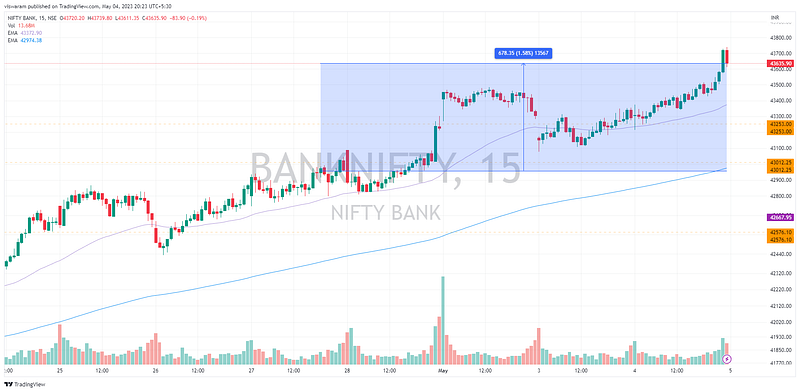

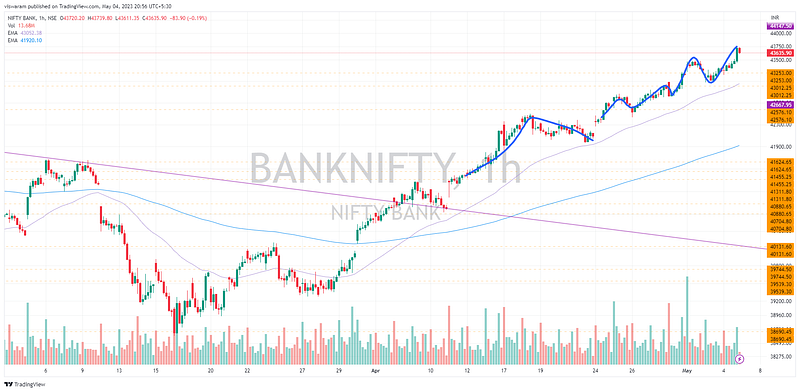

Banknifty has gone up by 1.58% ~ 678pts from last Thursday to today. It has taken out 2 crucial resistance points in the process and nearing the ATH now.

Really impressive performance — the banks in India are standing out with their outperformance. Global financial institutions are melting down and many US banks are trading less than 50 to 60% below their ATHs

Today's Analysis

Banknifty opened inline today and had a parabolic upside move, something that we usually see during range breakouts. At present banknifty is not in a range, so the price action could even be due to short covering.

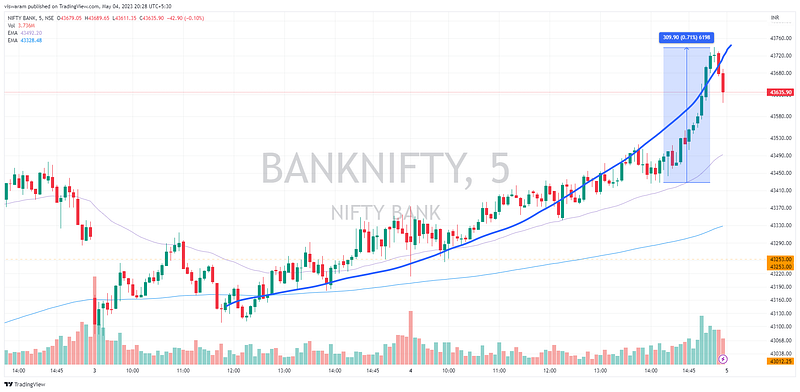

Of the 0.86% gained today, 0.71% aggressive move came between 14.15 to 15.10 — once the HDFC declared its results. Since today was an expiry day, the last 1 hr move would have shocked many.

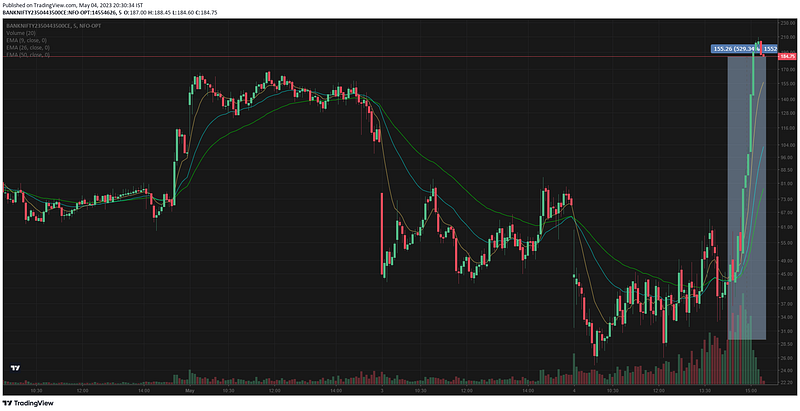

43500 CE option chart would have amazed many by a 530% upmove between 14.15 to close. When the VIX is low, volatility is at its lowest point — the option buyer gets a rag-to-riches kind of story like this every week.

The same spike was available on 18200 CE Nifty50. I was not really interested in fishing for these opportunities even though the risk:reward looked interesting. Mainly because I prefer to sell the options first rather than buy.

15mts TF is showing today's move quite prominently. Once it took out the swing high of 02 May there was no stopping. Most of the option traders would be frustrated as the moves are coming only in the last 1 hr — this would spoil their trading plans.

Also during low volatility & low option premium periods — positional trading gives far more returns than intraday.

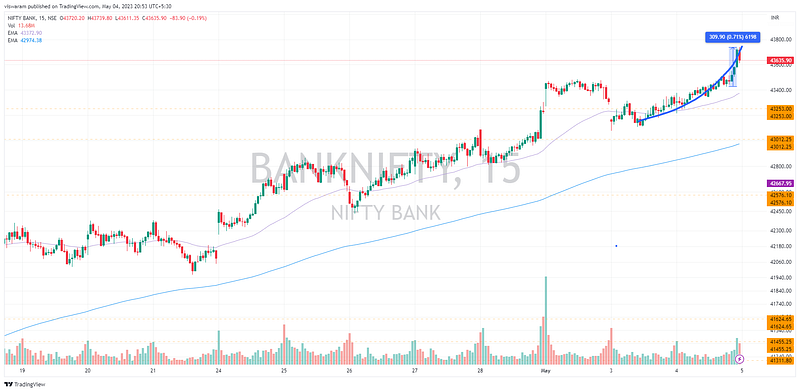

1hr TF shows the new higher-high that got formed. In yesterday's report we discussed the possibility of the same happening. What is more surprising is how it happened today even after FED raised interest rates to 5.25% & SPX tanked 0.7% overnight.

Nifty50 has also created a higher-high and closed above 17976 conclusively. The next resistance is at 18419

Comments

Post a Comment