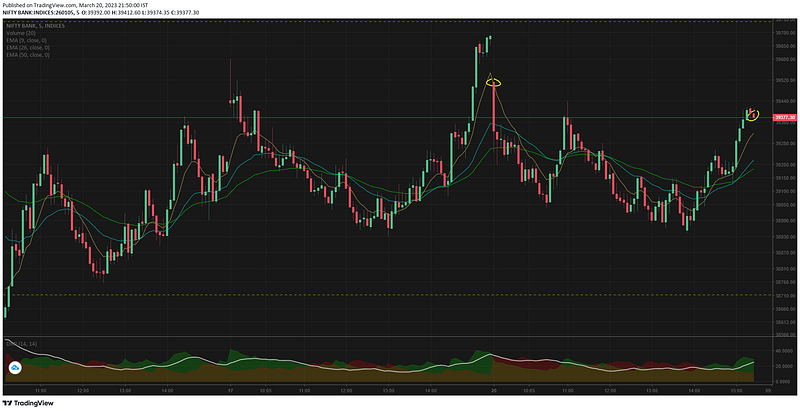

I really cant say that the volatility is that high, if we follow the slope of the moving average — India VIX is still staying low. Not quite a representation of the things happening in global markets. Today i saw VIX trading near 17% higher than last close — but that did not really translate into lot of fear on Nifty50 & BankNifty.

People who look at the headline index performance today would have seen bank nifty close 0.65% lower, but i saw lot of strength in today's trade. No i am not bullish — but there are good numbers of bulls who are not yielding.

Global markets handout was very weak on friday & the news of Credit Suisse, UBS were not comforting either — so the gap down open at 39512 was something on expected lines. From there we started dipping till 10.30 — but the options volumes were not really reflecting the fear !

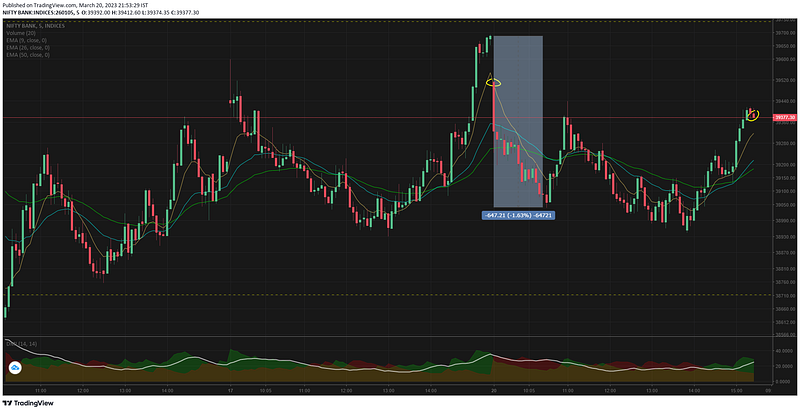

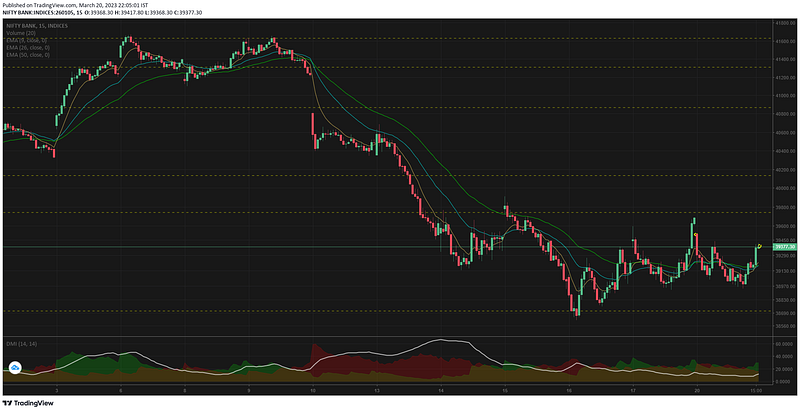

The total drop was 1.63% ~ 647pts till 10.30, as i said earlier the options premium & volume data was not giving a further meltdown signal.

At 10.19 i posted this "$BANKNIFTY bulls are holding on, they have no fear ! i would not go long personally" this was because i felt there could be a bounce back & unlike other traders i did not see it as a bullish move.

TradingView India. View live NIFTY BANK chart to track latest price changes. NSE:BANKNIFTY trade ideas, forecasts and…in.tradingview.com

We did get a bounce of 379pts, traders who went bullish would have booked profits before 10.55 or would have waited for more & walked right into the trap.

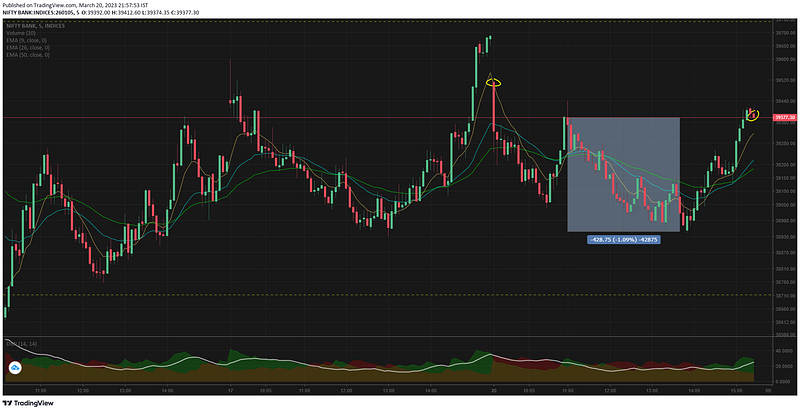

Because from 11.00 to 13.50 we had the 2nd leg of fall of 428pts. This time the low went below the 1st swing showing bearish signal.

At 12.12 i posted that "$BANKNIFTY would prefer to go short below 38690" Thats because even though the chart showed bearishness the options data was not reflecting fear.

TradingView India. View live NIFTY BANK chart to track latest price changes. NSE:BANKNIFTY trade ideas, forecasts and…in.tradingview.com

In the opening paragraph i did mention about the VIX, in bank nifty's case the implied volatility was not exploding. Lack of which gave a contra signal not to go short too.

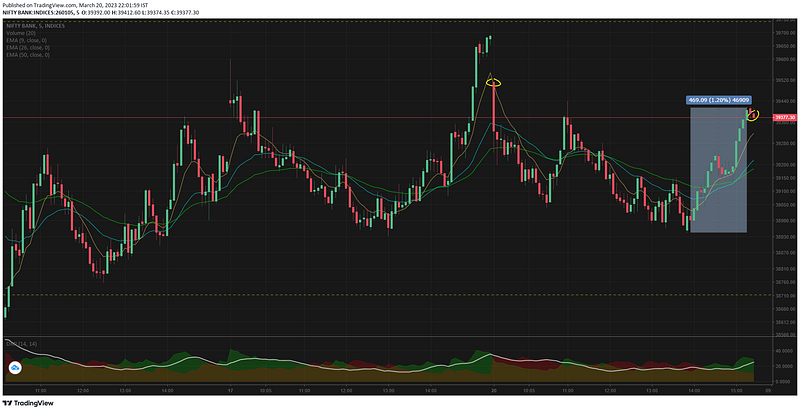

What happened next — i had absolutely no clue. Bank nifty from the LOD rallied 469pts ~ 1.2% to close the day strongly (even though ended in red). This is specifically why i said the bulls have no fear !

Guess what happened to my trading today — 0. I couldnt find a single strong buy/sell signal.

15mts TF is kind of showing a range emerging between 38690 & 39742. The resistance of 39742 is a strong zone — i know. But not quite sure how long the 38690 level will hold up.

Just like the earlier analysis reports — for further bearish entries we need close below 38690.

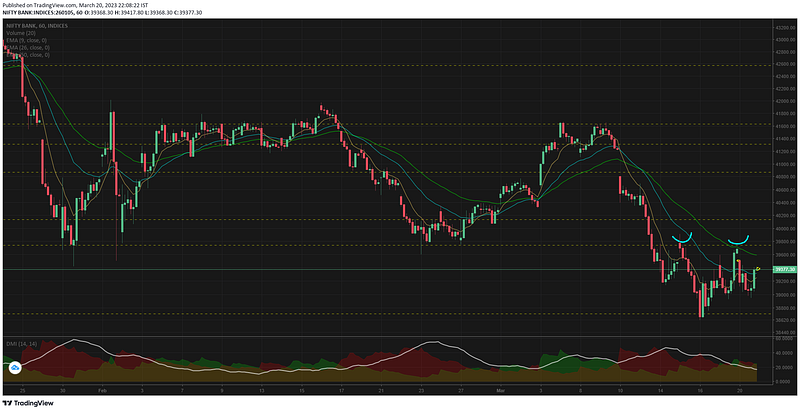

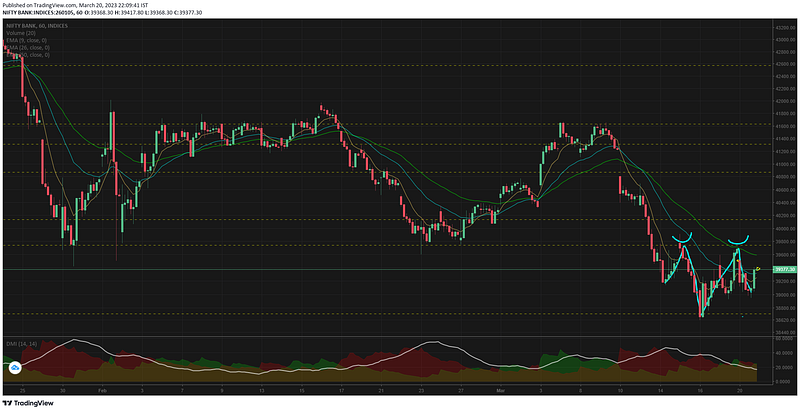

1hr TF shows 2 retest rejections from the 39742 level. Its not a perfect M pattern ie double top. It would have been unless for the last 1 hr rally today.

See below chart ! The last 1 hr has negated the 2nd leg of the M pattern. Was that a fake move or original — we will get to know tomorrow.

Comments

Post a Comment