make up for the subscription volumes. SEBI's probe also made up so much sense now.

One thing is guaranteed — if its not a free market, then the retail traders will always lose money. No matter of skill, talent or discipline — a retail trader will never match up to the information, access & manipulation tactics of an institution.

Comments

Post a Comment