We had a relatively stable trading day today, bank nifty was nicely held between the adjacent support & resistance levels. But the opening moves were quite scary.

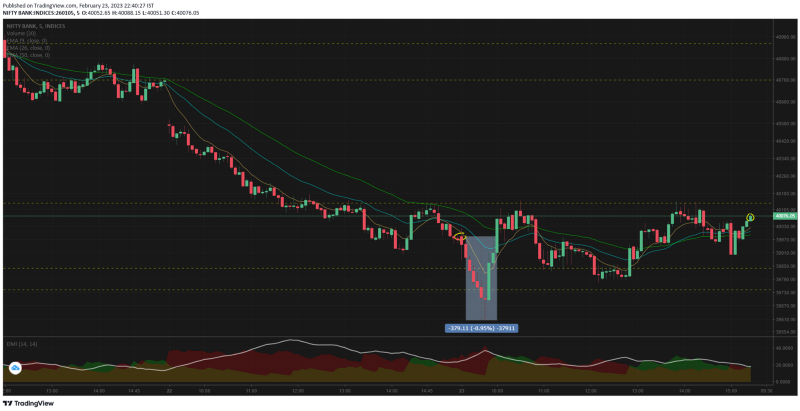

Bank nifty opened inline at 39983 and started falling pretty quickly, we took the 1st support 39839 by 09.35 and the next major support of 39742 by 09.45.

We fell almost 0.95% ~ 379pts in the opening 30mts. On the 5mts TF the support level was seen as broken & i almost thought we are going to get deeper cuts today.

But the next 3 candles undid the damage & we got above the opening levels. We hit the resistance of 40134 at 10.30 & the same was rejected. The rejection made bank nifty to fall to the first support level of 39839 & it held.

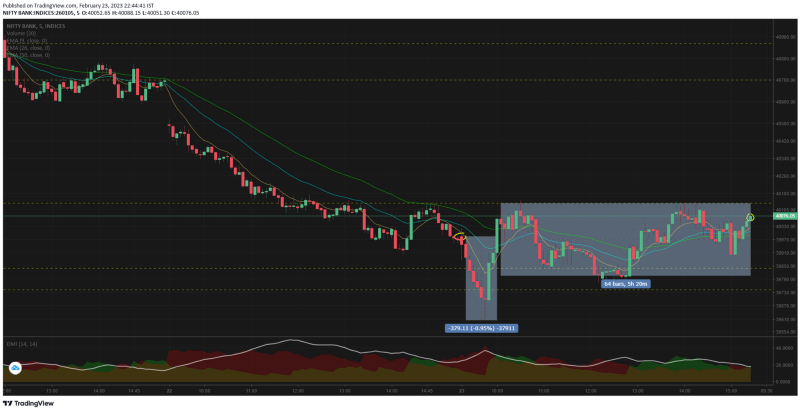

So by now the momentum was fading and the remainder of the day bank nifty traded between these support & resistance zones — providing a huge relief to all those option sellers who would have taken expiry day positions today.

5h 20mts was spent in the range today, much contrary to the opening show we had. These flat traded minutes shows the lack of confidence for a directional move by the either side. Or else there could have been a much more stronger stabilizing non-directional institutional trader controlling the flow. Whatever it may be — it was a blessing to all the straddlers for today & the expiry traders.

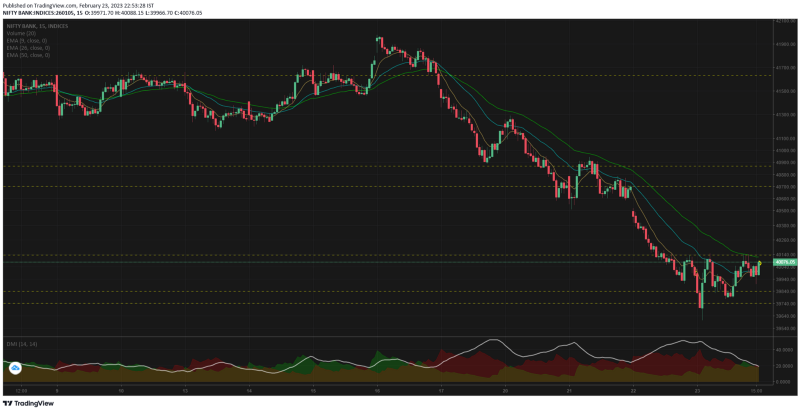

The candle chart is of Nifty50 and the line chart is of banknifty for a side by side comparison.

From 12.45 to 14.20 nifty50 was trading sideways whereas banknifty was gaining. BN moved up 135pts. I found that quite unusual to have a decoupling for 1.5 hours.

On the 15mts TF, we are seeing a minor pause between the support resistance mentioned earlier. This could also be the rest period where bank nifty is catching breath for the next leg. We do not change our bearish view till the EMA crosses over or the options volume data provides a contradicting signal.

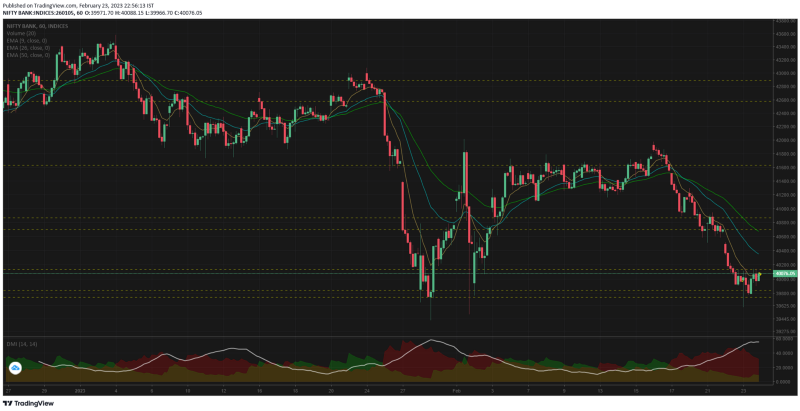

On the 1hr TF, we can only go aggressive once the main support level breaks. Hopefully that break could come in this weekly series which could drive up the options premium. Whenever there is panic — the option prices is guaranteed to go up.

Comments

Post a Comment