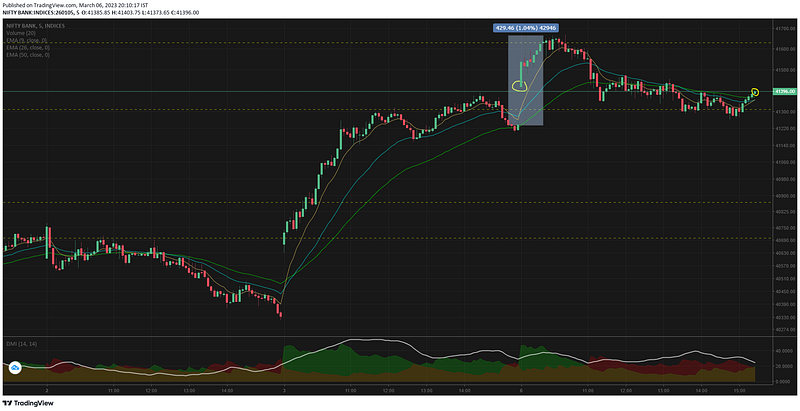

But for every other trader, it was a tough day to plan. Gap up opening & hitting the resistance by 09.45. The 30mts of move would have changed everyone bias to the long side.

That was 1% ~ 429pts upmove considering the gap up also. The surge in the ATM & near OTMs were so huge that traders were busy exiting their short position or adding on to fresh longs.

Check the volume build up for 42000 CE, 42500 CE and 43000 CE in the opening 30mts — you will get a fair idea on what i am referring to. But here is where bank nifty almost trapped most of them.

41629 resistance was quite hard to beat. After spending 40mts at this level we saw a drop to the 1st support of 41309.

And the next 1hr 35mts was spent at this support level. Not breaking down showing strength & conviction of bulls. Not rising up showing bulls are taking some rest after the move on Friday.

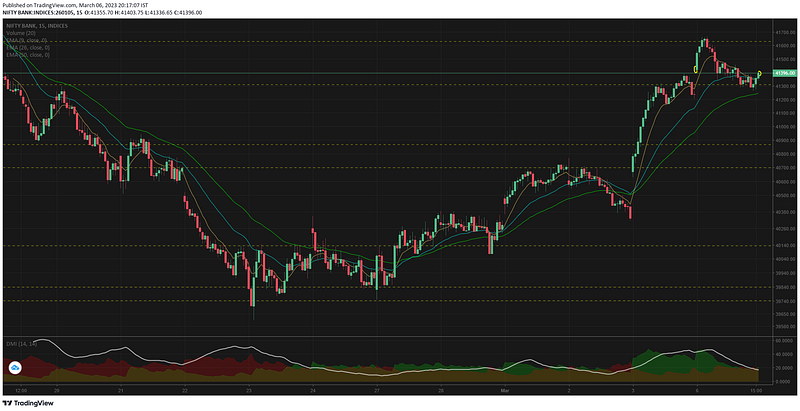

Bank nifty underperformed Nifty50 and NiftyIT today after outperforming for so many days in succession.

15mts chart is not showing bearishness yet, but today's move creating a rounding top may be an interim swing high for this week. Thats what i feel personally.

Since we have a holi-day on 07 Mar, the reopening on 8th will have a huge gap up or gap down based on how US market trades today & tomorrow.

If the gap up takes out the resistance then 15mts will show super bullishness.

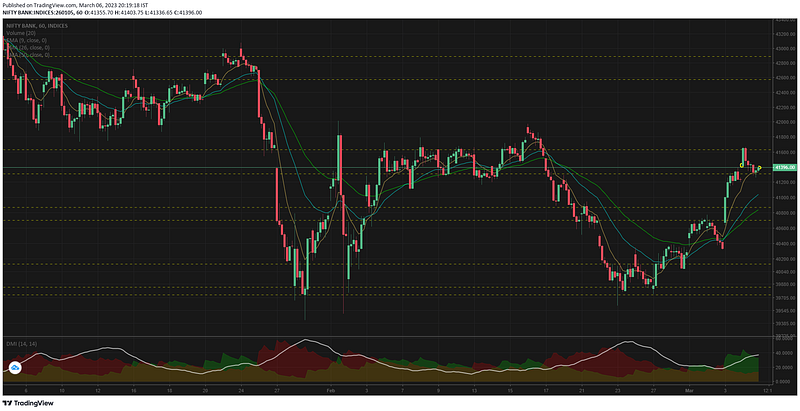

1hr TF is still not bullish according to me, mainly because the resistance is still holding. 2 other times in the last month we did have a retest & rejection of this resistance level

So for 40 days and 4 hours we are in a flattish market but which has really given a scare to the bulls. And trust me the bears have not been able to capitalize in this timeline (people like me) because every attempt to create a lower low has been nullified.

Bank nifty's real scare is on the upside, because the downside seems like pretty protected. The low premiums on the PEs is definitely an indication that most of the participants are not even expecting a 500 pts fall in this expiry.

However once it falls this 500pts the dynamics will change and the option pricing will look attractive to take some bets. Till its best that people like me wait & preserve capital.

Comments

Post a Comment