If you go by the levels US markets closed on Friday — SPX 2.28%, NDQ 2.78% we should have started much more strongly today.

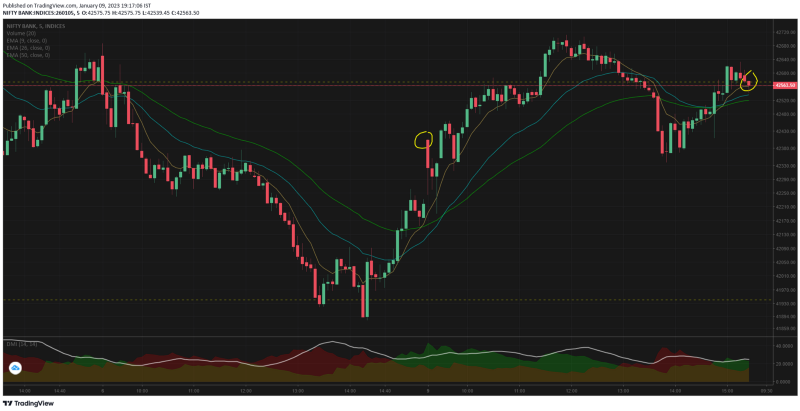

Bank nifty opened 42404 up 0.44% only and then closed the gap within the first 15mts. The buying momentum was surging in NiftyIT index and Nifty50 which prompted buying in bank stocks as well.

We had a rally of 520pts from 09.25 to 11.15 — broke through the resistance level of 42573 very easily. But this did not last and the selling came in quite harshly.

So from the HOD to 13.50 we lost over 373pts ~ 0.87% broke below the SR level proving that the resistance breakout was fake. When i looked at the FIIs figure it has come in negative today also — which means this period would have been used by them to offload more stocks at a good premium.

The period from 13.55 to EOD saw bank nifty scaling back upto the resistance level and closing there — which might give an upper hand to the bulls.

So we now have 2 forces acting

-

FIIs who are selling for the 10th or 11th consecutive day — which might aggravate going forward

-

SPX closing just above the SR of 3833 which is proving to be quite a level to watch out for. Any upward moves might trigger further buying interest by retail and DIIs in Indian market.

The run upto budget will be quite interesting as conflicting forces will ensure the markets go nowhere. Now on the Point 2 — if the SPX is falling further we then have an imbalance in India as well and the direction should tilt in favor of selling.

Again a good time for normal investors & traders to stay out and save your capital !

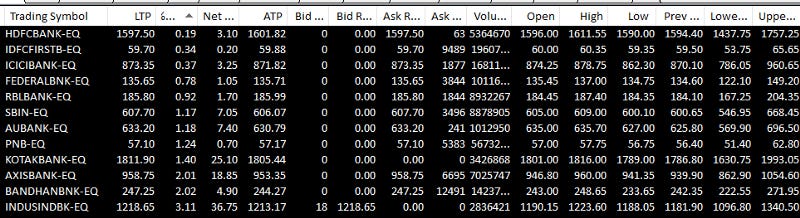

Of the bank nifty components

-

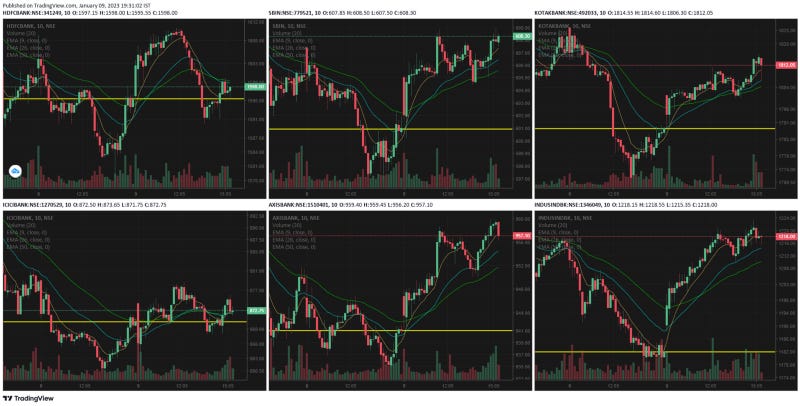

HDFC bank had a good start peaked at 12.05 and then started falling. The fall went below the opening levels but managed to finally close just above the flat line

-

ICICI Bank did not sway that much, the open did in fact take it lower and then it built its gains till 11.35. This level did not sustain and then started falling, went negative at 13.45. And final 90mts ensured the closing is in green.

-

SBI had good buying momentum today, it has come out from a negative pattern for the time being. Final closing at 608 is at a make/break level.

-

AXIS also followed SBI pattern esp the buying interest at 11.25 & 14.00. Again its trying to snap out of the negating pattern formed from 4th Jan

-

Kotak did close with gains today with the volumes supporting the green candles. Today's price action has negated the 2 red candles formed at 11.55 and 12.05 on 6th Jan.

-

IndusInd also went up higher almost unchecked till 12.35, then a minor pullback and rally continuation pattern.

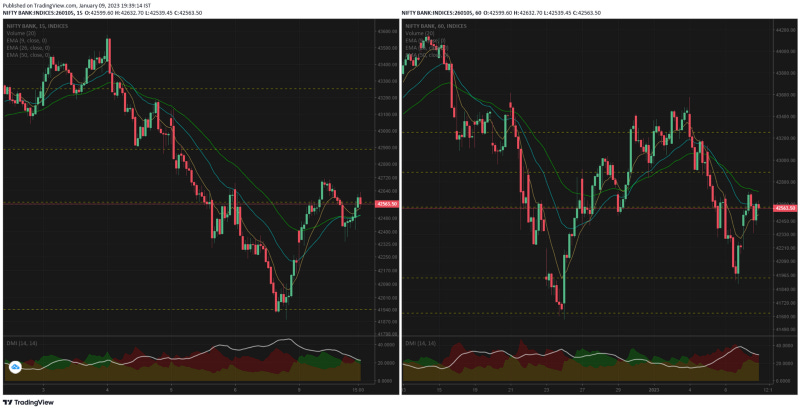

The 15mts TF & 1hr TF has not negated the bearish pattern yet. We may need consecutive resistance breakouts to confirm that.

15mts might also look like a lower high formation if the next 2 days are getting traded lower.

We need more evidence before taking positional bias — as of now there is no clarity

Comments

Post a Comment