Today was another day of personal disappointment for me as i could not find a suitable option selling opportunity.

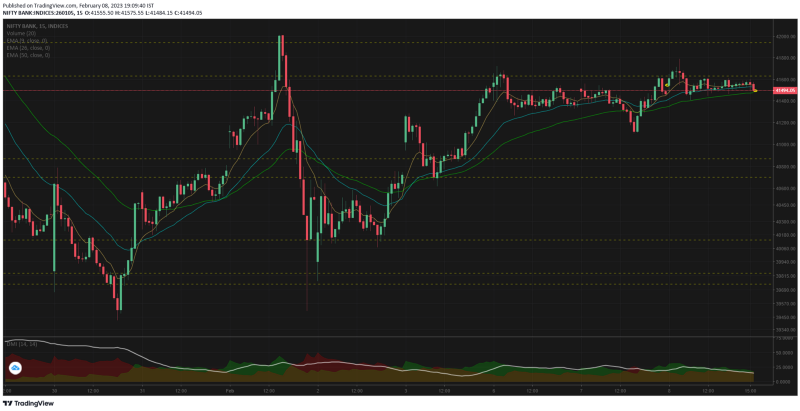

Bank nifty opened inline went over the resistance line of 41629 and then fell back to the negative zone. The open to HOD was only a move of 0.73% ~ 304pts.

The swing of HOD to LOD was a fall of 0.92% ~ 382pts ie from 10.05 to 10.45. Even though we had 2 swings, first into positive territory & second to the negative — the option premiums did not jump that much. There was very little volatility that could cause the option mispricing — so i was sitting like a guy in the park with nothing to do.

While the premiums are low its quite dangerous to short options — because you never know when the premiums will shoot up. Since we had the RBI MPC interest rate decision (0.25% hike in interest rate), i thought atleast that will create some wild swings.

So now for 2 consecutive days we have a low volatility market. End of the day i bought a 41000/40900 2:3 debit ratio spread for tomorrow expiry. Well the rationale being to go ahead and short some PE options & use the debit spread as a hedge.

15mts TF is showing sideways momentum only. The inability to break the 41629 resistance is now starting to get serious. I still think only a gap up can break it.

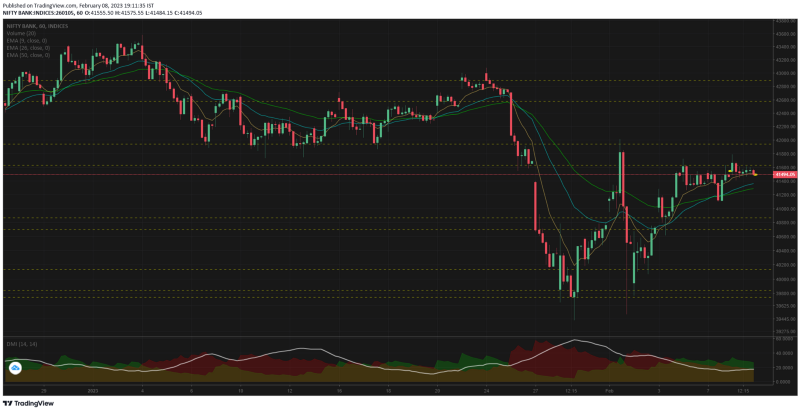

1hr TF is starting to become a lower high if the resistances are not getting taken out. If it spends more time like this it will give the bears more courage to take fresh short positions & tip the market to the negative territory.

So now we have the Nifty50 and NiftyIT sharply outperforming NiftyBank today. We cannot count on the NiftyIT because thats quite a reflection of what happens with NDQ in US. If NDQ falls today then NiftyIT will underperform tomorrow.

That is the only index that has some level of correlation with the US markets — all other indices are in an orbit of its own. India being the first market to stay in the bull market throughout the Covid period.

Among the bank nifty components:

-

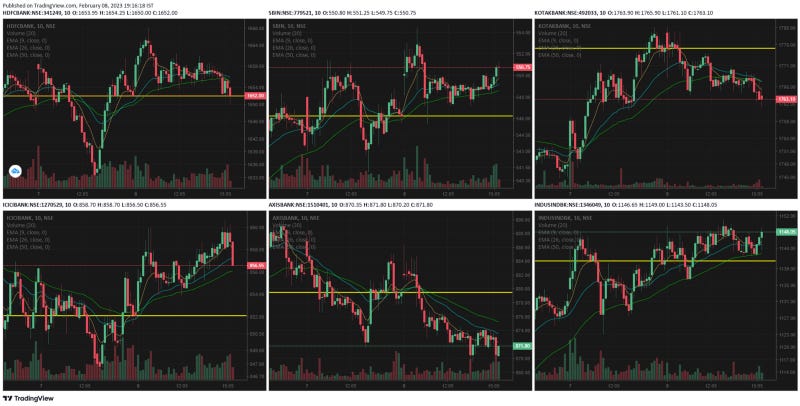

HDFCbk again had a good correlation with the nifty bank today also.

-

ICICI had a rising chart pattern with the last 2 candles trying to tell something

-

SBI stayed in positive zone, there was a dip below water in 1 candle but the recovery was good.

-

AXIS stayed down today with no signs of recovery

-

Kotak has again hit its multi year resistance line and just dropped slightly.

-

IndusInd ended the day in positive with a nice looking chart pattern showing further bullishness.

Comments

Post a Comment