There are 2 major news, one acting on the bull side & the other bearish for bank nifty tomorrow !

- HDFC & HDFCBk merger news

National Company Law Tribunal (NCLT) has reserved the order for its approval of the Housing Development Finance…www.moneycontrol.com

2. India's GDP rises to 4.4% vs 4.6% estimates

Services continued to drive India's economic growth in the third quarter, while manufacturing remained tepid, according…www.bqprime.com

So the trade today has set up a perfect stage for tomorrow, i may not know the direction but i seriously think we might be able to get a trend.

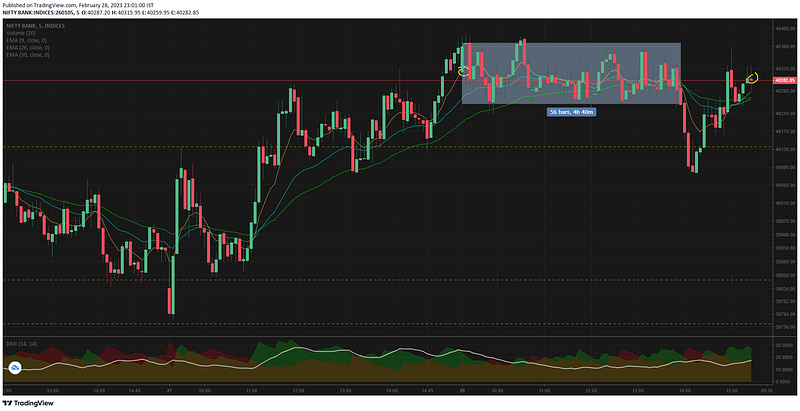

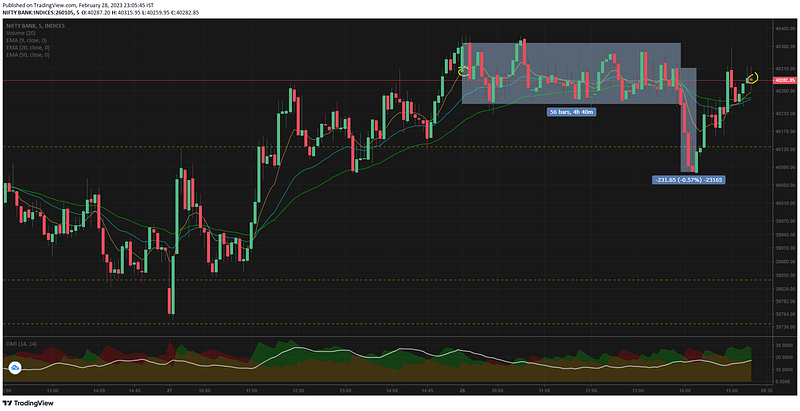

Today's open was inline at 40302 and stayed above the support line, infact we had a good range bound trade for 4hr 40mts. This also reflected quite well with the FinNifty as well & the expiry trading would have worked out quite well for the latter.

Bank nifty was not at all looking in the mood to rally or break today — it seemed like there was so strong momentum in either direction. But by 13.26 i almost thought we will have a good fall & posted the same in bank nifty minds in TradingView

TradingView India. View live NIFTY BANK chart to track latest price changes. NSE:BANKNIFTY trade ideas, forecasts and…in.tradingview.com

The fall lasted only 231pts and briefly broke the support line (not a conclusive break still), before recouping the losses & returning to where it started.

During the close i felt there was a huge volume traded on $ICICIBANK $SBIN $AXISBANK $KOTAKBANK. Maybe its related with the month end closing or rebalancing — but the spike in volumes seemed like a positional build up or unwinding for me.

TradingView India. View live NIFTY BANK chart to track latest price changes. NSE:BANKNIFTY trade ideas, forecasts and…in.tradingview.com

The volume is one of the reason i feel we could expect a support or resistance break tomorrow.

Regarding the options premium — we had a good decay today & lack of volatility would have killed the spirits of the option buyers & debit spread takers. Straddlers would have enjoyed trading today !

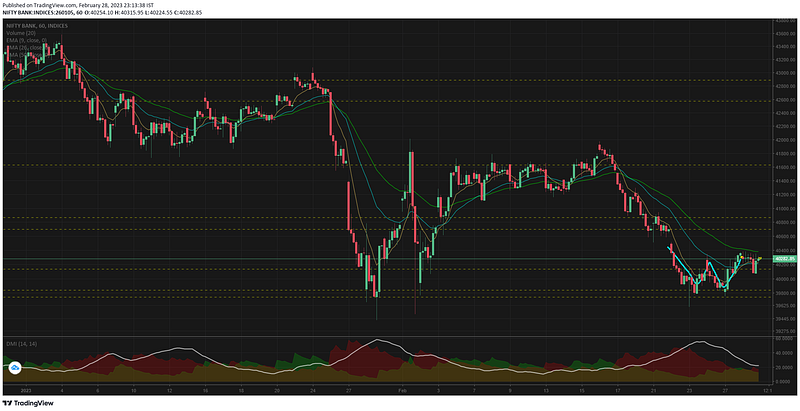

15mts TF shows a range bound trade (not perfect range, ideally range should be within the support & resistance levels) for 6 days 4hrs now. Those who had positions from 16th feb & went through the fall would be feeling quite uneasy by now.

I was hoping for the retest of 39742 lows in this series itself, since there are 2 more days to go i will keep the hopes alive.

1hr TF shows a possibility of a double bottom (W pattern), but for this pattern to work the trades breakout. If we have further consolidation then this pattern will not play out well.

I havent changed my bearish view for the 1hr TF yet, i still need to see close above the resistance levels to change by opinion. And clearly it doesnt pay to have an opinion — its how we react when markets prove us wrong !

Comments

Post a Comment