Unlike yesterday we had some price moves today, a typical V pattern that would have given traders something to cheer about. Otherwise a falling volatility would have sucked out the premiums from the weekly options.

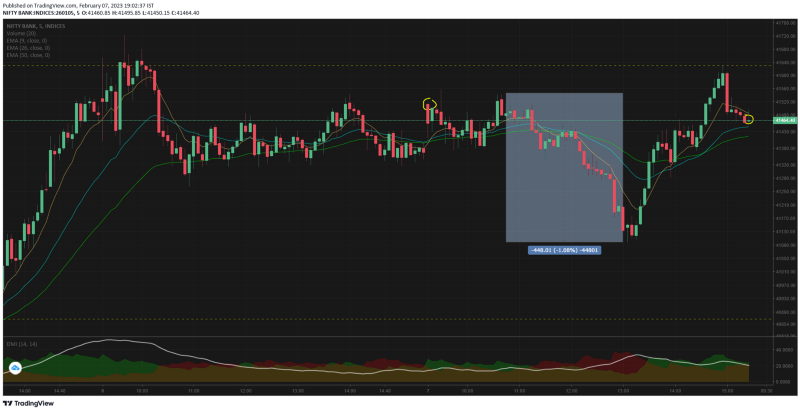

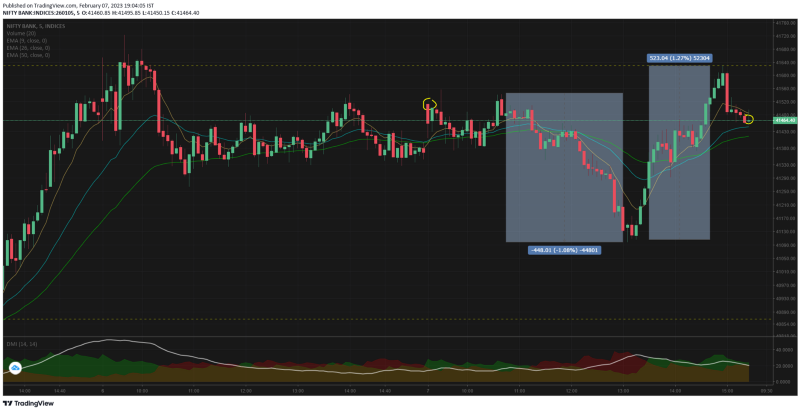

Bank nifty open was inline at 41513, traded flat till 10.35 after which we had our first move of the day. A 1.08% ~ 448pts fall from 10.40 to 13.05. This was a gradual down move and nothing alarming.

Then we had a V shaped recovery from 13.15 to 14.55, a 1.27% ~ 523pts upmove that halted right at the resistance line of 41629 & then cooled off & closed at 41464. I was almost enticed to do the 42000/42100 2:3 ratio spread but when i saw the halt at resistance — i opted out.

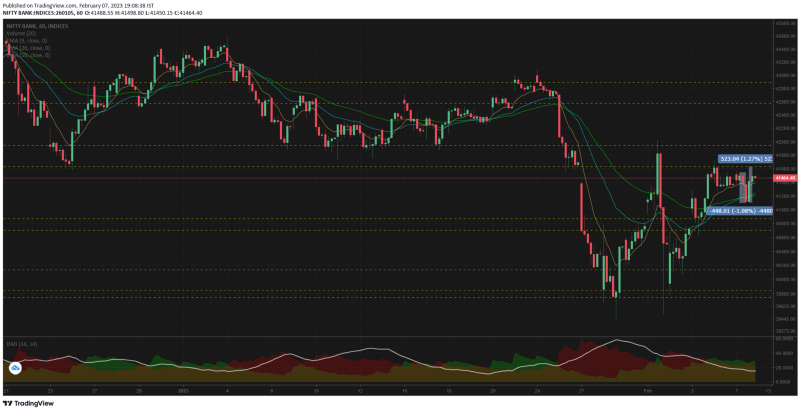

Seems like the only way bank nifty can take out the 41629 level is by a gap-up, because on all the recent traded attempts — its just failing. And we all know BN is a master of gap-up & gap-down.

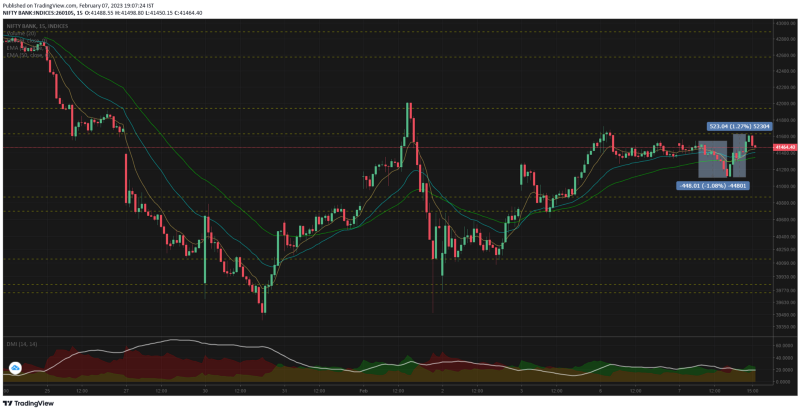

The final close was pretty similar with the opening levels and today's price move was almost a mirror image of yesterday's session.

When we look at the 15mts chart, its showing sideways momentum. So we need a gap up/down opening to change the status quo. If it stands like this we might really have a boring expiry on 9th Feb.

Today's flat move and the inability to take out the resistance may dent the bullish case from the W pattern as discussed yesterday and 3rd. So we wait and watch for clarity.

Among the bank nifty components:

-

HDFC had a good correlation with the banknifty chart today. A fall of 1.69% in the forenoon session & a recovery to close with 1.17% upside from the LOD

-

ICICI was trading below water for most of the day today, There was a recovery of 1.02% from the LOD to the flat line by 14.45 but that faded out.

-

SBI was staying above the water for most of the time, there was a fall of 1.81% from HOD to LOD but the final close was in green. This is quite good because we had a good QoQ & if SBI isnt falling then its pulling up its socks for an upside momentum.

-

AXIS had a bearish day today, chart pattern continuing with the trend set yesterday. The fall from HOD to LOD was 1.87%, but there was a recovery and it went above water for a brief period before closing in red

-

Kotak was outperforming today right from the start. 2 legs of upmoves, first one with a gain of 1.32% then a slight cool off followed by another 1.06% gain. Final close 1.63% high.

-

IndusInd was also continuing from the trend set yesterday, with steady upmove today.

Comments

Post a Comment