You might be already aware that i was expecting a bearish week, the 39500/39400 4:5 debit spread of mine was sitting at a loss right from monday. Today's gap down opening at 39836 gave me some hope that we will have a miraculous down day.

The handout from US markets yesterday was completely bearish S&P500 lost 1.03% in the last 15mts of trade. So it is just commonsense that we expect our markets also to trade negatively.

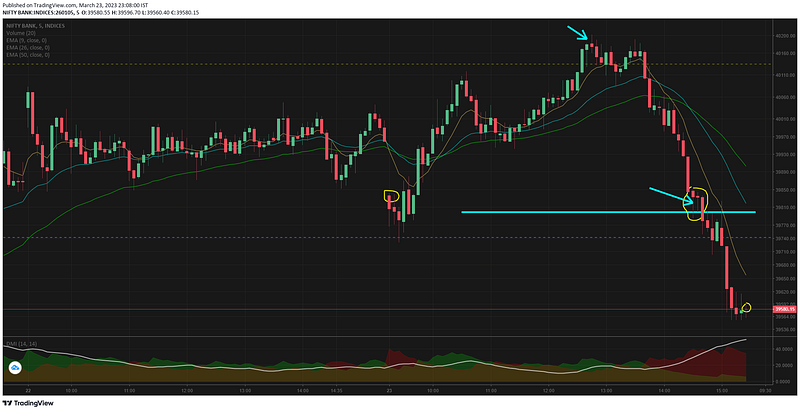

But what happened was totally unplanned for, banknifty took support at 39742 by 09.25 and then started rallying up. We had a 1.18% ~ 468pts rally from the LOD to HOD by 12.45.

And usually when markets move upwards, the options premium drops equally fast. Volatility cools & more people join the party as bullish rallies are easier to participate.

By 12.46 i took a debit spread of 39800/39700, i am not here to brag how much money i made. Infact i am going to show you how much i lost. So now my hedge has 1 debit spread and 1 debit ratio spread — but i was not finding any OTM puts unusually priced. All of them were already near the fair value.

The cyan colored solid line is where my debit spread will go in the money. At 12.46 bank nifty was at 40200, i was expecting a rejection from the resistance level of 40131. Honestly i never thought my debit spread will even go in the money.

Normally i take debit spreads to hedge for the naked options that are sold. But today i took the spread first and then thought will take the short position once the market starts dropping.

The resistance rejection came at 13.40 and then there was a strong down move. But it was already late, we hit the blue line by 14.30 and with just an hour to go for close. So when i saw the 2nd candle at 14.35 i thought that bank nifty may not fall further, it was already at 39799 and then the support is just 50 pts below.

My intuition told me bank nifty will bounce back from the support level and if that happens my debit spread will go worthless (to zero). So i squared off the position right away making a return of 7.6 times the premium paid.

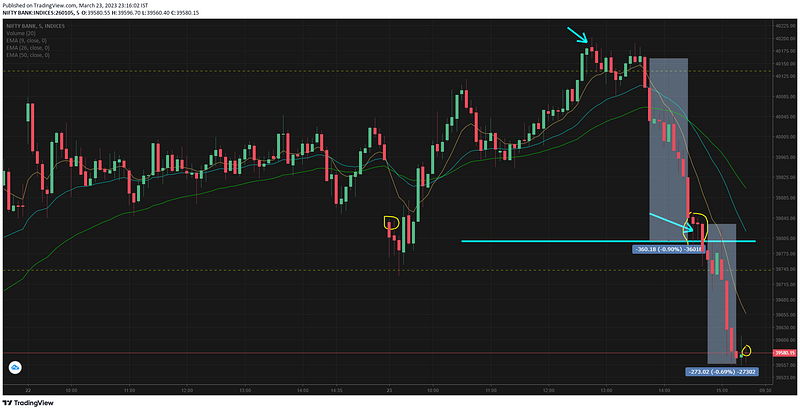

Guess what happened next, between 14.40 to 15.10 bank nifty fell another 273pts ~ 0.69%.

Once it broke the support line, the single 5mts candle itself swung 147pts. And guess what my position would have made an additional 25.7 times the premium paid.

7.6 & 25.7 times means 630% & 3074% respectively. Now these are the one-off lottery deals that come up. The mistake i made was to think the time factor will get in the way of delta increase.

So now on the 15mts we have broken the support level, the red candle right after the break is showing some signs. Also notice 8 consecutive red candles.

Bank nifty lost 1% in just the 1hr candle at 14.15 — this is the candle that broke through the support level. Further price moves are going to get exciting & i would like to see the next support level of 38690 to be taken out before the bearish momentum continues.

Comments

Post a Comment