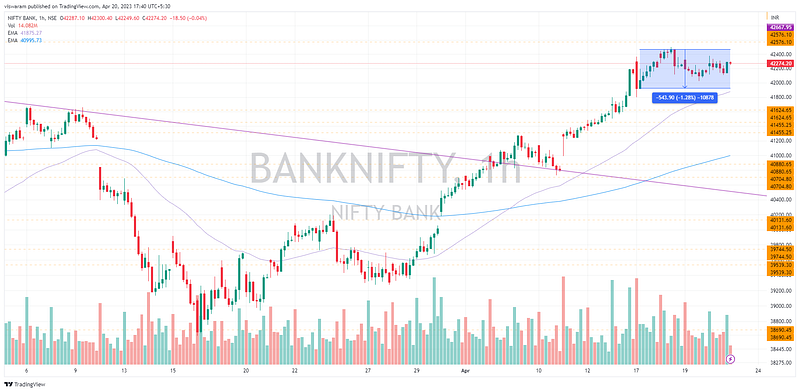

Banknifty has gained 0.29% ~ 123pts from the last Thursday to today. Expect for the 1st hourly strong candle on 17th, the rest of the trading was range bound with a slight positive bias.

The range banknifty traded in (max swings) indicated below. It just had a maximum swing of 1.28% and this explains why the options premium had no air in it.

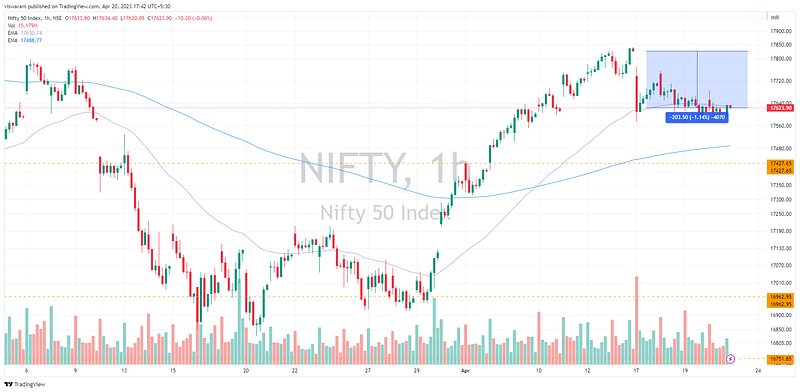

Nifty50 on the other hand fell 1.14% ~ 203pts this week. The 1st candle of 17th basically set the tone for this week. The rest of the trades were contained within the shadow of this 1hr candle.

20th April Analysis

BankNifty is struggling to break-out from this level. Might be its taking a rest before the next move — but as it stands its out-performing Nifty50 quite strongly.

Even though bank nifty was unable to take out the recent swing high, the downside protection is seen as quite strong. No matter what happens — bank nifty is not falling to the 41624 levels.

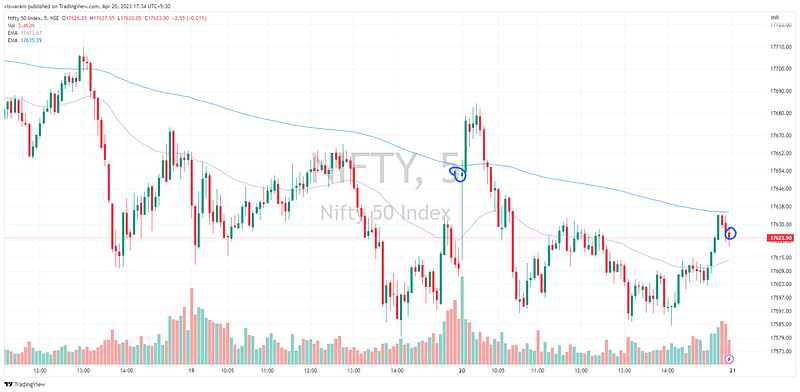

Nifty50 on the other hand is going through a weak sentiment, triggered by the IT QoQ results.

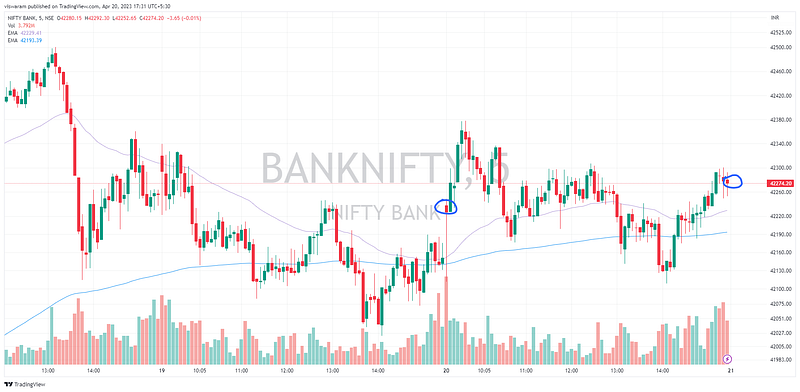

Looking at the option's premium data I strongly felt we have a down-trend post 12.30 — but the lows were strongly protected on both the indices. I must say my debit spread again went to zero !

15mts chart is looking strong as ever, today's price action has confirmed that bulls are still in control. Yesterday I was of the impression that the support of 41624 could get taken out by 20th or 21st — thats because of a weak global sentiment. Seems like bank nifty has no intention to give up the gains!

1hr chart is also looking quite strong, the 14.15 candle of today (+156 pts) ensured that the swing-low of 42034 is not getting taken out. Also this candle gave so much of confidence to the bears — I could say with confidence that this move ensured even the Nifty50 is closing in green today!

Comments

Post a Comment