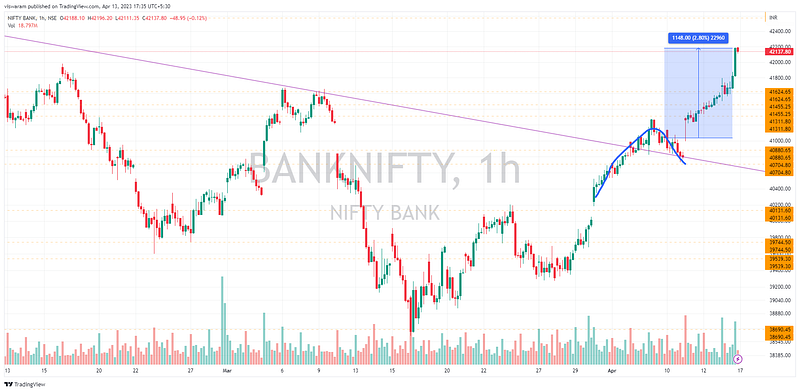

Since 7th April was holiday, I have taken the closing price of 6th April as starting point. We had a 2.8% ~ 1148pts rally in this week. Let me zoom out and provide a perspective of what this means.

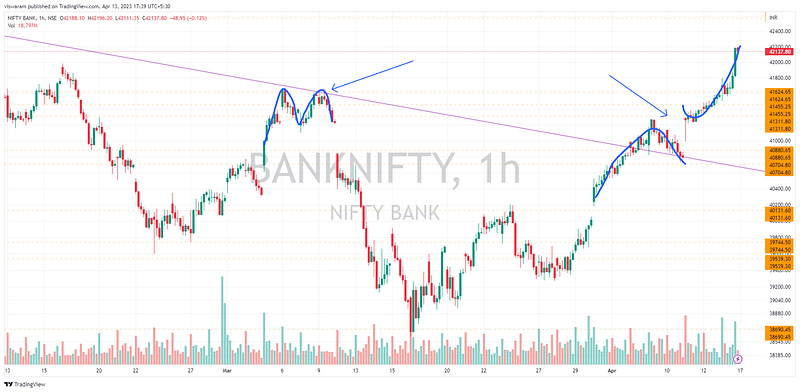

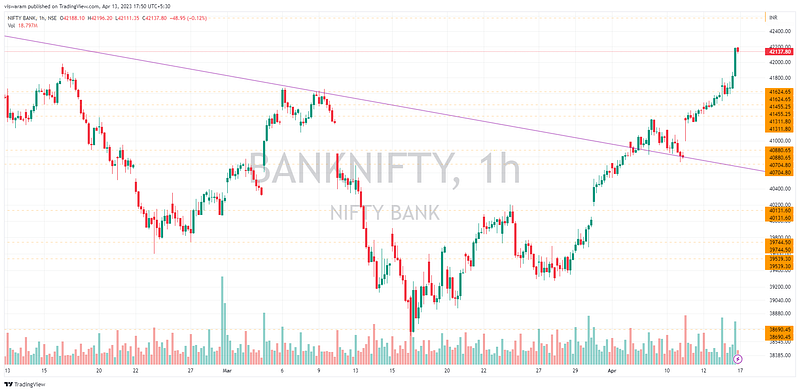

If you notice we had a breakout from the 41311 levels which was the swing high of 6th April. Also notice how we broke the channel upper band. The beauty of break-outs are that the final leap will be intense — notice how we moved 367pts just in the closing hour today.

The real momentum picked up once we crossed the 41624 level which was the swing high from 6th March 2023. Note the M like pattern formed then. And what followed from the was a fall to the 38690 level. From there bank nifty came back strongly & finally took out this resistance today.

One particular strike ie 42000 CE stands out today, let me pull its chart here

We had a rally of 3335% ie up 129pts from Rs4 today. The real power of options explained in just 1 strike!

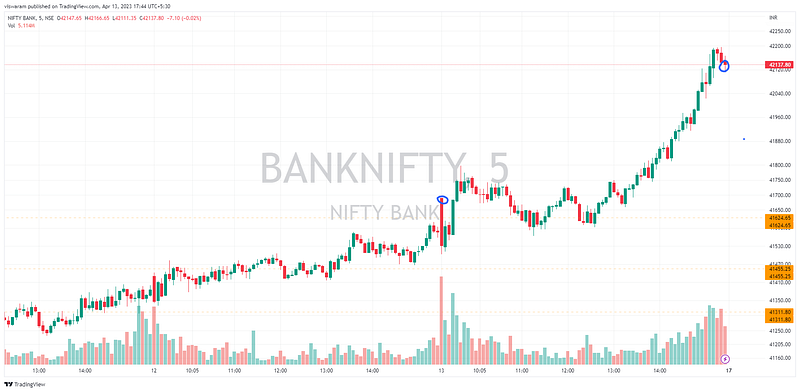

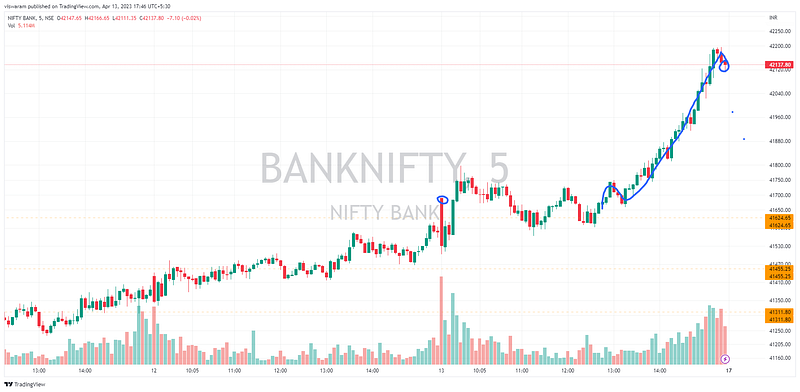

Coming back to the daily analysis now. Bank nifty opened at 41680 and fell for the first 5mts. From there it maintained a flattish pattern till 12.35 near the 41624 support/resistance zone.

It was quite clear that if we break out from this level we will have huge momentum. However I was still looking at the bearish side. My analysis made me think bearish & plan that way.

Once we started breaking out at 12.45 — there was no stopping. The momentum favored the breakout.

Even though I was inclined to take a bullish position, I did not. I simply did not have enough confidence and this is where the market wronged me.

As I stated earlier, 42000 CE was in my radar at 4.30 level — the magic by which it closed at 132 level still shocks me — an opportunity lost. For the option sellers who would have sold the 42500 CE and upwards never felt threatened as those strikes did not surge like the 42000 one.

Now the 1hr chart is also screaming bullish, at least it is out of bear's hold for now. 41600 & 41800 both are safely breached.

As most stock markets are skewed in favor of the bulls i.e everyone wants the stock market to go up. So when we see out-performance more people will join in and add funds — the classic FOMO effect.

Since tomorrow is a holiday, we would need to wait for Monday to see further action. If we do not get any negative news from the global markets — bank nifty will be rocket-powered next week too.

Comments

Post a Comment