Yesterday we discussed the possibilities that the Finnifty expiry would have interfered with the BankNifty's natural price flow. It was almost proved right today !

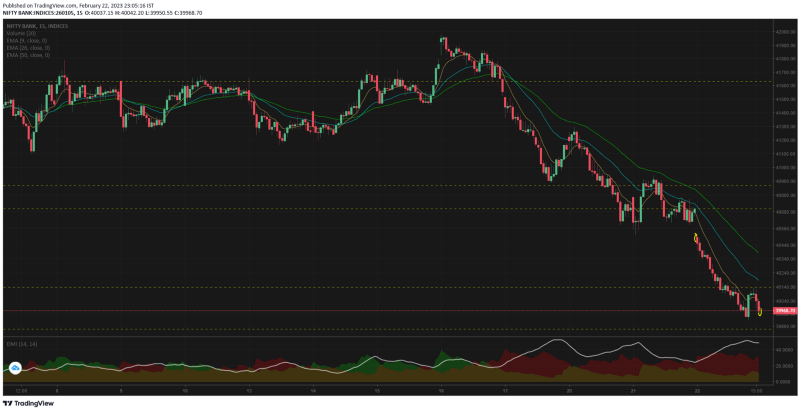

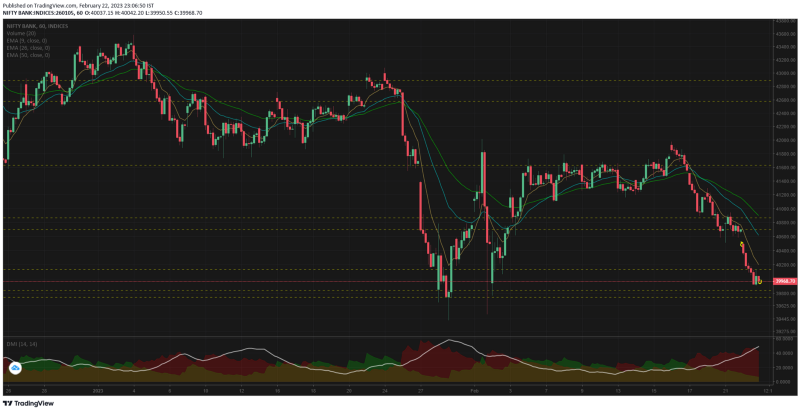

Bank nifty opened gap down at 40494 well below the resistance zone of 40700. From there it was an unidirectional fall till almost 14.15. A total fall of 1.95% ~ 794pts from the Prev close & a traded fall of 1.47% ~ 594pts from the open today.

The support of 40134 was taken out at 12.30 the first time & then conclusively at 13.25. Bank nifty spent 21 bars ~ 1hr 45 mts at this support zone before breaking down.

From 14.20 to 14.50 there was a pull back to the new resistance level of 40134 but that failed and the final closing & the sentiment was near the low of the day.

The resistance rejection came very early with just 3 bars ~ 15mts time spent. In a way showing the aggressiveness of traders to take further short positions.

The option prices reacted quite violently last 15mts with a heavy skew to the CE side especially the far OTMs. The huge surge in their traded volume shows the intensity of credit spreads taken for CEs. Indicating a further bearish stance.

The moving averages were sloping almost in a 45 degree angle downwards today showing a clear downward pricing pressure. I am not sure what has fundamentally changed to have this negative sentiment. But on technical levels we were bearish right from the 13th Feb wherein the option price fluctuations gave a slight clue of the same.

Next minor support is coming up at 39839 & a major support at 39742 which coincides with the 2 rejections we had on 30th Jan and 1st Feb. I am strongly looking forward for bank nifty to break these support levels at least for a short term, mainly because of the momentum its carrying now.

To fall further we need changes in fundamentals, bad news or bad events. So if something of that sort comes up — the job is made easy !

15mts TF looks strongly bearish now as the support levels are getting taken out. If bank nifty pauses or reverses at any of these SR zones, i will be willing to change my bearish decision.

1hr TF is not strongly bearish yet, it wont be until the 39742 level is not getting taken out. The momentum is favoring further downside movement — but we strongly act only if the major support is getting broken.

Tomorrow's expiry will be exciting, especially on the PE side. Any major dips in the opening 15mts will see the PE premiums jumping. This should create a golden opportunity to get some contra positions added — just for 1 day.

Comments

Post a Comment