Looking at the opening 30 minutes i seriously thought today's price action is really going to be awesome. I was fully loaded with a 41000:40900 debit ratio that would have made a lot of money if bank nifty crossed the 40900 barrier.

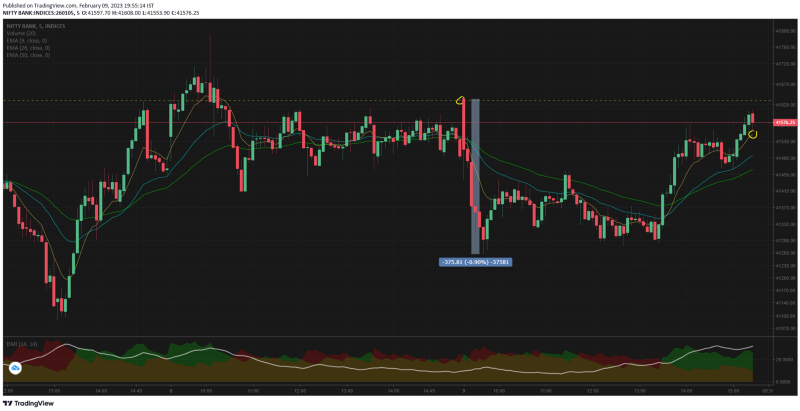

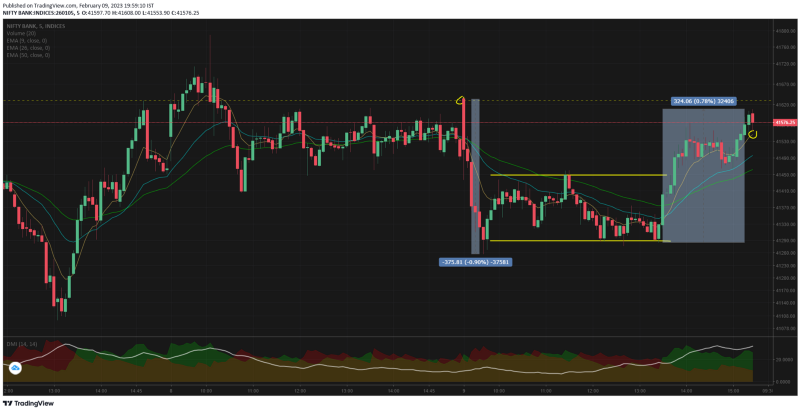

And for a moment i seriously thought we will have deeper cuts, but quite unsurprisingly bank nifty stopped falling at 09.45. The open was right at the resistance level of 41629 & the fall was 0.9% ~ 375pts in 30mts.

From 09.45 to 13.40 we had a sideways move that failed to create option mispricing. So this entire week we had a low volatility, low premium expiry.

Bank nifty started picking up momentum after 13.25, again the same ended just before the resistance zone of 41629. The upmove was 0.78% ~ 324pts.

To make some money today, i had to exit and reenter the same strike price multiple times. I could not afford to short a nearer ATM strike due to the fear of a big move. So i had to time the exit and re-entry properly to catch the small price swings.

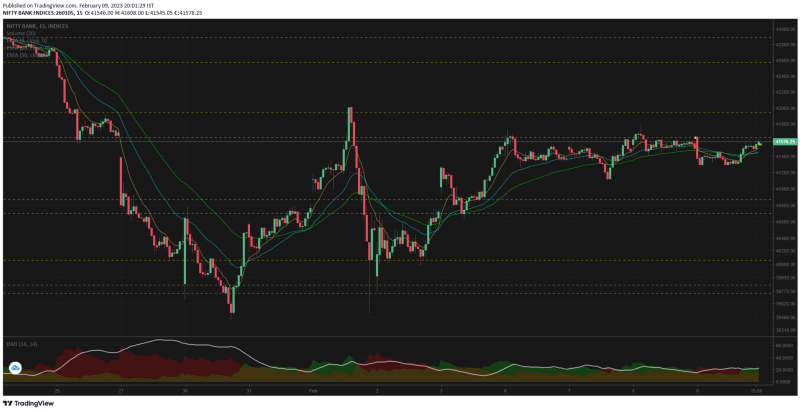

The 15mts TF is again showing sideways momentum, but the downside is clearly getting protected. If BN is able to take out the nearest resistance we may really have a good upmove.

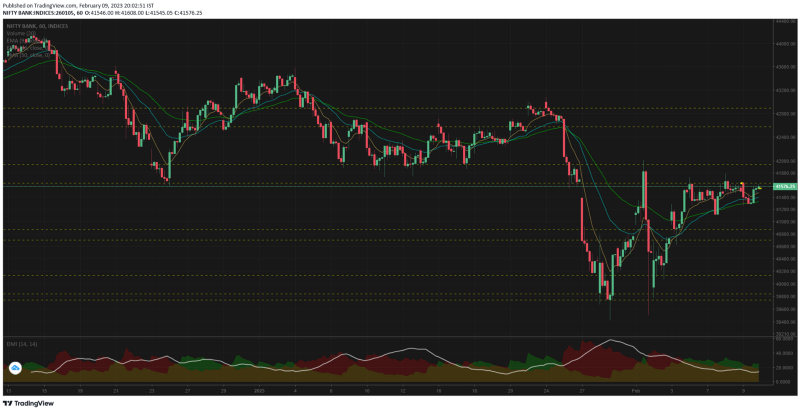

1hr TF is not showing bullishness yet — its kind of tricky to take a trade now. In case of a breakout the momentum is going to be so strong that the jump in premiums will be multi fold.

Comments

Post a Comment