MSCI intends to add HDFC Bank to the largecap segment of MSCI Global Standard Indexes, with an adjustment factor of 0.5…economictimes.indiatimes.com

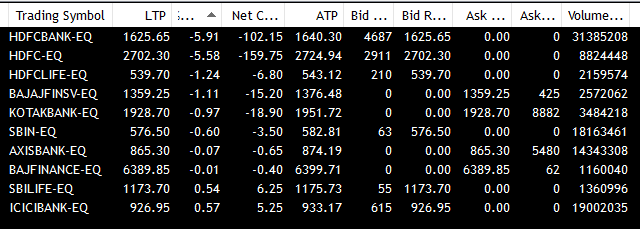

The MSCI news hit just before the start of the day and HDFCBK and HDFC were down 5% in pre-open. The biggest loser was Finnifty index compared to Banknifty & Nifty50 during the preopen session.

Even after such bad news the other banks did hold banknifty up till 12.55 after which the banks had a near free fall.

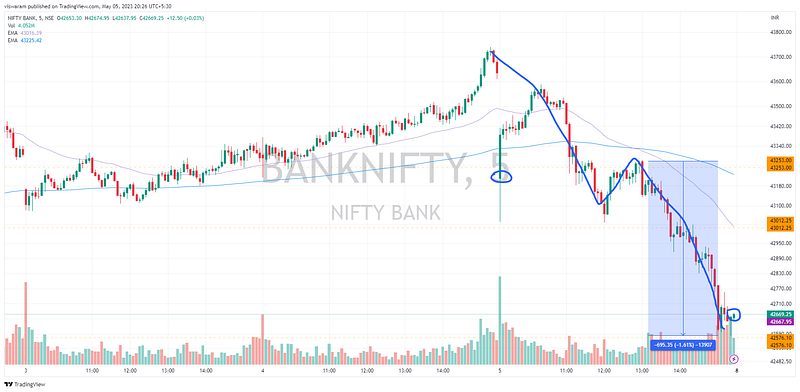

The open was gap down, but it recovered very neatly till 10.20, there was volatility visible in CE options premium, but PE premiums were still under control. Obviously the near ATMs had huge spikes as the gapdown itself was an uncertainty in itself.

The pattern formed after 10.20 was a perfect 2 legged down-fall. The 2nd leg had a depth of 1.6% ~ 695pts. Banknifty was holding its ground near the 43253 support at the start as well as from 11.05 to 12.55. In this period of 2 hours the options premiums started decaying.

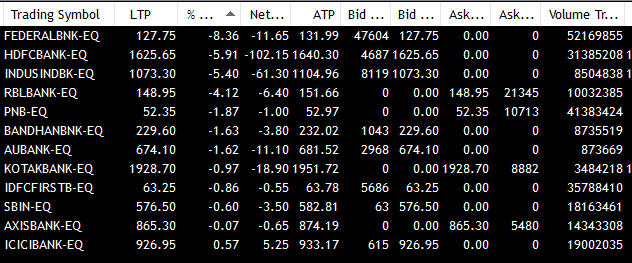

Right after the 1pm move there was a broad-based selling on other banks as well. And what it did was to ensure banknifty's fall was matching the Finnifty's percentage drop. Its true that both of them fell exactly 2.34% today. However the HDFC which fell 5.58% is just present in Finnifty.

Somehow to the naked eye I am not convinced how banknifty had an equivalent fall as finnifty. The only positive contributor to finnifty was SBILIFE which has a small weightage.

Seems like IndusInd & Federal bank which has weightages of 5.4% and 1% would have made the difference. I am still not convinced :(

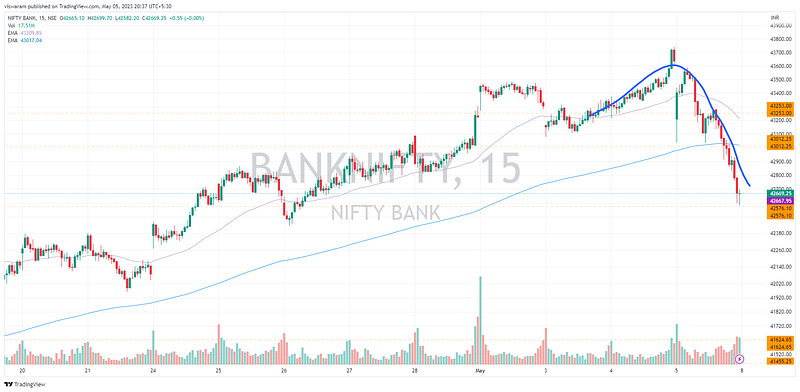

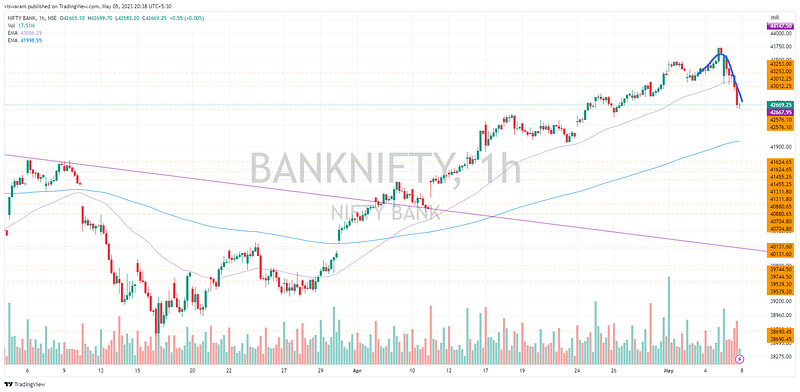

15mts TF is showing banknifty has broken 2 supports 43253, 43012 today and was stopped at 42576 support.

This is the first time in many sessions that we had a decent retracement. Since its fundamental/news driven, the technical analysis wont really work here.

1hr shows the top formation quite clearly. The nearest support of 42576 if broken will open up a free-fall gap of 952pts till the next decent support at 41624. If that happens we can start taking bearish trades.

Nifty50 chart pattern is not bearish even after the blip today. The nearest support is at 17976 and the next support is 3% lower at 17429. Interestingly this 3% gap between 2 SR zone is similar to banknifty as well showing a vulnerability.

If the indices can hold its ground very well we will not have a snowballing effect.

Comments

Post a Comment