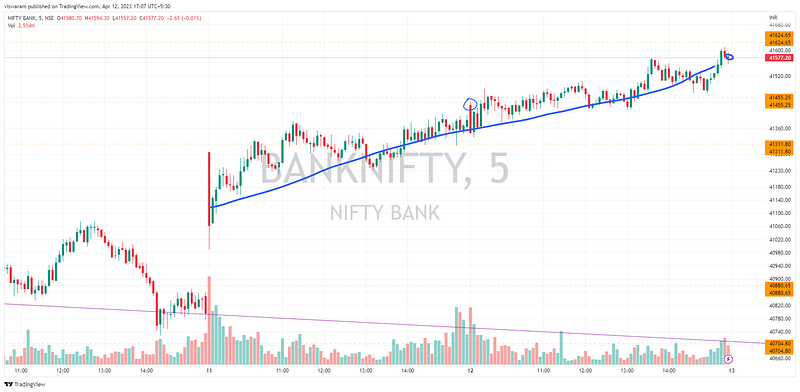

If we notice closely the pull backs were not strong enough to break the momentum. I sincerely thought we will have a reversal or a bearish day today and had taken PE debit spreads to capitalize.

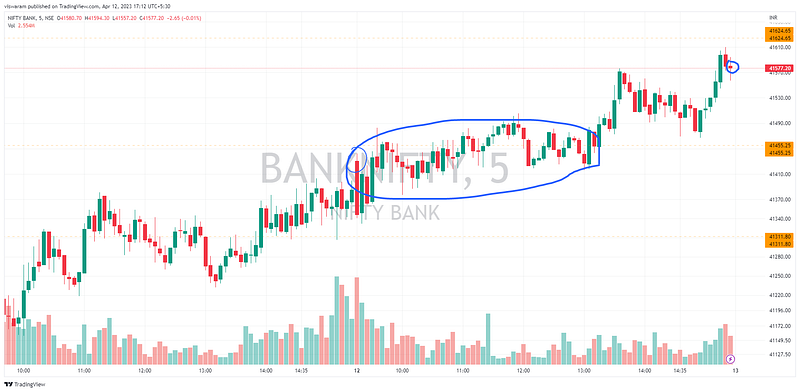

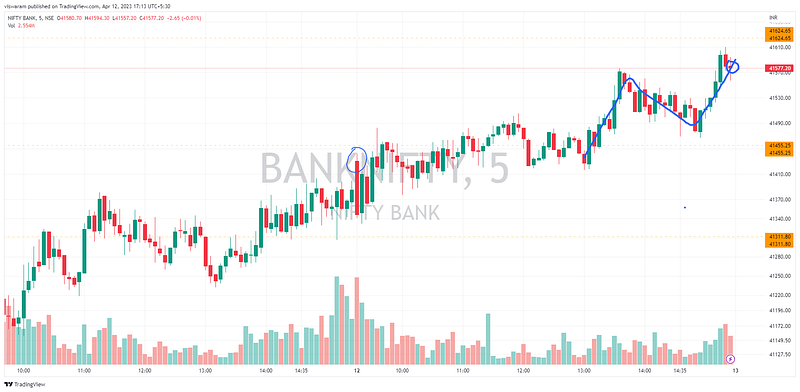

If we analyze today's pattern closely bank nifty took some time to take out the 41455 resistance. It was hanging around this SR zone for quite some time. Only at 13.20 did we break away from the area.

And once we broke that, banknifty started another leg of rally to the next resistance of 41624. Also notice the pullback from 13.40 to 14.55 gave it good confidence as the support of 41455 held.

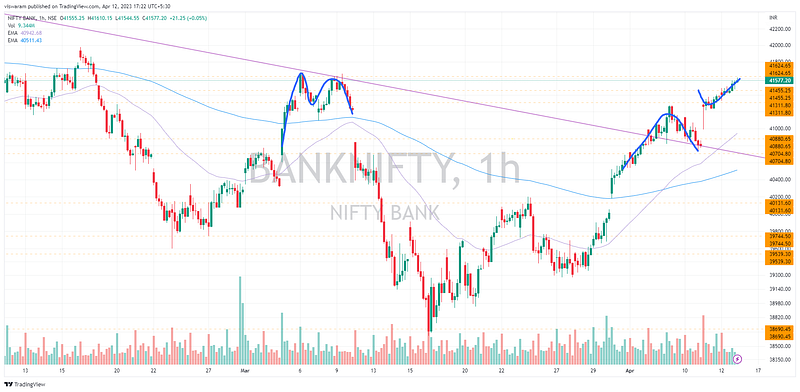

Now why was I bearish — mostly I went with the contrarian decision to go short before the US CPI data. If you track the US markets you can see SPX is well above the bearish channel. This might give the US agencies to release a hotter CPI data as the markets will be ready to absorb it.

So I applied the same logic here, if we were to crash — then the 40800 to 40700 levels looks quite possible.

95% of traders would have made money, excluding people like me as the current situation is of a break-out. And you should always stick to the main trend to keep your pockets full of cash !

What I did today is to go against the trend, try to me a little adventurous.

15mts trend is again favoring the bulls. I am so very sure 95% of traders will be looking out for bullish opportunity in bank nifty as the chart cries bullishness.

On the 1hr chart, a resistance breach of 41624 is going to give bulls immense momentum. Last time we were at that level we had a double top M pattern formed i.e. on 6th and 9th March 2023. And then you know what happened — we fell all the way to the 38690 support level.

So tomorrow is going to be a very serious day to have either a decisive breakout from these levels or fall back to range. The jump on 31st March has made all the difference to this chart and has given the bulls a new hope.

Comments

Post a Comment