Apologies for not able to prepare this report earlier in the day as i had some personal commitment.

The day was nothing short of exciting though, well not as much drama as yesterday. Even though bank nifty traded in a tighter range today — the options premium were bloated. Knowing very well its an expiry day too — option sellers did utilize the opportunity to drive the prices.

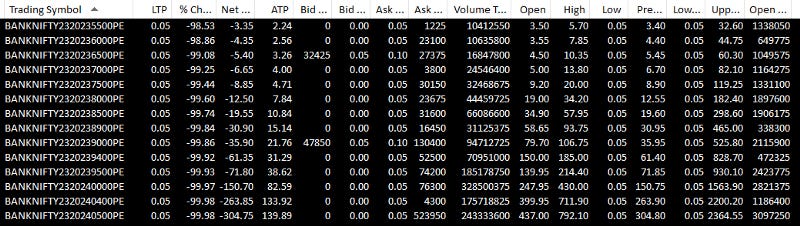

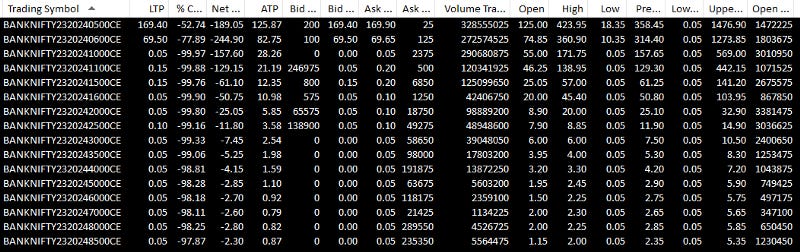

Why else would 35500 PE a strike 4450 pts below the spot trade at a max price of 5.7 rupees? 38000 PE a strike 1950 pts below @ 34.2? No wonder the volumes were pretty high today

Almost all the far OTM PE strikes traded not less than 1 crore qty. This must be a new record considering it was not a monthly expiry.

The CE strikes were not that volatile today, the day's high well within the acceptable swing standards — volumes were still good though.

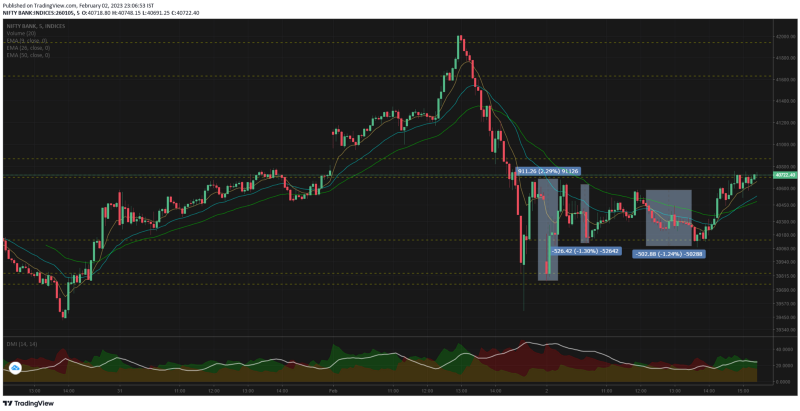

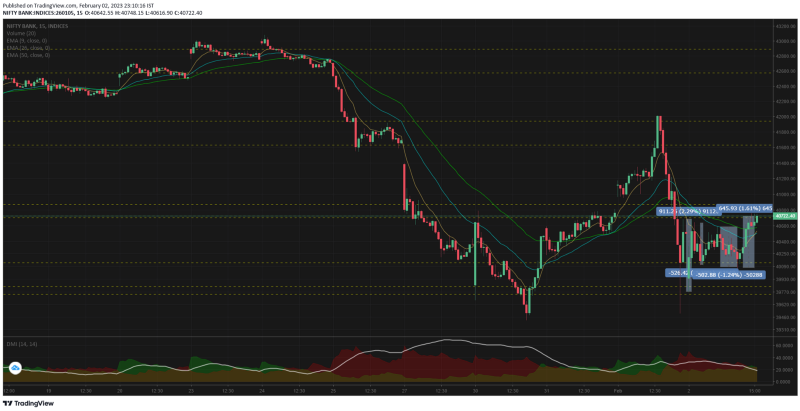

Now from the price action perspective, bank nifty opened gap down at 39943 right at the 2nd support level of 39839. This support was held and we had an immediate retracement to 40700 resistance level by 09.40. This opening 35mts swing of 2.29% ~ 911pts was the trading range today.

Further the support & resistance levels held quite decently. There was a 1.3% fall from 09.50 to 10.30 but the support level at 40134 held. We had another 1.24% fall again back to this support level by 13.35 & it stayed strong.

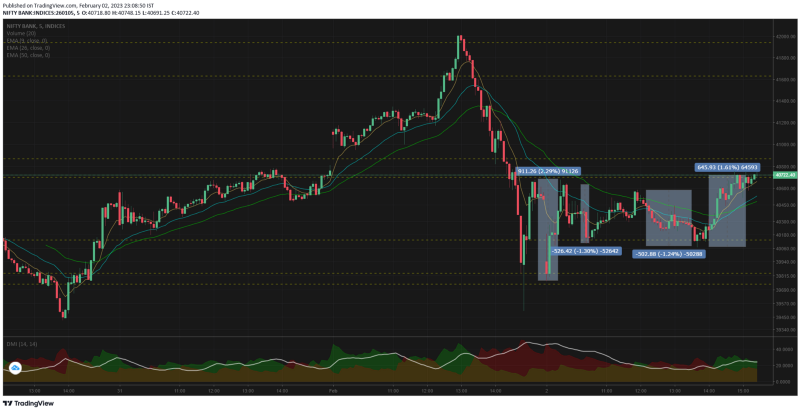

The price action from 13.40 to close took bank nifty from the support to the resistance a rally of 1.61% ~ 645pts.

Final close was 0.39% up in green.

The 15mts TF now shows a range bound trade possibility before an event or macro driving the news & direction. If you notice i have consecutive support & resistance levels (see yellow dotted lines), this shows that the area is quite a place where banknifty spent some time before. Ideally the direction should be towards bottom if the 39770 support gets taken out, if it does the next support levels are quite far away !

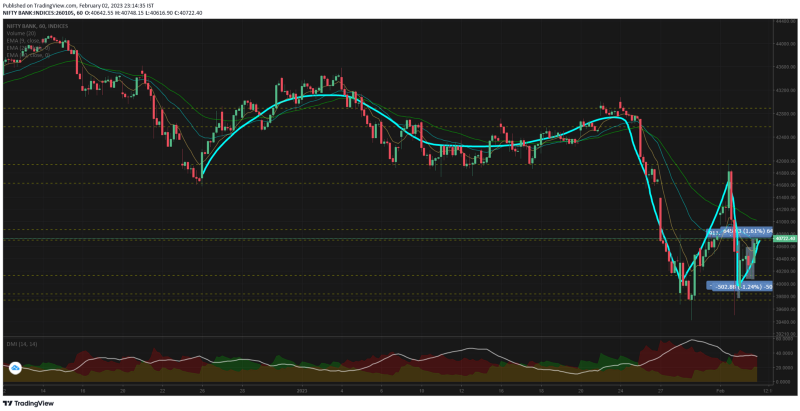

1hr TF shows a tendency for bank nifty to fall mostly because of the recent negative bias. This quick drop was event related & would have led to lot of unusual shorts entering the system. So unless there are some strong bulls to take out this swing high — the shorts will ensure the prices are pushed down further.

However if the bulls are ready to take out the swing high (the bank nifty bulls are pretty strong as we have seen in the past) then the short covering will come into play.

Comments

Post a Comment