Contrary to the popular belief, Kotak bank has the 3rd most weightage to bank nifty above SBIN and AXIS even though kotak has lower net interest income. And today's 5% gap up due to the MSCI news spelled real trouble.

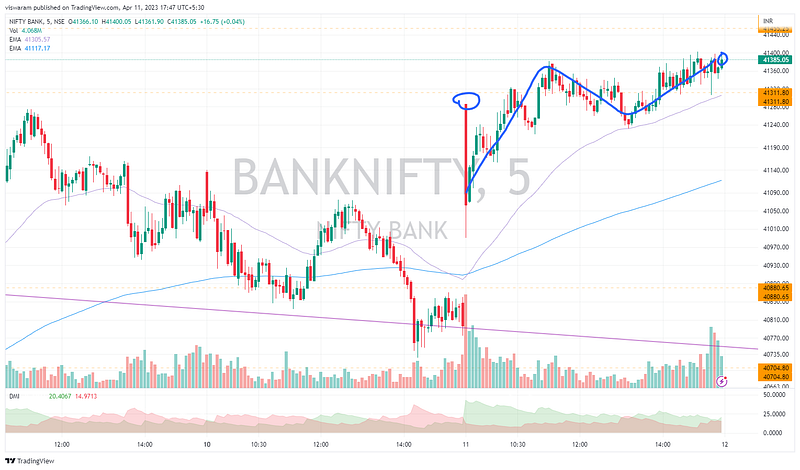

Bank nifty opened gap up at 41232 and had a massive 1st 5mts candle. There was a price swing of 297pts in the opening 5mts. What it created was a break away gap negating the downward sloping pattern from 6th. The jump in volumes also proved we had a sentiment shift too.

Was the MSCI news a big trigger — I do not think so, but it really helped the bulls breakout from the bearish grip. Also it would have spoiled few CE seller's Finnifty expiry.

There was also a healthy rally to take out the resistance at 41311, ICICI bank, SBI all helped to close bank nifty with a lead of 531pts.

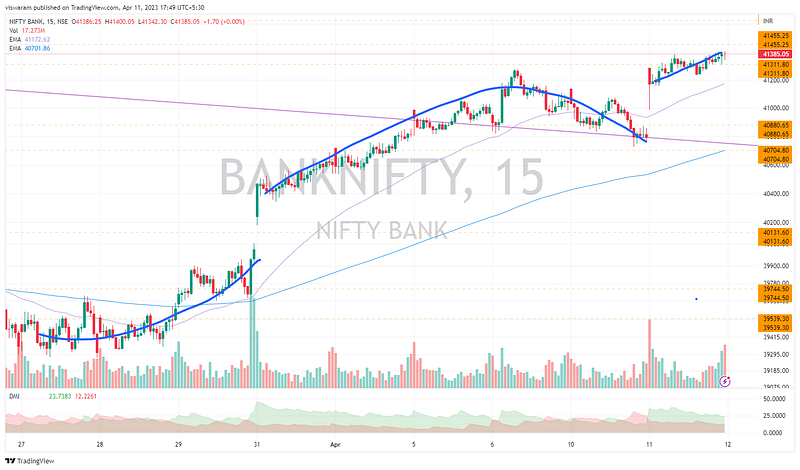

15mts is showing the break out quite decently. And this is formed above the channel top line which will give it good momentum.

Yesterday we discussed the possibility that the bears may want to take control and bring banknifty to the range — well, that is not going to happen very soon.

The last time we had a breakaway ie on 31 Mar 2023, the volume spiked. Today also the volume was considerably higher than usual.

And also note, the stock market is heavily skewed in favor of bulls. Everybody like to make money and push prices up. Only few people like me prefer to find contrarian trends — mostly on the bearish side.

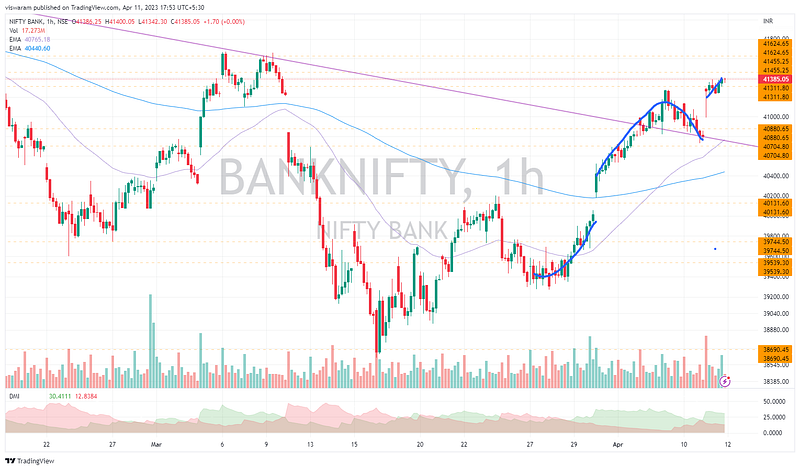

1hr is showing the trend channel breakout quite clearly. See the break away from the purple downward sloping line.

Till yesterday we had a hope to get trades below 40700 levels and stay in the bearish medium-term trend.

The only hope for bears now is to watch out for the US CPI data tomorrow. A massive sell off could bring back banknifty back to realistic levels of 40700 or lower.

I will also be covering Finnifty charts on Tuesdays wherein we have the weekly expiry

Finnifty has a similar chart to bank nifty, that makes it quite interesting to take expiry trades just as we do on Thursdays.

The W pattern indicated in blue highlight was formed in the same similar fashion.

Today's trade happened above the recent swing high ie from 06 Mar 2023, this again is a breakout style of trade. Just as when bank nifty falls below the 40700 levels, we can expect finnifty to fall below the 18246 SR zone and continue its range trade.

But if that does not happen soon, then the only way we can look is to handle the bullish momentum.

Comments

Post a Comment