Traders who got into straddles & exited by the noon would have made handful today, but people like me who depend on volatility as entry criteria would have been disappointed.

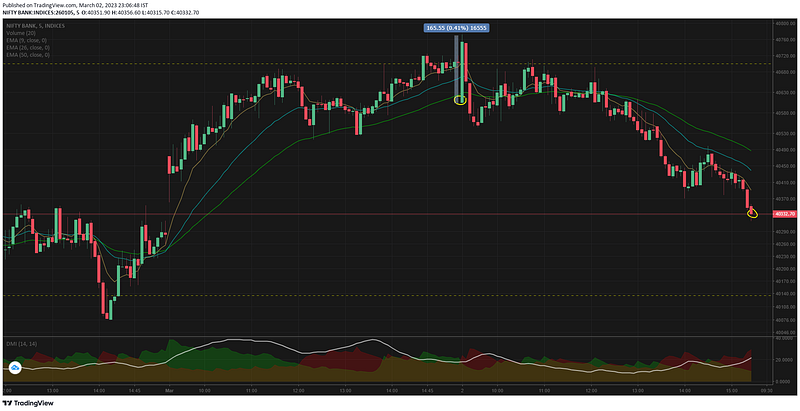

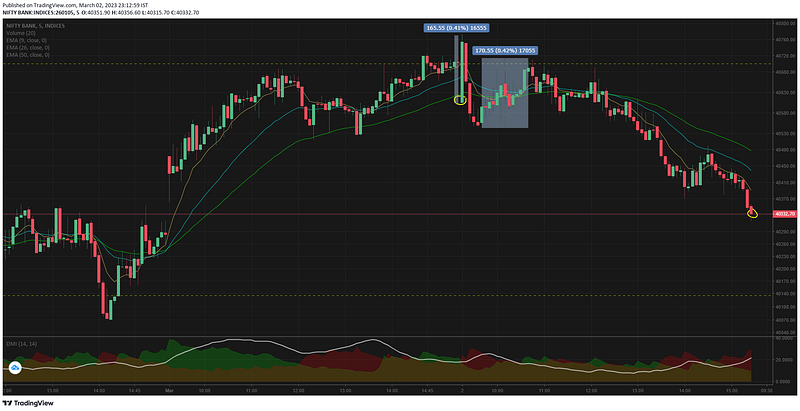

Today's opening candle was unbelievable, 165pts swing in the first 5 mts. And this 5mts killed the put option premium very quickly. Even though we gave up the gains & lost more than the opening candle in the next 10mts — the move failed to spike premiums to the usual extent.

Usually CE premiums would have spiked in the opening 5mts, but even that didnt happen. This was like an expiry pre covid days when the trader plays with the ATMs & ITMs to get the reward.

If you have read my yesterday's report — i was expecting the moves to the bearish side (see the 1hr TF statement). Yeah we went bearish in the afternoon and finally closed the day lower than yesterday.

So we had a fake move yesterday that sucked out the premiums both on wednesday & thursday. Dont think i am complaining or being negative here.

If the market has changed its behavior, we need to find smarter ways to trade. As we all know the same strategy or style will not work all the time !

From 09.40 to 10.40 we had a small rally that went upto the resistance level & then turned.

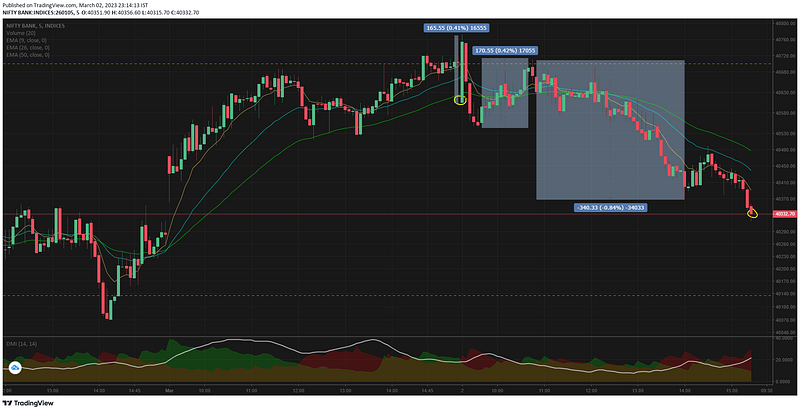

And then from 10.45 to 14.00 we had a steady down flow of 0.84% loss ~ 340pts. This is the fall i was referring to — where it failed to light up the PE prices upto 38500 PE. Usually we see huge sudden spikes whenever market falls.

At 12.15 i posted on Tradingview bank nifty minds that we may expect a fall, even having a position to capitalize it did not work out :(

TradingView India. View live NIFTY BANK chart to track latest price changes. NSE:BANKNIFTY trade ideas, forecasts and…in.tradingview.com

In fact i had a 40200/40100 PE debit spread — even at 14.00 that position was in loss. Imagine the participants were not even expecting another 150pts fall in the next 1.5hrs — for a market that has been bearish from Dec 2022.

15mts TF now shows the smooth top like formation that got created yesterday & today. The momentum for a big fall or the triggers to get that big news/event is still lacking.

1hr is still bearish, the last 5 consecutive candles are red — which is good for the bears. But the length of the candles which shows the intensity or momentum are not that big to create ruckus.

Comments

Post a Comment