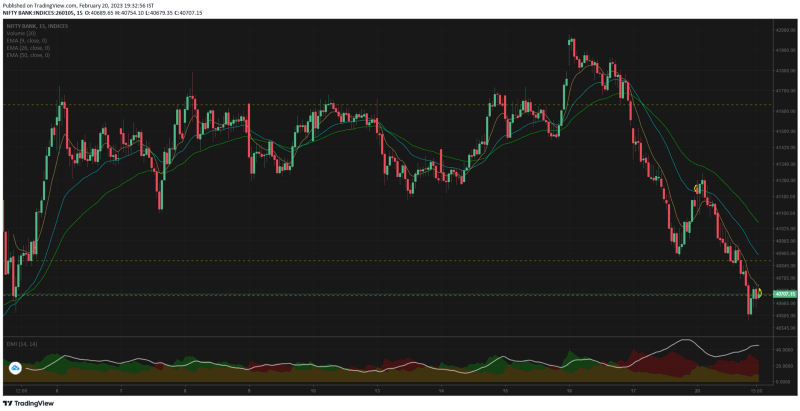

The support that showed strength on 17th gave away today. Even the 2nd support also looked vulnerable today. All this on a day where US markets are on a holiday!

Most of the traders would have felt bank nifty is going up today especially when the open was in the green 41221 & first 1hr was above flat line. This was not the case though, we had almost a one way fall right till the support level that showed rejection on Friday ie 40880 zone.

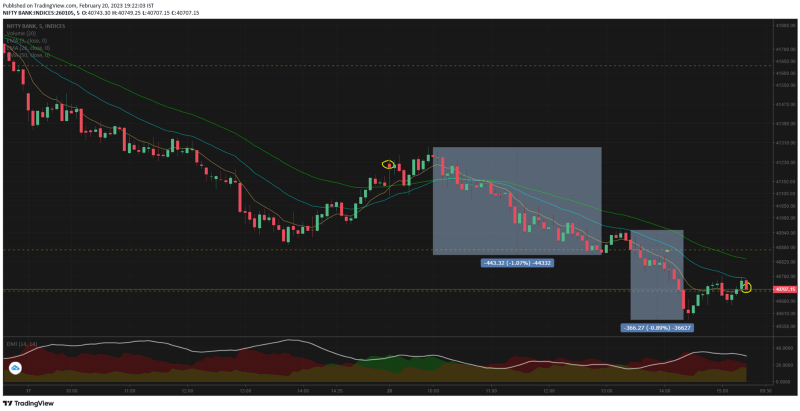

There was a fall of 1.07% ~ 443 pts from the HOD to the first rest zone. Bank nifty started the next leg of fall at 13.20 and went below the 2nd support level of 40704 another 0.89% ~ 366pts fall.

From here there was some pull back approx. 0.42% ~ 168pts to close right at the support level. If we look at the 5mts TF we had a break of support, whereas in the 1hr TF the support level is yet to be broken.

The dangerous aspect is that my next support zone comes at 39742 ie 1000pts lower than the current level. Also the same area which had prior retests ie on 30th Jan & 1st Feb. Somehow if the third time we go there — there is a high likely hood that we may see a pass !

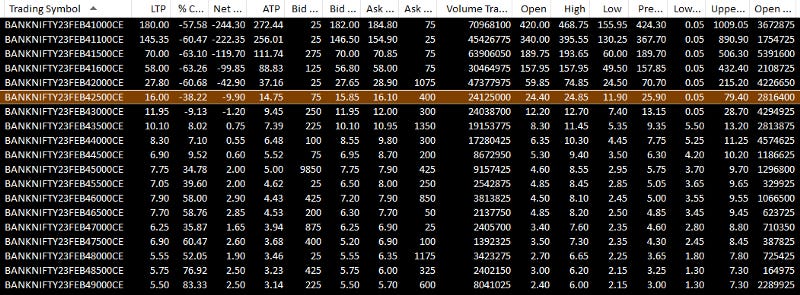

The option prices were quite crazy today, equidistant PE & CE were having a huge anomaly. PE prices were not rising even after the kind of butchering we saw today — whereas there was heavy option writing volume on the CE side creating this unexplainable skew.

39000 PE 23.8 to 10.6 from 14.25 to 15.25 ie a fall of 55.5% this is a strike that is 1700pts away from ATM

On the same level, 42500 CE which is 1800pts away from ATM closed at 15.85 up 4.07% from the 14.25 price.

Just imagine, the PE has a premium of 10.6 vs CE of 15.85 for a market that has fallen 1.05%. What this translates into is that PE option writers are willing to sell at a lower premium — being very confident that the markets will not dip that much over the next 3 days.

Whereas the CE option writers are making good use of the implied volatility & trying to get max bang for their rupee.

15mts TF is looking bearish now because of the quick break in 3 SR levels. Also the price action formed via 2 legs is showing stability, also indicating the momentum could pick up in a week or two.

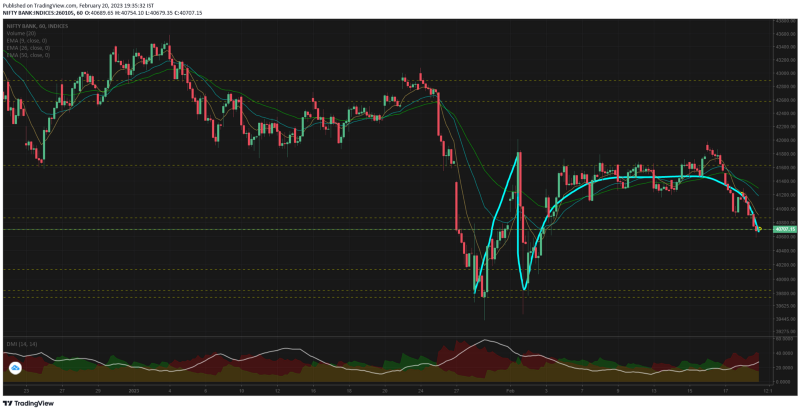

1hr TF, this is the 3rd time i am seeing an inverted cup & handle pattern. We could call it the "inverted cup after cleaning" pattern.

The 3 instances of the same pattern highlighted in blue pen.

Comments

Post a Comment