Another range bound day today with no resistance or support breaks, straddles would have loved it with the premiums dying 17 to 18% without having to do anything.

This week on monday, wednesday & friday — i was unable to find any short selling opportunity — now thats a first!

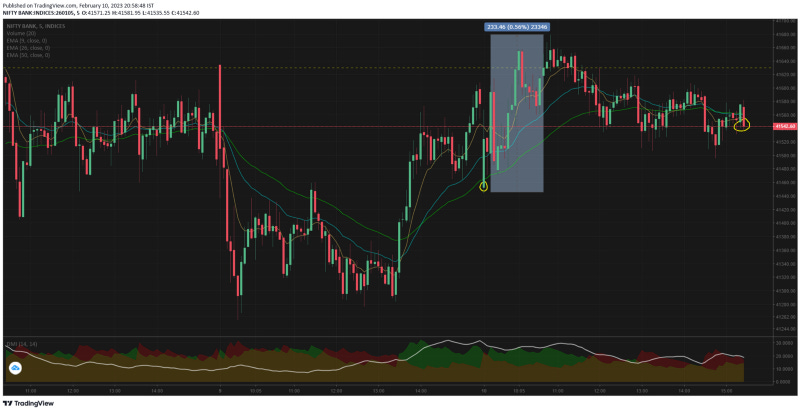

Bank nifty opened gap down 41452, but if you look at the trading chart — it felt inline. See the 2 upward sloping yellow line, BN was continuing from the momentum it got from 13.25 yesterday.

But this did not last that long, we hit the resistance zone at 41629 & had a reversal back to previous close. The rally was only of 0.56% ~ 233 pts from LOD to HOD.

Straddlers ie those who would have sold ATM CE & PE would have benefited the most as it was a perfect flat close.

Nifty50 had a negative closing today — the traded range was steady wrt open & close

-

NiftyIT also had a lower close mainly on account of fall on HCLTECH

-

In that respect NiftyBank outperformed both the other indices

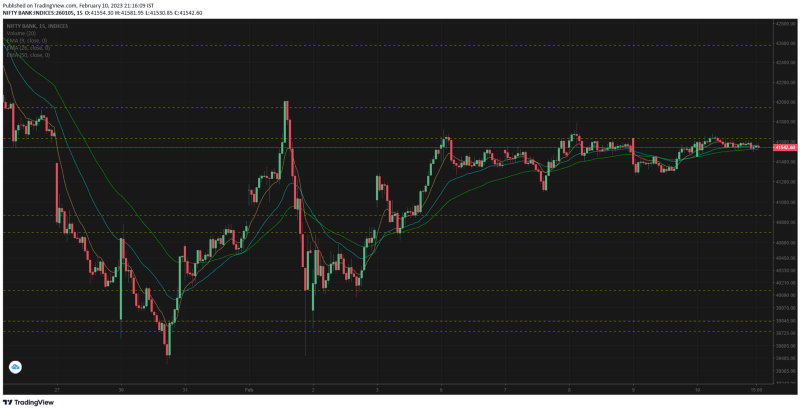

In the 15mts TF, bank nifty has not made any changes w.r.t the stance yesterday. The fall on 1st Feb is still not taken out, after 4 instances of retouch on 41629 resistance. I may be inclined to go bearish for an ultra short term if BN is unable to take out the resistance on monday also.

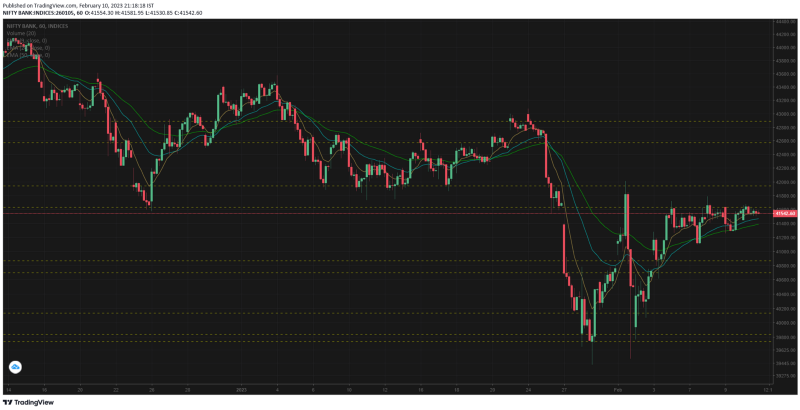

1hr TF is starting to swing in flavor or bears again because the inability to take out the resistance. Also the chart shows falling prices with some consolidation near the support lines.

Among the bank nifty components in 5mts TF

-

HDFCbk had a strange looking last candle, almost a Rs5 drop in price — i do not remember spotting it during market close. It was HDFCbk that was providing immense support to bank nifty today, from 12.10 to 15.20 there was a steady bullish momentum.

-

ICICI had a volume spike at 12.55 and from that point onwards the volume levels have stayed elevated. The chart promises to be bearish.

-

SBI also stayed in positive zone today, almost a 2% rally from LOD to HOD in opening 45mts & a gradual cool off from there.

-

AXIS did have some drama today, symmetrical drop & recoup of prices from HOD to LOD & then back to HOD. If we take into yesterday's price action also — the chart looks bearish.

-

Kotak had a flat chart pattern & its back to its multi year SR of 1780 to 1800.

-

IndusInd bank had an opening fall & the it gained back all it lost from 11.50 to 13.50

Comments

Post a Comment