We had a relatively calm day today comparing to what was happening last 2 to 3 sessions. Since we had the FinNifty expiry today — there was some stability offered by HDFC, HDFCbk & BajFinance.

This really prevented bank nifty making further lows for the day today because at 13.05 i almost thought we will be seeing a range expansion & a massive fall. Mostly because the options premiums were still higher anticipating a bigger move.

This is not the first time i am suspecting FinNifty to create unwanted speculations in BankNifty. The operators would have wanted a decent close for the expiry day & the position built in FinNifty would have altered the natural course for BankNifty index. But thats alright, because what is being done is 100% legal and legitimate.

If i am wrong, then HDFCBk should be holding the same levels tomorrow & thursday too.

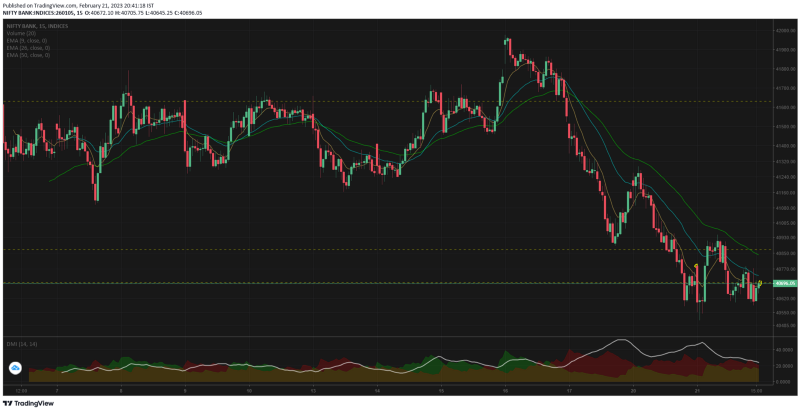

Today's open was at 40784 and we had the SR of 40704 getting taken out in the first candle itself. 130pts taken out in the first 5mts.

There was a fall to the LOD, a total fall of only 0.66% ~ 270pts. From there the HOD was made at 11.20 a good recovery of 431pts mainly led by HDFCBk.

This HOD might have formed the lower high if we look at the higher time frame, but the selling momentum was just not enough.

From 12.10 to close we had a perfect range bound trade just like an engineered one. This also ensured the options premiums fell.

Would like to reiterate from yesterday's report also that the PE option writers are not expecting a big fall for this expiry — that explains the unusual low premiums.

15mts TF showing a minor pause today from a down trend that just started forming. Coming sessions should be monitored closely to confirm if the bearishness continues or not.

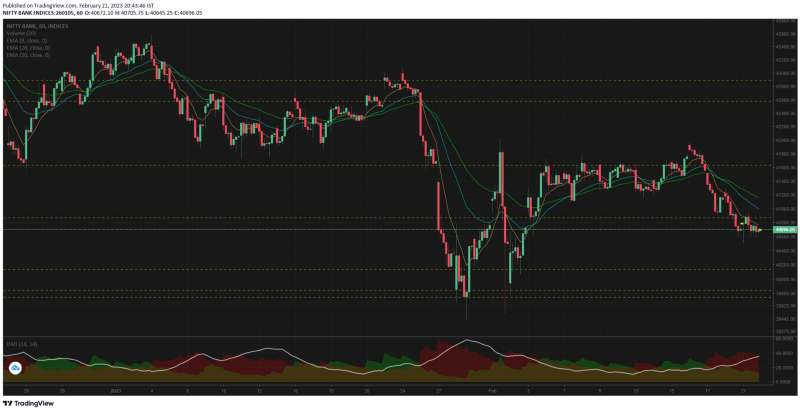

1hr Tf also showing a minor pause below the resistance level. My next marked support level is 1000pts deep, so i expect a fall if it happens to be brutal.

Lot of smart operators would have taken positions at the 39800 levels & they wouldnt be forced to square off that position until the index closes lower than that.

If the next 1000pts drop comes in pretty quickly, these smart operators may be forced to close out early — creating a further downside.

Now all these are speculations & has to be read with caution. Our job is to find how the market is moving & then try reacting to it by taking positions. We could be right or wrong — if we are right we should be making good money. And if we are wrong we shouldnt lose that much !

Comments

Post a Comment